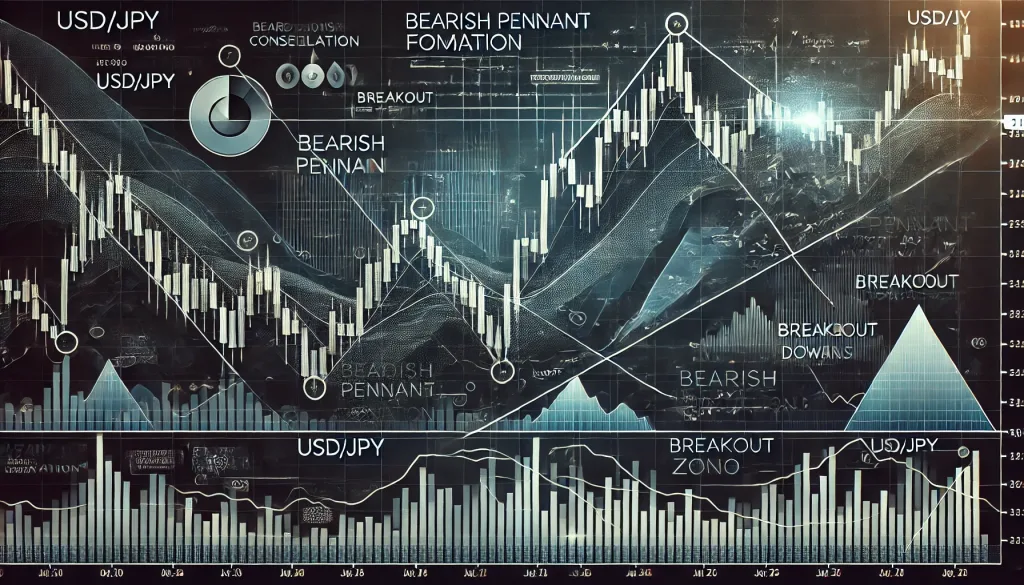

USD/JPY Bearish Pennant: The Hidden Pattern Most Traders Miss

The Silent Killer of Forex Profits: How the Bearish Pennant Traps USD/JPY Traders

If you’ve ever felt like the market is playing mind games with you—making you think prices are reversing, only to smack you down with another leg lower—you’re not alone. One of the most deceptive yet powerful continuation patterns in Forex trading is the bearish pennant, a pattern that often tricks traders into going long on the USD/JPY pair just before the real breakdown happens.

Today, we’re lifting the hood on this sneaky formation. You’ll discover:

- Why most traders misread the bearish pennant (and how to avoid their mistakes).

- Underground tactics to profit from the inevitable breakdown.

- Expert insights and real-world examples that prove why this pattern is your best friend if you know how to use it.

Buckle up, because by the time you’re done reading, you’ll never look at the USD/JPY chart the same way again.

What Is a Bearish Pennant? The Pattern That Whispers ‘Get Ready to Short’

A bearish pennant is a continuation pattern that appears after a strong downward move in the market. It forms when price consolidates into a small symmetrical triangle before breaking down further. Think of it like a boxer catching his breath between rounds—he’s not done fighting, just pausing before another knockout punch.

Key Characteristics of a Bearish Pennant:

- A strong downtrend: Price drops sharply, creating the “pole” of the pennant.

- Consolidation phase: Price moves sideways in a narrowing range, forming a triangle (the pennant itself).

- Breakout confirmation: When price breaks below the lower trendline, the next leg of the downtrend begins.

This pattern is deadly because it lures in hopeful buyers thinking the downtrend is over—only to slam them with another wave of selling.

Why Most Traders Get It Wrong (And How You Can Profit From Their Mistakes)

Most traders see price pausing after a big drop and assume it’s a reversal. They jump in long, expecting a rally. But here’s the brutal truth:

- Bearish pennants rarely fail—they usually break downward.

- False breakouts happen often, trapping amateur traders in losing positions.

- Stop losses are predictable, making them easy prey for market makers who love to hunt stops before the next big move.

How to Avoid the Trap:

- Don’t trade inside the pennant. This is the ‘chop zone’ where price moves erratically.

- Wait for a clean breakout below support. This confirms the downtrend is continuing.

- Use volume analysis. A breakout with strong volume increases the probability of success.

The Hidden Formula Only Experts Use

If you want to trade a bearish pennant on USD/JPY like a pro, you need to master the entry and risk management strategy.

Step 1: Spot the Setup Early

- Identify a strong prior downtrend on USD/JPY.

- Watch for price consolidation into a small symmetrical triangle.

- Confirm the pattern with declining volume.

Step 2: Wait for the Breakout (Patience = Profits)

- Set alerts at the lower trendline of the pennant.

- If price breaks below, wait for a candle close below support before entering.

- Avoid fakeouts—watch for a retest of the broken level.

Step 3: Execute Like a Sniper (Not a Shotgun)

- Enter short at the breakout confirmation.

- Place your stop loss above the pennant’s highest point (giving it room to breathe).

- Set a target at least 2x your risk (measured from the pennant pole).

This method allows you to maximize gains while keeping risk controlled.

Real-World Case Study: The 2023 USD/JPY Breakdown

Back in September 2023, USD/JPY formed a textbook bearish pennant around the 147.50 level after a massive drop from 150.00.

- Retail traders started buying, thinking it was a reversal.

- Smart money waited.

- As soon as price broke below 146.80, it collapsed another 250 pips.

Traders who followed the bearish pennant strategy made 3x their risk, while those who bought the fake breakout took painful losses.

Final Thoughts: Use the Bearish Pennant to Outsmart the Market

If you’re trading USD/JPY and you see a bearish pennant forming, remember:

- It’s not a reversal—it’s a continuation pattern.

- Most traders will get caught on the wrong side—don’t be one of them.

- Wait for the breakdown, enter strategically, and let the market do the work.

Want to sharpen your skills even further? Join our Forex community for real-time trade alerts, expert analysis, and exclusive trading tools:

- ???? Live Forex News: Stay ahead of market moves

- ???? Free Forex Courses: Learn next-level strategies

- ???? Smart Trading Tool: Automate risk management

Trade smart, and may your charts always be in your favor! ????

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The