LTC/USD and the Descending Triangle: The Hidden Playbook for Traders

The Elephant (or Should We Say, the Triangle) in the Room

Imagine you’re at a poker table, holding what seems like a solid hand, but your opponent keeps making small raises, never going all-in. You’re tempted to call, but the pressure builds as they slowly squeeze you out. Welcome to the world of the descending triangle pattern—where price action plays the role of a sneaky poker player, slowly forcing the market into submission before the inevitable breakout.

And if you’re trading LTC/USD, buckle up, because this pattern is one of the most misunderstood, misplayed, and downright deceptive formations in crypto and Forex alike. Today, we’re diving deep into how to trade LTC/USD when a descending triangle shows up, unveiling some elite tactics that separate rookies from the pros.

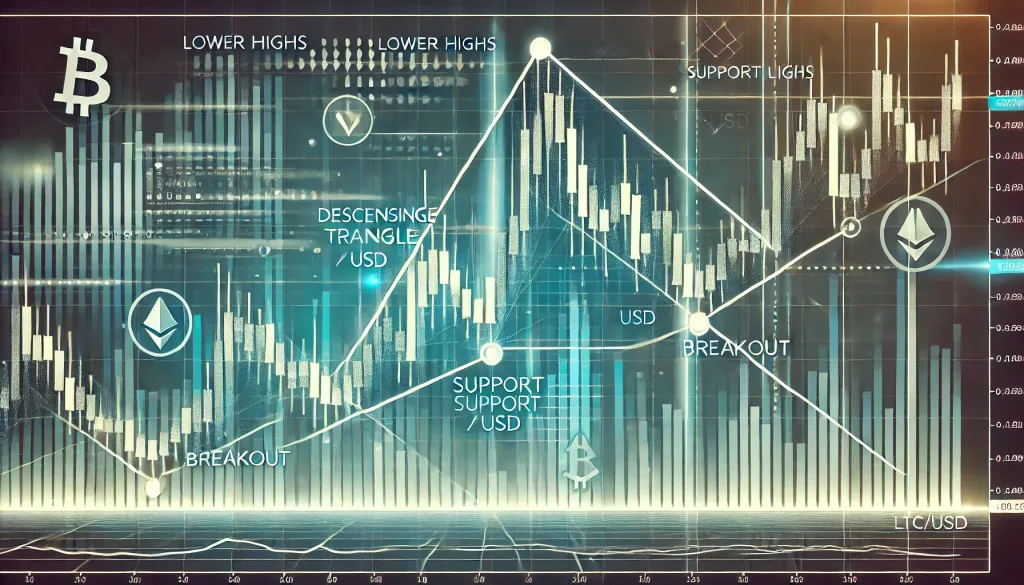

Decoding the Descending Triangle: What It Means for LTC/USD

A descending triangle is like that awkward party guest who refuses to leave—it just keeps testing lower supports until the floor gives out. But here’s what makes it powerful:

- Lower Highs: Sellers keep pushing down price, showing consistent bearish pressure.

- Flat Support Line: The market keeps hitting the same bottom level, until…

- Breakout (Usually Bearish): When the floor collapses, price plummets like a reality show contestant realizing they forgot to pack their mic.

The Myth: “It’s Always Bearish”

While a descending triangle is typically a bearish continuation pattern, here’s what the textbooks don’t tell you: false breakouts and squeezes are more common than most traders realize. And in a volatile asset like LTC/USD, these fakeouts can wreck stop losses faster than you can say “margin call.”

How to Trade a Descending Triangle in LTC/USD Like a Pro

1. Look for Volume Confirmation

A true breakout doesn’t whisper—it ROARS. Before making a move, analyze volume:

- High Volume + Breakdown = Real move

- Low Volume + Breakdown = Fakeout trap

- Volume Dwindling = Potential squeeze

2. Trap the Fakeout Traders

Institutions love to manipulate markets by triggering stop losses before the actual move. Here’s a ninja move:

- Place a sell stop BELOW the support line, but keep a watchful eye.

- If price fakes a breakdown and shoots back up, be ready to flip and go long.

- Use tight stop losses—LTC/USD can be erratic, so minimize damage.

3. Identify Key Support & Resistance Levels on Higher Timeframes

Too many traders obsess over the 1-hour chart, missing the bigger picture. Instead:

- Check the daily and 4-hour charts to spot major zones.

- If the breakdown aligns with a weekly support level, it’s likely a major move.

- Watch for bull traps and bear traps—a sudden reversal can happen when least expected.

4. Use Moving Averages as Extra Confirmation

A descending triangle breakdown is even more powerful when it aligns with:

- 200 EMA acting as resistance (strong bearish bias)

- 50 EMA crossing below 200 EMA (“death cross” scenario)

- Price rejecting off major EMAs on multiple timeframes

Real-World Example: LTC/USD Descending Triangle Breakdown in Action

In early 2024, LTC/USD formed a classic descending triangle, pressing against the $72 support level for weeks. Traders were divided—some anticipated a reversal, while others shorted aggressively.

What happened next? A fake breakdown occurred first, luring in breakout traders, only for price to whipsaw back up, liquidating shorts before finally making the real breakdown. The pros waited patiently and entered at the retest, while impatient traders got slaughtered.

Takeaway: The first breakout isn’t always the real move. Always look for a retest before committing fully.

Underground Tactics: The Game-Changing Edge

1. The “Liquidity Grab” Strategy

- Instead of placing orders at the exact breakout zone, wait for a wick below support and a fast reclaim before entering.

- This helps avoid stop-loss hunting and positions you for the true breakout move.

2. Combining Fibonacci Retracements

- If a descending triangle coincides with a 61.8% retracement level, odds are a major move is coming.

- Look for confluence with key support zones to boost confidence in the setup.

3. Watching Correlations

- LTC/USD often mirrors BTC’s price action, so monitor BTC for clues on upcoming breakouts.

- If Bitcoin is breaking major resistance, LTC/USD may follow with a delayed reaction.

Final Thoughts: How to Stay Ahead of the Market

The descending triangle isn’t just about breakouts—it’s about patience, precision, and knowing when NOT to trade. The key takeaways:

✅ Volume tells the truth—no confirmation, no trade.

✅ False breakouts are weapons of mass liquidation—stay one step ahead.

✅ EMAs and Fibonacci levels are your best friends for confluence.

✅ The first breakout isn’t always the real move—look for a retest.

Want to trade like a pro?

Join the StarseedFX community for exclusive strategies, elite trading insights, and market-breaking updates.

???? Get real-time Forex news: StarseedFX Forex News

???? Master Forex with free in-depth courses: Forex Education Hub

???? Level up with a free trading plan & journal: StarseedFX Trading Resources

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The