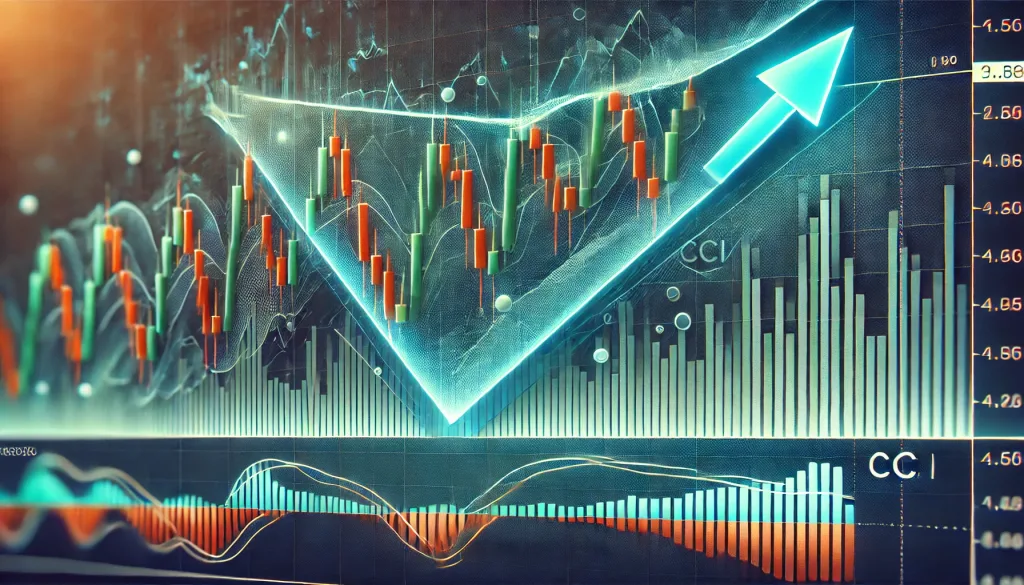

The Hidden CCI Trick That Exposes Rising Wedges Before They Collapse

The Market’s Dirty Little Secret: Rising Wedges and CCI

Some traders treat the Commodity Channel Index (CCI) like that old gym membership—use it a couple of times, then forget about it. Others misunderstand the Rising Wedge pattern, thinking it’s just another boring chart formation. But here’s the real deal: if you know how to read CCI inside a Rising Wedge, you can predict market reversals before most traders even know what hit them.

This isn’t some overhyped, recycled strategy. I’m about to show you an insider trick to detect when a rising wedge is about to pull a disappearing act—before it wrecks your trades. And no, it doesn’t involve black magic, just some good ol’ market psychology and a few ninja tactics.

Why Most Traders Get It Wrong (And How You Can Avoid It)

The Rising Wedge is a bearish reversal pattern that many traders misinterpret. Why? Because price action fools them into thinking the uptrend is still strong—until it’s too late. The pattern forms when:

- Higher highs and higher lows are made, but they start squeezing into a tightening range.

- Volume begins to drop, showing that momentum is fading.

- A sudden breakdown happens, catching FOMO buyers completely off-guard.

Most traders react too late, panicking as their long positions collapse. But what if you could see it coming before the breakdown? That’s where CCI steps in like a market whisperer.

CCI + Rising Wedge = Your Secret Weapon

The Commodity Channel Index (CCI) measures price momentum and overbought/oversold conditions. But here’s what the textbooks don’t tell you: when paired with a Rising Wedge, CCI gives early signals that price is about to drop off a cliff.

Here’s how it works:

- CCI Divergence: If price is making higher highs inside a rising wedge but CCI is making lower highs, that’s a major red flag. This means momentum is draining while price keeps rising—a classic recipe for a breakdown.

- CCI Overbought Zone: If CCI is above +100 and starts curling downward, get ready. The market is shifting gears, and a breakdown is lurking.

- CCI Breakout Confirmation: If CCI breaks below the zero line while price is still inside the wedge, that’s an early warning that a crash is coming.

Real-World Example: Let’s say GBP/USD is climbing within a rising wedge. Price is making higher highs, but CCI is showing divergence. Then, CCI suddenly dips below zero. A week later, GBP/USD tanks, and those who didn’t see the warning signs are left holding the bag.

How to Trade This Like a Pro (Step-by-Step Guide)

Now that you know what to look for, here’s a simple 5-step game plan to trade CCI + Rising Wedge like a seasoned pro:

- Spot the Wedge: Identify a rising wedge forming on a higher timeframe (H4 or Daily) to filter out weak setups.

- Check CCI Behavior: Look for bearish divergence—price makes higher highs, but CCI makes lower highs.

- Confirm Overbought Conditions: If CCI is above +100 and curling downward, prepare for a breakdown.

- Wait for CCI Breakdown: Once CCI crosses below zero, it’s your final signal to enter a short trade.

- Set Smart Stop-Loss & Take Profit: Place your stop above the wedge’s recent high and target previous support zones.

Why This Works (Backed by Market Psychology)

Most traders chase rising wedges thinking the uptrend will never end. But what they don’t realize is that a wedge forms because buyers are getting exhausted. Smart money (aka institutions) quietly distribute their positions, while retail traders get lured in by the illusion of an endless rally. When the wedge collapses, those who weren’t paying attention get wiped out.

By using CCI as an early warning system, you get to position yourself before the crowd realizes what’s happening. You’re not reacting—you’re anticipating.

Final Thoughts: Mastering the Hidden Art of Market Timing

Mastering the CCI + Rising Wedge strategy isn’t just about reading indicators—it’s about understanding market psychology. If you want to start using this elite-level approach, test it out, refine your entries, and watch how often it saves you from getting caught in fake rallies.

Want access to real-time market updates and expert insights? Check out StarseedFX’s latest Forex news for game-changing strategies and exclusive alerts.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The