Uncovering Swing Trading Secrets: Mastering the Bearish Pennant

When it comes to swing trading, the bearish pennant pattern is a game-changer, yet it’s a little-known gem hiding in plain sight. This pattern, with its sharp moves and precise formations, offers traders a reliable roadmap to navigate market downturns like a seasoned pro. In this article, we’ll dive into the nuances of swing trading using the bearish pennant, revealing insider tips, hidden opportunities, and proven techniques that most traders overlook.

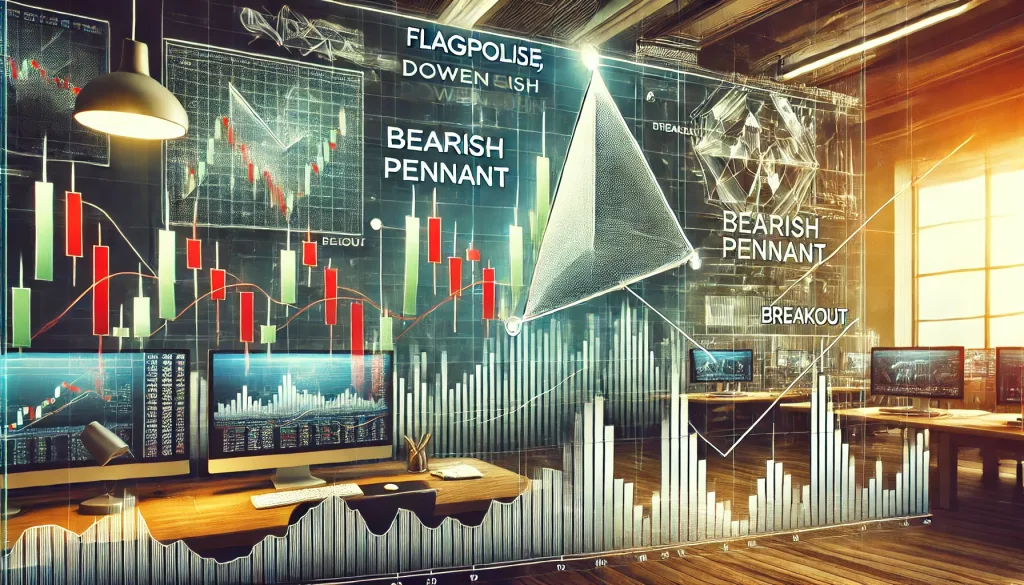

What is a Bearish Pennant, and Why Does It Matter?

Picture this: the market drops sharply, catches its breath for a moment, and then plunges again. That breather? It’s the pennant. The bearish pennant is a continuation pattern that signals the market is likely to continue its downward trend.

Why it matters: It’s like finding a signpost on a winding road, pointing you to the next big move. If you know how to read it, you can anticipate price movements with precision.

Spotting the Pattern Like a Pro

Think of the bearish pennant as a two-act play:

- The Flagpole: This is the initial sharp price drop that sets the stage. It’s the market yelling, “The trend is bearish!”

- The Pennant: A small, triangular consolidation forms as the market takes a breather. Volume often declines here—a subtle hint that traders are waiting for their cue.

Pro Tip: Use your favorite charting tools to spot this formation. Indicators like volume and trendlines can confirm what your eyes see.

Breaking Myths About the Bearish Pennant

Myth: “The pattern is too simple to work in today’s complex markets.”

Truth: Simplicity is often overlooked but incredibly effective. Even seasoned traders swear by the bearish pennant for its clarity and reliability.

Myth: “It’s risky to trade during consolidation.”

Truth: While there’s always risk, understanding the context of a bearish pennant minimizes guesswork and enhances your strategy.

Insider Tips for Trading the Bearish Pennant

- Entry Point: Wait for the price to break below the lower trendline of the pennant. This confirms the pattern and reduces false signals.

- Stop Loss Placement: Place your stop loss above the pennant’s resistance line. It’s like setting up a safety net.

- Target Price: Measure the height of the flagpole and project it downward from the breakout point. This gives you a realistic profit target.

Ninja Tactic: Use multiple timeframes to confirm the pattern. Spot it on the daily chart but validate it on the hourly chart for added confidence.

Real-World Example: The 2023 EUR/USD Bearish Pennant

In 2023, EUR/USD showcased a textbook bearish pennant during a volatile market phase. After a steep decline, the pair consolidated into a neat triangle before breaking downward. Traders who spotted this opportunity reaped significant gains by sticking to the basics—entering at the breakout, setting tight stops, and targeting the measured move.

Why Most Traders Miss Out on Bearish Pennants

- Overcomplicating Analysis: Many traders overlook simple patterns like the bearish pennant in favor of complex indicators.

- Ignoring Volume: A decline in volume during the pennant’s formation is a crucial clue. Failing to recognize this can lead to missed opportunities.

- Fear of Continuation Patterns: Some traders are hesitant to trade continuation patterns, mistaking consolidation for indecision.

Lesson: Simplicity and discipline are your best allies. Stick to proven methods, and don’t let fear or over-analysis cloud your judgment.

Common Mistakes and How to Avoid Them

- Entering Too Early: Patience pays. Wait for a confirmed breakout before jumping in.

- Setting Loose Stop Losses: A poorly placed stop loss can wipe out your gains. Be precise.

- Forgetting Risk Management: Even the best setups can fail. Always manage your position size and risk.

Advanced Insights: Mastering the Bearish Pennant

- Combine with Indicators: Pair the bearish pennant with RSI or MACD to strengthen your analysis.

- Watch the News: Market sentiment plays a significant role. Economic reports or geopolitical events can validate or invalidate your setup.

- Hone Your Timing: Use tools like Fibonacci retracements to fine-tune your entry and exit points.

Why the Bearish Pennant is a Swing Trader’s Best Friend

Swing traders thrive on patterns that offer clear entry and exit points. The bearish pennant’s structured nature makes it an ideal candidate. Its ability to signal continuation in a downtrend aligns perfectly with the goals of swing trading—capturing significant price movements over days or weeks.

Hidden Opportunity: Many traders focus on breakouts or reversals, but the bearish pennant sits in a sweet spot, offering reliable setups that others often miss.

Takeaway: Master the Pattern, Master the Market

The bearish pennant isn’t just a pattern; it’s a blueprint for success in volatile markets. By mastering this formation, swing traders can unlock consistent profits while avoiding common pitfalls.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The