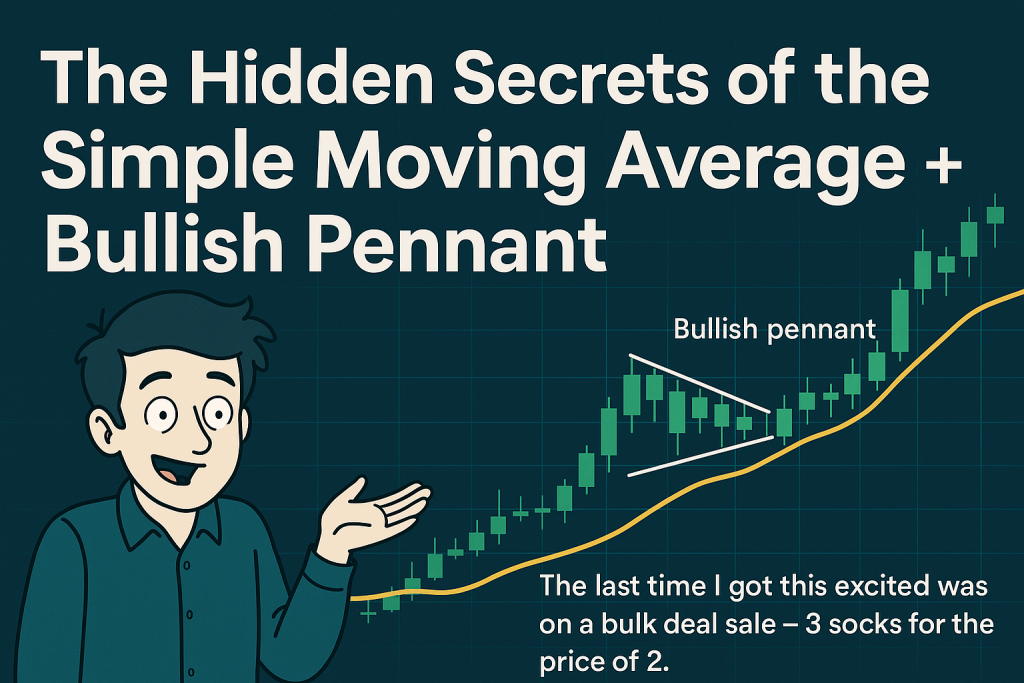

The Simple Moving Average + Bullish Pennant Combo That Outsmarts the Crowd

What Do a Latte, a Trendline, and Your Last Impulse Trade Have in Common?

They all cost you more than you thought.

But here’s the thing—if you know how to pair a humble Simple Moving Average (SMA) with the high-probability Bullish Pennant formation, you can start treating your trading like a Michelin-starred menu instead of reheated leftovers from the dollar store of indicators.

In this underground playbook, we’re diving into the advanced, lesser-known tactics of combining the “simple moving average” with the “bullish pennant” for high-precision entries, sniper exits, and ninja-level trade confidence.

This is not your basic how-to.

We’re pulling back the curtain on hidden gems, insider strategies, and time-tested secrets.

Why the SMA Isn’t Just a Newbie Indicator (And Why That’s a Myth You Should Shred Like Expired Sushi)

The Simple Moving Average (SMA) gets unfairly thrown into the rookie toolbox. You know, right next to “Hope” and “Gut Feelings.” But seasoned traders who know what to look for see the SMA as a filter for noise, a radar for trend health, and—with the right partner—a hidden accelerator.

Contrarian Insight: The 50-period and 200-period SMAs are not just about golden/death crosses. They’re trend validators for continuation patterns like the Bullish Pennant.

According to Linda Bradford Raschke, legendary trader and market wizard, *”Price patterns should always be confirmed with a broader trend context.”

Translation? Your Bullish Pennant means squat if it’s forming against the tide.

And that’s where the SMA steps in like a wise uncle who once traded the Deutsche Mark barefoot in the 80s.

What Most Traders Miss in the Bullish Pennant (And How to Spot It Like a Sniper)

The Bullish Pennant is a pause. A nap in the middle of a sprint. But if you’re entering at the wrong moment, it’s not a setup—it’s a setup for failure.

Here’s what 90% of traders do wrong:

- They jump in on the breakout without confirming trend strength

- They ignore volume—aka the engine behind price

- They place stops tighter than a caffeine addict’s jawline

The Ninja Fix:

- Step 1: Confirm the uptrend with the 50 SMA above the 200 SMA (Golden Cross or strong bullish slope).

- Step 2: Spot the pennant forming above both SMAs

- Step 3: Use volume spikes to validate breakout momentum

- Step 4: Set stop-loss below the pennant base or the nearest swing low

Stat to Know: According to a study by Thomas Bulkowski, bullish pennants break upward 54% to 63% of the time, with success rates soaring when they align with a confirmed trend.

The Hidden Power Combo: SMA + Bullish Pennant in Action

Let’s get surgical.

Imagine EUR/USD is trending upward. The 50 SMA is cleanly above the 200 SMA—no cross-dressing confusion. You spot a bullish pennant forming after a strong impulsive move.

The candle wicks are consolidating, volume’s taking a nap, and you’re seeing price snuggle between the lines.

That’s your tension build-up. Like waiting for your coffee to brew while your cat knocks over your favorite mug.

Then—boom—a bullish breakout on increased volume.

Entry: Right above the pennant breakout SL: Below the pennant structure TP: Use Fibonacci extension (127.2% or 161.8%) or ride it until a reversal candle breaches the 50 SMA

Now you’re not just playing breakout roulette. You’re making precision moves.

How Algorithms and Institutional Traders Use This Combo (And Why You Should Too)

Smart money doesn’t guess. It reacts.

According to CME Group research, institutional traders use moving averages as part of algorithmic filters to detect high-probability continuation patterns.

So when price hovers above a rising 50 SMA and forms a bullish pennant—those aren’t random squiggles. They’re tripwires.

You’re essentially syncing up with the machines that move the market.

Avoid These Traps or Risk Becoming a Trading Meme

- Chasing the breakout without a trend filter: That’s like skydiving with a backpack full of sandwiches instead of a parachute.

- Forgetting volume: A pennant without volume is like a joke without a punchline—awkward and easy to misread.

- Overleveraging: Don’t pour rocket fuel into a tricycle. Respect risk.

Why This Combo Thrives in Liquid Markets (And Dies in Choppy Ones)

Liquidity matters. In high-volume markets (think EUR/USD, USD/JPY), the SMA-pennant combo behaves predictably.

In choppy, illiquid pairs, however, it’s more fakeouts than a soap opera wedding.

Stick to major pairs and look for confluence with macro news: like the ECB rate decision or NFP Fridays.

Little-Known Enhancers: Filters That Supercharge the Strategy

- ATR for Volatility Management: Use Average True Range to determine realistic SL and TP zones

- VWAP for Institutional Bias: If price breaks above a bullish pennant and the VWAP—the move has legs.

- Pivot Points: Add these as static S/R zones for precision exits

Pro-Level Checklist: How to Trade the SMA + Bullish Pennant Like a Market Wizard

- Identify a strong uptrend with SMA alignment (50 > 200)

- Wait for a bullish pennant above both SMAs

- Confirm with decreasing volume inside the pennant and increasing volume on breakout

- Enter above the breakout candle

- SL below pennant base; TP using Fib or S/R zones

- Validate with VWAP or news confluence

- Track results using a trading journal

Elite Tactics Summary: What You’ll Walk Away With

- SMA isn’t basic. It’s a gatekeeper to trend legitimacy

- Bullish Pennant = precision continuation setup

- Combine both and align with volume, VWAP, and Fib levels for sniper trades

- Avoid fakeouts using trend validation and proper risk settings

- Sync your strategy with what institutions and quants look for

Looking to Trade Smarter, Not Harder?

Explore our Smart Trading Tool for real-time order management, lot size calculations, and precision-based entries: https://starseedfx.com/smart-trading-tool/

Stay ahead of the curve with real-time insights: https://starseedfx.com/forex-news-today/

And don’t forget your Free Trading Plan: https://starseedfx.com/free-trading-plan/

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The