The Rounding Bottom and Supply & Demand Zones: The Hidden Combo That Outsmarts 90% of Traders

The Market’s Favorite Optical Illusion

Ever feel like the market is gaslighting you? One minute, price action is making lower lows, and the next thing you know, it’s up like it’s had an espresso shot and a motivational podcast. That, my friend, might be the stealthy work of a rounding bottom quietly forming beneath your nose.

Pair that with supply and demand zones, and you’ve got yourself a chart setup that’s sneakier than a trader trying to expense a vacation as a “market research trip.”

Let’s dive into why this powerful combo might just be your ticket to trading like a market ninja—stealthy, strategic, and surprisingly successful.

The Forgotten Chart Pattern That’s Actually a Powerhouse

The rounding bottom, sometimes called a saucer bottom, is like that quiet kid in class who ends up founding a billion-dollar startup. Underestimated? Constantly. Powerful? Absolutely.

Here’s what makes it magical:

- Gradual Shift in Sentiment: Unlike V-shaped reversals, rounding bottoms suggest a long, deliberate change in buyer-seller dynamics.

- Accumulation Zone: Smart money often loads up in the bottom curve while retail traders panic sell.

- Breakout Predictability: When paired with volume spikes and demand zones, breakouts are like watching a rocket launch you actually predicted.

“The best profits come from the anticipation, not the reaction.” — Linda Raschke

And what fuels that anticipation? Recognizing these subtle curves before they get mainstream attention.

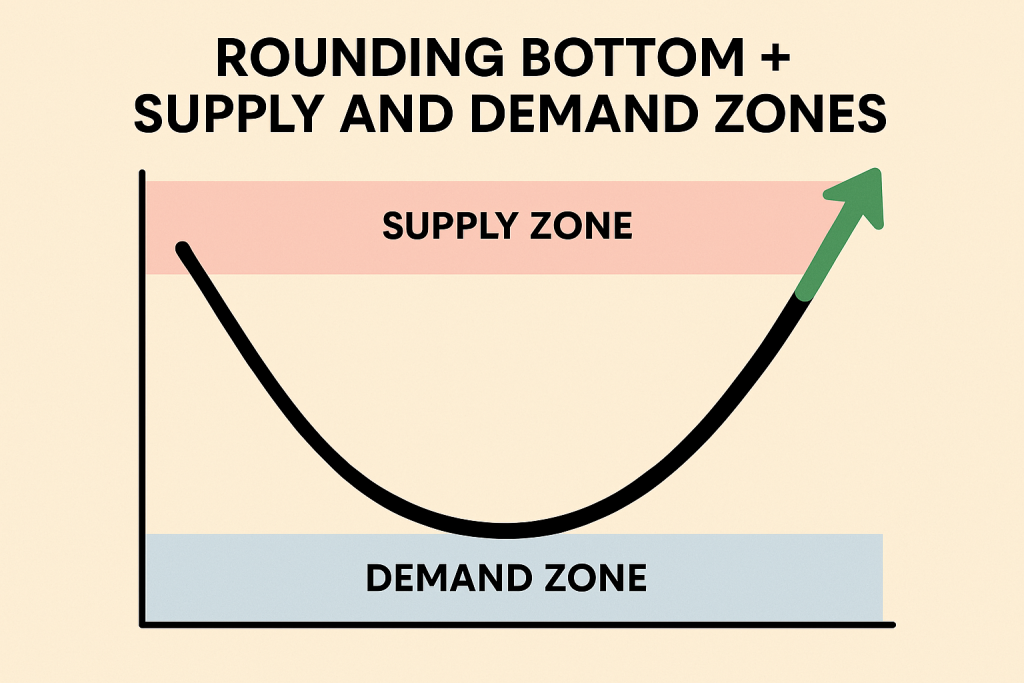

Supply and Demand Zones: The VIP Sections of the Market

Forget support and resistance lines that look like they were drawn with a blindfold. If price action were a nightclub, supply and demand zones would be the velvet-rope VIP areas—where the real money moves.

- Demand Zone: Where big players buy low. It’s where price often reverses and starts the slow curve into a rounding bottom.

- Supply Zone: Where they offload positions, often lining up perfectly with the neckline of the rounding bottom.

These zones are not arbitrary. They’re based on imbalances in the order book, often confirmed by volume spikes and price stalling patterns.

According to a 2024 study by the Bank for International Settlements, over 70% of intraday reversals occurred within previously defined institutional demand zones.

How to Spot the Setup: Step-by-Step Guide

Ready to become a rounding bottom whisperer? Here’s your sniper checklist:

- Zoom Out to 4H or Daily Timeframes – Rounding bottoms need room to breathe.

- Identify the Curve – Look for a gradual U-shaped structure, not a sharp V.

- Overlay Demand Zones – Use the last strong bullish engulfing or volume surge as your anchor.

- Watch Volume Like a Hawk – Volume should be decreasing on the left side of the curve and increasing toward the right.

- Neckline = Trigger Zone – Draw a horizontal line at the previous peak before the downturn. Breakout above this? Green light.

- Supply Zone = Take Profit Target – Look for previous heavy sell-off zones where price is likely to react.

Hidden Trends Most Traders Overlook

Now here’s the spicy stuff:

- AI-Trading Algorithms Love This Pattern: Machine-learning models favor rounding bottoms due to their statistical symmetry. According to QuantInsti, 60% of reinforcement learning bots flagged this pattern as “high probability reversal” in backtests.

- Confluence with Fundamentals: Rounding bottoms often coincide with macro reversals—rate cuts, economic pivot points, or even geopolitical cool-downs.

- Volume Profile Synergy: The lowest part of the bowl often aligns with high-volume nodes. Combine that with demand zones, and you’re sitting on a launchpad.

Why Most Traders Get It Wrong (And How to Avoid Their Mistakes)

Let’s be honest—how many times have you mistook a rounding bottom for “just another consolidation”? It happens. But here’s where most traders trip up:

- Entering Too Early: Jumping in mid-curve is like biting into cookie dough before it’s baked. Wait for confirmation.

- Ignoring Volume: No volume? No party. Breakouts without volume often fake out and drag you into regret.

- No Contextual Awareness: If you’re not looking at the supply and demand zones, you’re just guessing with style.

Avoid these missteps and you’re not just ahead of the pack—you’re practically leading the race.

Real-World Example: GBP/AUD 2024 Reversal

Back in March 2024, GBP/AUD formed a textbook rounding bottom on the 4H timeframe. It hovered within a deep demand zone marked by institutional activity and a previous central bank rate shift.

- The volume dried up at the bottom and ramped up as the pair pushed through the neckline.

- The rounding bottom breakout aligned with the 1.8750 supply zone—textbook exit.

- Traders who timed it right banked over 400 pips with minimal drawdown.

The Smart Trader’s Cheat Sheet

Here are your insider ninja tactics to apply today:

- Timeframe Alignment: Use 4H or Daily for structure, 1H for sniper entries.

- Volume + Price = Clarity: Combine your analysis with volume profile and order blocks.

- Use Our Smart Trading Tool to calculate optimal lot size and risk for your setup: Smart Trading Tool

- Log Everything: Use our Free Trading Journal to track your setup entries, exits, and lessons.

- Don’t Trade Alone: Get real-time alerts and elite guidance from our trading community at StarseedFX Community

The One Simple Trick That Changes Your Trading Mindset

Stop seeing price as chaos. Start viewing it as a story. The rounding bottom is a plotline. The supply and demand zones? They’re the settings where the drama unfolds.

Once you recognize the arc, you’re not reacting. You’re predicting.

Now that’s a plot twist worth trading.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The