The Rounding Bottom Secret: Capital Allocation Hacks That Pros Won’t Tell You

Picture this: You spot a rounding bottom forming on your chart. Your heart flutters like you just found a $100 bill in your laundry. You KNOW it’s about to pop, but here’s the real question—how much should you actually invest? And what if it goes sideways, literally? You don’t want to end up like that guy who YOLOed his rent money on a meme stock and now lives off instant noodles.

Let’s break it down—like the pro traders do—but with a twist. We’re uncovering the hidden link between rounding bottoms and capital allocation that could give you the trading edge you didn’t know you needed.

Why That Perfect Rounding Bottom Might Still Wreck You

A rounding bottom pattern looks smooth and sweet—like a perfectly brewed latte. It signals a potential bullish reversal. But here’s where most traders go wrong:

They over-allocate.

It’s like walking into an all-you-can-eat buffet and filling your plate like you’re feeding a small army. The excitement clouds your judgment. You bet big because the setup looks textbook. Then, the market dips slightly, and boom—your account balance is thinner than your patience.

According to the Bank for International Settlements (BIS), over 75% of retail traders blow their accounts within the first year.

Here’s What Pros Know That You Don’t:

- Capital Allocation Adjusts with Pattern Maturity: Early rounding bottoms are deceptive. The pattern is fragile. Allocating 2% of your capital early is safer. Once the curve tightens and volume increases, pros scale up to 4-5%.

- Volatility Dictates Risk: If ATR (Average True Range) is high, pros reduce their position size. High ATR means the market is doing Zumba—lots of movement, but hard to predict.

- Partial Entries Are King: Experts like Kathy Lien emphasize partial entries. “Entering in tiers allows you to average into volatility,” she advises (source).

The Hidden Formula Only Veterans Use

Capital allocation during rounding bottoms isn’t guesswork. It’s math meets ninja discipline.

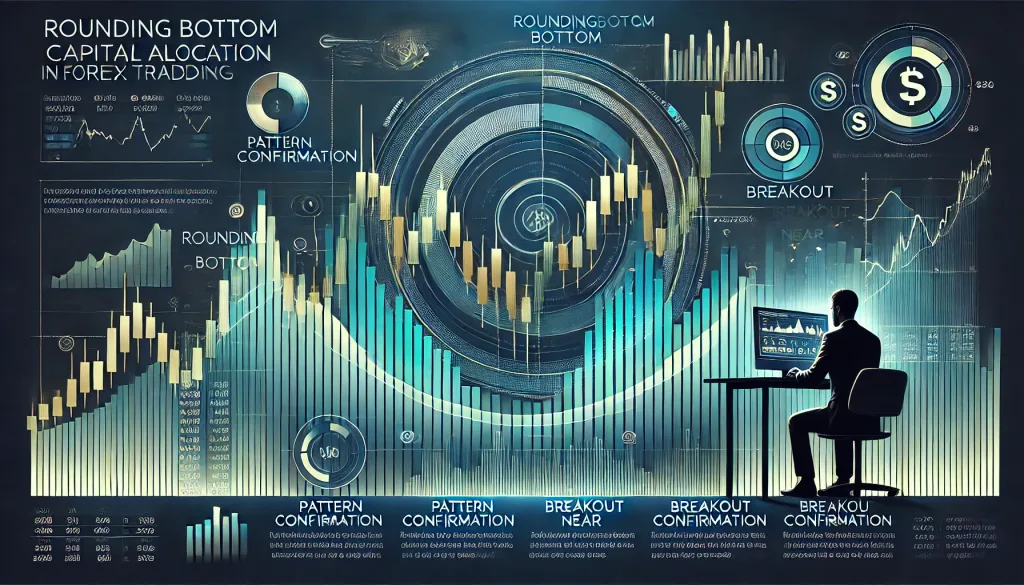

Advanced Allocation Model for Rounding Bottom Setups:

- Phase 1: Pattern Confirmation (Low Allocation)

- Allocate 1.5% of your account balance when you spot the initial rounding curve.

- Wait for volume to increase by at least 20% compared to the 50-day average (BIS recommends volume analysis for reliability).

- Phase 2: Breakout Near (Moderate Allocation)

- Scale up to 3% once the price hugs resistance.

- Set a stop loss below the rounding curve base—tight, but not suffocating.

- Phase 3: Breakout Confirmation (Aggressive Push)

- Increase allocation to 4.5% on a clean breakout with 30% volume spike.

- Lock in profits incrementally; don’t get greedy.

Pro Tip: Use the StarseedFX Smart Trading Tool to automate these allocations with precision. It calculates optimal position sizes based on your account and volatility (tool here).

Why Most Traders Miss the Rounding Bottom’s Sweet Spot

Think of rounding bottoms like ripe avocados. Too early, it’s hard and bitter. Too late, it’s brown mush. The timing of your capital allocation is the secret sauce.

How To Nail the Sweet Spot:

- Volume Surge Is the Catalyst: John Bollinger, creator of Bollinger Bands, advises: “Volume is the most valuable confirming indicator for pattern validation” (source).

- Watch the Retest: After the breakout, if the price retests the neckline without breaking below, seasoned traders often increase their stake by another 1-2%.

- Cut Early, Scale Hard Later: Legendary trader Paul Tudor Jones once said, “Don’t focus on making money; focus on protecting what you have” (source). Reducing early-phase allocation protects your bankroll for that killer Phase 3 move.

Underground Tactic: The Stealth Re-entry

Sometimes, the rounding bottom fakes out. You enter, it dips, and your stop loss triggers. Most traders rage-quit. Pros? They re-enter stealthily.

Re-Entry Blueprint:

- Wait for the Dip-Then-Snap: If the price falls 1-2% below your initial entry but rebounds fast, it’s likely a stop hunt.

- Re-enter with 50% of the initial position size.

- Tight Stop: Place a stop loss tighter than your ex’s emotional boundaries.

Why It Works: Market makers often flush weak hands before a real breakout.

Capital Allocation Myths That Keep You Losing

Myth #1: “Big Patterns Need Big Bets”

Reality: Size of the pattern doesn’t equal position size. It’s volatility and volume that dictate your capital.

Myth #2: “Allocate Consistently Across All Trades”

Reality: Adaptive allocation beats fixed allocation. Rounding bottoms need more dynamic scaling.

Proven Techniques Summary: What You Need to Remember

- Phase Allocation Model: Start small, scale as confirmation builds.

- Volume > Everything: Treat it like your GPS. No volume, no trade.

- Stealth Re-entries: Stop-loss hits aren’t the end. Sometimes, they’re just the beginning.

- Partial Entries: Average into volatility like the pros.

- Tool Up: Use the StarseedFX Smart Trading Tool for precision.

Final Thoughts (Because We’re All Human)

Let’s be real. Trading can feel like speed dating—fast, confusing, and occasionally humiliating. But with rounding bottoms and capital allocation, precision beats emotion. Trade smart, not big.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The