The Not-So-Obvious 15-Minute Wedge: An Underground Gem

When most traders look at charts, they see random lines zigzagging up and down like a toddler with a crayon. But those of us in the know? We see art, we see purpose, and in the 15-minute timeframe, we see an opportunity that moves faster than a sale at your favorite shoe store. (And, yes, unlike that pair of neon loafers you bought, this one is actually useful.)

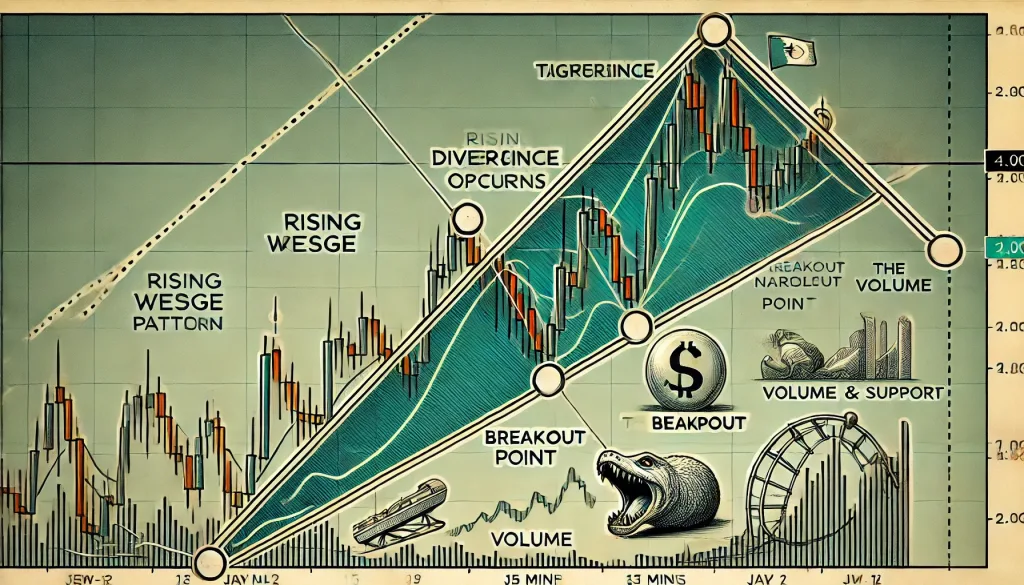

In this post, we’re diving into the rising wedge on the 15-minute chart—a pattern that many dismiss or underestimate. But here’s the catch: once you understand its potential, the wedge can become a true profit powerhouse in your trading arsenal.

The Secret Behind the Rising Wedge Pattern

The rising wedge pattern is essentially that one friend you have who seems to have everything going great on the surface but you just know there’s a breakdown around the corner—kind of like that time I accidentally hit ‘buy’ instead of ‘sell’ and the market decided to take a dive, much like my optimism. The rising wedge is characterized by a gradually tightening upward channel that, surprise surprise, loves to fake people out before sending prices lower.

A Quick Rundown of the Pattern

To keep it simple, the rising wedge is a bearish reversal pattern. Yes, even when price action seems to be climbing, it’s actually moving towards a setup for a decline. It forms when the price makes higher highs and higher lows, but the movement between those highs and lows starts to converge—like a spring coiling tighter. And what happens to a coiled spring when it releases? Exactly.

Key Characteristics:

- The channel gradually narrows as price action creates higher highs and higher lows.

- Volume typically declines, hinting that buyers are getting less enthusiastic as they hit resistance points.

- As the wedge narrows, watch for the big break below the support line.

This is the ideal moment to enter a short trade. But here’s where the ninja-level tactics come into play: timing your entry, avoiding traps, and maximizing your profit (while avoiding the regret that rivals buying Bitcoin pizza in 2010).

The Real Juice: Trading the Rising Wedge on the 15-Minute Timeframe

Trading the rising wedge on the 15-minute timeframe is a bit like being at an exclusive club. You get to see moves developing before the bigger crowds catch on. Here are some pro tips to make sure you’re that VIP trader:

1. Look for Divergence—Your Early Warning System

One way to boost your odds is by spotting bearish divergence on a momentum indicator (like the RSI). As the price continues to edge higher within the wedge, the RSI might be quietly calling it a day and forming lower highs. This tells you that the price rally is running out of steam.

Pro Tip: Think of divergence as that friend who loves to tell you the truth, even when no one else will. It’s the market hinting, “Hey buddy, it’s getting a bit dicey up here.” Use that to your advantage.

2. Know the Entry Sweet Spot—Where the Magic Happens

The wedge is just about to end, and here’s the golden nugget: you want to get in just as price breaks below the lower support trendline. A lot of traders—the amateurs—wait too long. By the time they realize the wedge is crumbling, the move has already begun, and they’re left wondering why they missed it. Getting in early, within a 15-minute window, gives you the leverage to maximize profits while limiting risk.

To make things even sweeter, place your stop just above the last high of the wedge. If it takes out the stop, guess what? It wasn’t a valid breakout—meaning the market just did you a favor and kept you from a losing trade.

Breaking Myths and Finding Gold

Now, let’s bust a couple of myths about the rising wedge pattern:

Myth #1: Rising Wedge Is Always Bearish

That’s not true. Rising wedges can also form during uptrends, continuing the bullish movement. But here’s the secret: it’s about context. In a 15-minute timeframe, you’re more likely to find it acting as a reversal signal, especially in range-bound markets. Remember, not every wedge is born to fall, but they do love to trick traders into thinking the rally will go on forever.

Myth #2: The Breakout Always Leads to Massive Moves

The rising wedge breakout on a 15-minute timeframe doesn’t necessarily mean we’re going to the moon (or plummeting to the earth’s core). Sometimes, these moves are subtle. Recognizing the pattern and taking small, consistent profits is what turns you from average to exceptional. And isn’t that what we’re all here for?

Ninja-Level Exit Tactics

Alright, so you’re in. Congratulations! But before you start patting yourself on the back, it’s important to know when to get out. One method is using the measured move, essentially calculating the distance between the initial high and low in the wedge and projecting it from the breakout point. Or, you could do what some pros do and set trailing stops—allowing profits to run until there’s a clear reversal signal.

Avoiding Common Pitfalls

We’ve all been there: staring at a chart, seeing a rising wedge, and telling ourselves, “This is the moment I’ve been waiting for.” Only to realize after hitting the button that we were totally wrong and the market just played us like a bad sitcom plot twist.

1. Don’t Force It

If the wedge looks forced—like it’s one of those ‘kinda looks like’ situations—leave it alone. Not every narrowing channel is a wedge. Real talk? If it looks like that one weird cousin at family gatherings, it’s probably not a valid wedge. Only trade those that are textbook perfect, or you’ll be kicking yourself when the market moves in the opposite direction.

2. Volume Matters

As the wedge narrows, volume should taper off. It’s a clear signal that traders are losing confidence in the continuation. But if volume is blasting off like fireworks on New Year’s Eve, maybe reconsider—you might be looking at something else entirely.

Real-World Example: The Power of Patience

A perfect real-world example happened earlier this year. A 15-minute rising wedge formed on EUR/USD, just around a major resistance level. Traders who recognized the pattern and patiently waited for the breakdown were able to ride the subsequent bearish move for over 40 pips. The pattern took nearly four hours to develop, but patience, in this case, paid off. It’s like the ultimate slow-cooker recipe—you have to let the flavors build.

The Big Takeaway

If there’s one thing you should remember, it’s this: the rising wedge pattern is a master at creating false hope. It tricks the market into thinking everything is peachy—only to suddenly shift gears. Learning to identify and trade this pattern effectively on a 15-minute timeframe gives you an edge most traders lack.

And here’s the part where I drop a bombshell: mastering this wedge can be simpler than you think when you understand context, volume, and divergence. Like any good strategy, it’s about consistency, managing your risk, and never forcing a setup.

So, the next time you see a rising wedge, treat it with the respect it deserves. Let it develop, keep an eye on those divergences, and be ready to pounce when the moment is right—before you end up like that friend who bought those neon loafers.

Take Action: Ready to up your wedge game? Head over to StarseedFX’s Free Forex Courses and get access to in-depth materials that’ll make your understanding of wedge patterns sharper than ever. Or join our community at StarseedFX Community for daily alerts, live analysis, and ninja-level tips to stay ahead of the market.

And don’t forget: you miss 100% of the wedges you don’t see. Let’s keep an eye out together.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The