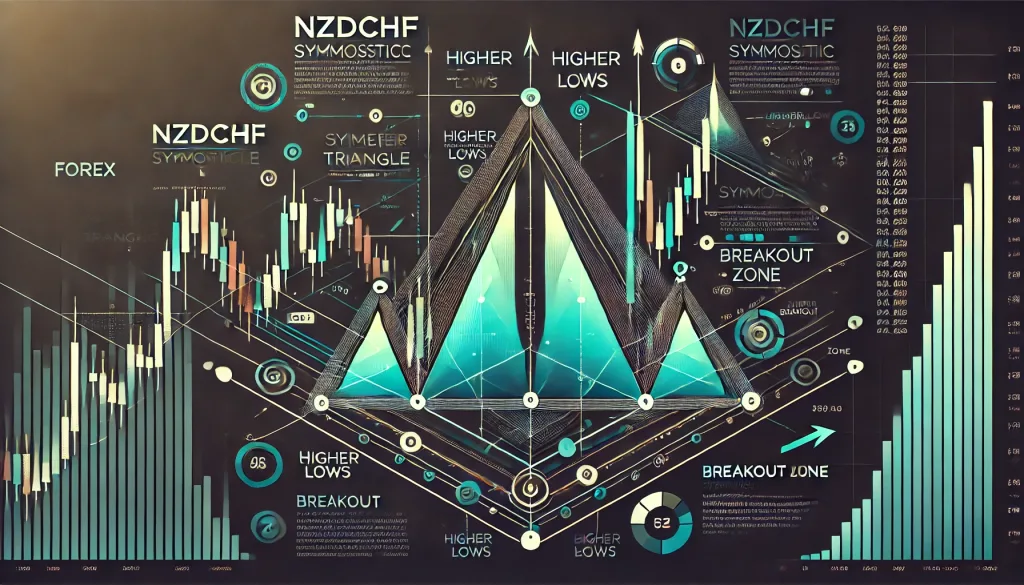

Master the NZDCHF Symmetrical Triangle: Hidden Tactics Revealed

When it comes to Forex trading, some patterns fly under the radar—hidden gems waiting to be discovered by savvy traders. The NZDCHF symmetrical triangle is one such pattern, a technical formation that offers incredible potential when wielded with precision. Let’s explore how to master this lesser-known setup, combining humor, advanced insights, and ninja-level tactics to take your trading game to new heights.

What is the NZDCHF Symmetrical Triangle?

Imagine a tug-of-war where both teams are equally matched, pulling the rope into a perfectly triangular formation. That’s your symmetrical triangle—formed when NZDCHF price action consolidates into a narrowing range of lower highs and higher lows. This pattern often signals a breakout, but the direction? That’s the million-dollar question.

Why Most Traders Miss This Hidden Gem

Trading is a lot like fishing. Most traders cast their nets where the crowd gathers, missing out on the quieter spots teeming with opportunity. The NZDCHF symmetrical triangle is one of those quiet spots. Why?

- Lack of Awareness: Many traders overlook cross pairs like NZDCHF, focusing instead on major pairs like EURUSD.

- Misinterpreting Patterns: Symmetrical triangles often look mundane to the untrained eye, leading traders to dismiss them as noise.

- Fear of False Breakouts: The pattern’s ambiguity—whether it will break bullish or bearish—scares off less confident traders.

Breaking Down the NZDCHF Symmetrical Triangle

Step 1: Identify the Triangle

- Use the 4-hour or daily timeframe for clarity.

- Look for converging trendlines connecting higher lows and lower highs.

Step 2: Measure the Potential

- Calculate the height of the triangle at its widest point. This gives you a projected breakout target.

Step 3: Watch for the Breakout

- Use volume as a confirmation. A breakout accompanied by increasing volume is more reliable.

- Wait for a candle close outside the triangle before entering a trade.

Step 4: Manage Risk

- Set your stop loss just outside the triangle on the opposite side of the breakout.

- Use a 1.5:1 or 2:1 risk-reward ratio for optimal results.

Advanced Ninja Tactics for Symmetrical Triangles

1. Use Fibonacci Retracements

Combine Fibonacci levels with the triangle to pinpoint high-probability breakout zones. For instance, if the breakout aligns with a 61.8% retracement level, it’s a strong signal.

2. Pair it with Economic Indicators

NZDCHF is heavily influenced by New Zealand’s dairy exports and Swiss franc’s safe-haven status. Watch for news impacting these economies to anticipate breakout directions.

3. Trade the Fakeout

Sometimes, price action fakes a breakout in one direction before reversing. Advanced traders can capitalize on these fakeouts by setting trap orders.

Humorous Anecdote: The Triangle Tango

Trading the symmetrical triangle is like going to a wedding where everyone expects you to dance. The triangle teases you, hinting at a breakout. You step forward, unsure if it’ll lead to a slow waltz (gradual breakout) or a wild cha-cha (sharp price movement). Either way, the key is not to trip over your own feet—or your stop loss.

Case Study: A Real-World Example

In October 2023, NZDCHF formed a textbook symmetrical triangle on the daily chart. Traders who spotted the pattern and followed our ninja tactics saw a bullish breakout that rallied 120 pips. By combining Fibonacci retracements and volume analysis, they minimized risks and maximized profits.

The Power of the NZDCHF Symmetrical Triangle

The symmetrical triangle may not be the flashiest pattern, but it’s a reliable tool for traders willing to dig deeper. With careful analysis, disciplined risk management, and a sprinkle of humor, you can turn this hidden gem into a cornerstone of your trading strategy.

Elite Tactics in Bullet Points

- Identify the pattern on 4-hour or daily charts.

- Measure the triangle’s height to set breakout targets.

- Confirm with volume and candle closes.

- Manage Risk with strategic stop-loss placement.

- Enhance Accuracy using Fibonacci levels and economic indicators.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The