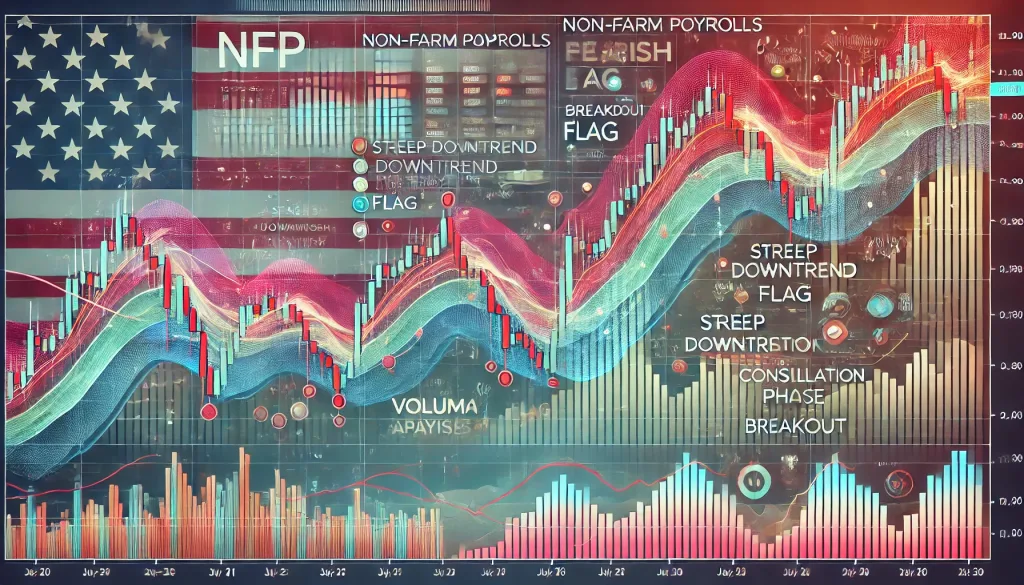

Master NFP Non-Farm Payrolls with Bearish Flag Strategies

NFP Non-Farm Payrolls and the Bearish Flag: Advanced Forex Strategies

The Non-Farm Payrolls (NFP) report is a cornerstone of Forex trading, causing ripples (or tidal waves) across the market every month. Pair this high-impact event with the bearish flag pattern, and you’ve got a recipe for precision trading with potentially massive payoffs. Let’s dive deep into how to leverage this combo to stay ahead of the curve.

Why NFP Matters More Than Your Morning Coffee

If Forex traders had a superhero event, it would be NFP day. Released on the first Friday of every month, the report provides key insights into the U.S. labor market. Better-than-expected data signals economic strength, often boosting the U.S. dollar. Conversely, weaker numbers can lead to dollar weakness—and volatility that’s a goldmine for prepared traders.

Here’s the catch: trading NFP without a solid strategy is like walking a tightrope blindfolded—thrilling but risky. Enter the bearish flag pattern.

What Makes the Bearish Flag a Trader’s Best Friend?

The bearish flag is a continuation pattern, signaling that a downtrend is taking a breather before resuming. Think of it as a marathon runner taking a quick sip of water before charging ahead. Here’s how to identify it:

- Steep Downtrend: Preceding the flag, there must be a sharp downward movement (the flagpole).

- Consolidation Phase: Price moves in a tight range, forming a rectangle that tilts slightly upward or sideways.

- Breakout Confirmation: The pattern is complete when the price breaks below the lower boundary of the flag, continuing the prior downtrend.

Pro Tip: Use higher timeframes like 15-minute or 1-hour charts to spot cleaner formations. It’s like upgrading your binoculars to a telescope.

Combining NFP and the Bearish Flag for Maximum Impact

NFP volatility amplifies the effectiveness of the bearish flag. Here’s the playbook:

- Pre-NFP Prep: Analyze key support and resistance levels and look for existing bearish flags on major USD pairs.

- NFP Release: Watch the market reaction to the NFP data. If the dollar weakens and a bearish flag breaks out, it’s your green light.

- Entry Strategy: Enter a short position just below the flag’s lower boundary, confirming the breakout with high volume.

- Risk Management: Place your stop-loss above the upper boundary of the flag and aim for a target 1.5-2 times your risk.

Case Study: Turning NFP Chaos into Controlled Gains

Let’s talk about Mark, a seasoned trader who leveraged this strategy. On the day of an NFP release, he identified a bearish flag on EUR/USD. The NFP data came in weaker than expected, triggering a breakout. Mark entered a short position at 1.1200, set a stop-loss at 1.1225, and took profit at 1.1150. The result? A 2:1 risk-reward trade executed with sniper-like precision.

Avoiding Pitfalls: Common Myths About NFP and Bearish Flags

Myth 1: NFP moves are unpredictable. Truth: While volatile, patterns like the bearish flag provide structure amidst the chaos.

Myth 2: Bearish flags always work. Truth: No pattern guarantees success. Validate breakouts with volume and broader market context.

Myth 3: Trading NFP is only for experts. Truth: With proper preparation and risk management, even beginners can benefit from this strategy.

Advanced Insights: Tools to Sharpen Your Edge

- Economic Calendars: Use tools like Forex Factory to track NFP release times and expectations.

- Volume Indicators: Confirm breakout strength with high volume on the flag’s breakdown.

- Correlation Analysis: Monitor related pairs like USD/JPY or USD/CAD for additional clues about dollar sentiment.

The 1% Rule: Staying Safe in High-Volatility Environments

NFP trading can be exhilarating, but don’t let the adrenaline cloud your judgment. Stick to the 1% rule: risk no more than 1% of your account on any single trade. Use a trailing stop to lock in profits while minimizing downside risk.

Wrapping It Up: Mastering the NFP and Bearish Flag Combo

The combination of NFP and the bearish flag is like pairing peanut butter with chocolate—a match made in trading heaven. By understanding the dynamics of both, you can turn market volatility into a strategic advantage. Remember, success lies in preparation, discipline, and the ability to adapt to market conditions. Now go forth and trade like a pro—or at least impress your friends with your newfound Forex knowledge.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The