Mastering MACD & Inverse Head and Shoulders: Ninja Tactics for Forex Success

The Real Secret Behind “Holy Grail” Patterns

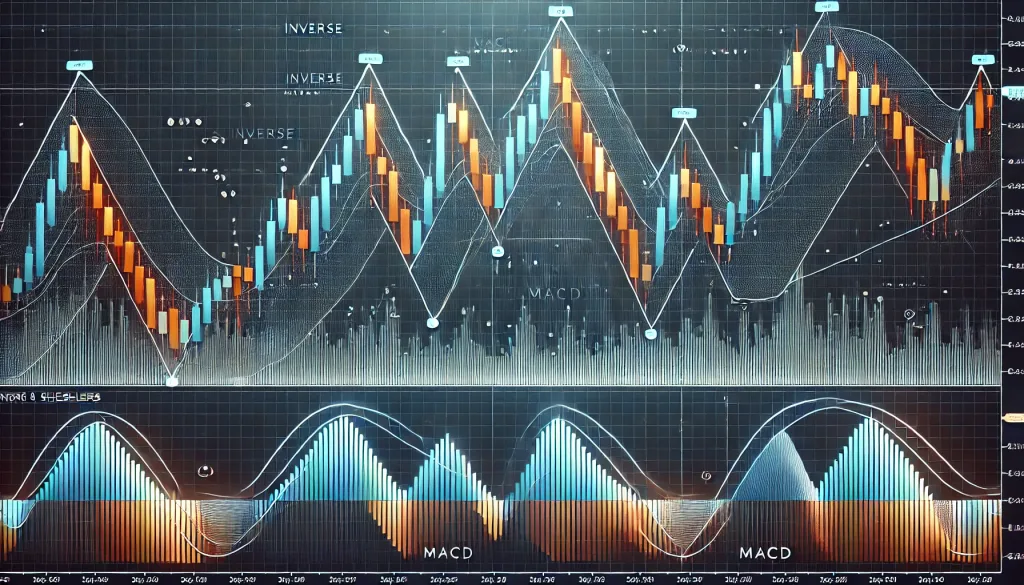

Imagine this: it’s late at night, and you’re staring at your Forex charts, eyes half-open from all that caffeine you had at 10 PM, and suddenly, a pattern appears—a perfectly formed Inverse Head and Shoulders. It’s like finding a hidden treasure amidst the chaos of candlesticks, and it screams, “Trend reversal ahead!” Now, picture adding the almighty MACD to the mix—it’s like upgrading your treasure map with a compass. But before you start popping champagne, there’s more to these tools than meets the eye. Success doesn’t lie in simply spotting these formations; it’s in reading the subtleties that most traders miss and avoiding those classic mistakes that make you feel like you bought Bitcoin at its 2021 peak.

Let’s get into the ninja tactics that separate those who win from those who accidentally click the wrong button, watching their trade sink faster than a bad sitcom plot twist.

Inverse Head and Shoulders: A Psychological Game

The Inverse Head and Shoulders is more than just a cute formation on your chart; it’s a battle of wits between bulls and bears—like a wrestling match where the bulls manage to get the upper hand after taking a few hits. You can think of it as the market’s way of faking out the weak-handed traders, shaking them down before reversing direction with conviction.

Here’s How to Truly Master It:

- Spotting the Shoulders and Head: It’s easy to confuse an inverse head and shoulders with, well, a bunch of random ups and downs. The key is to ensure the “head” really dips much lower than the “shoulders.” Think of it like a limbo contest—if the middle isn’t noticeably lower, it might not be time to start celebrating.

- The Neckline is Key: Consider the neckline as the market’s breaking point. If price breaks above the neckline with strong momentum, it’s like watching your favorite underdog team win in overtime—it’s your cue to start planning that entry.

- Volume Matters: Watch out for volume during the head formation and especially on the breakout. If volume’s missing when the price breaks the neckline, it’s like a party without music—everyone’s skeptical, and nobody wants to dance.

- MACD Confirmation: This is where the MACD comes into play. Look for the MACD line crossing above the signal line during or right after the neckline break. If MACD is on your side, it’s like having a sidekick who yells, “The coast is clear!” before you make a move.

Why Most Traders Get MACD Wrong

MACD is powerful, but it’s also one of the most misunderstood indicators. Many traders just glance at the crossover and pull the trigger, thinking it’s a sure-fire green light. But let me tell you—that’s like buying a pair of shoes just because they’re on sale without checking if they fit. (Who hasn’t regretted those?)

Here are the nuances that make all the difference:

- Ignore Flat MACD Histograms: The MACD histogram is that part of the indicator that’s like the soundtrack to a movie—if it’s flat, the action on screen is boring. When the histogram is flat, it tells you the momentum is dead or dying, and any price movement might just be market noise. Wait for clear, sharp bars that show acceleration—that’s when things get exciting.

- Beware the Fake Cross: Ever had that “it looks promising, but let’s wait a second” moment? That’s exactly how you should feel about the MACD crossover when the lines are moving parallel or just seem hesitant. The MACD should cross with confidence—like a hero charging into battle—not like a teenager unsure about which college to pick.

- Divergence is Your Crystal Ball: When price action and MACD start doing different things, that’s your early warning system. If prices are making lower lows, but MACD isn’t playing along, it’s like when your dog starts barking for no reason—you know something’s up. Divergences can hint that the trend is weakening and it’s about to get interesting.

Combining the Powers: A Real-World Example

Take a look at GBP/USD during the summer of last year. The pair formed a classic inverse head and shoulders on the daily chart—the head dipped below 1.1900 while shoulders held steady near 1.2100. At the same time, the MACD showed divergence—as price made lower lows, MACD refused to follow suit. When the price broke above the neckline at 1.2250, MACD also crossed up. This was the perfect setup: it was as if the market was giving traders a big thumbs-up, saying, “Go ahead, it’s all clear.”

And what happened next? The pound rallied nearly 500 pips. That’s the kind of move that pays for a lot of regrets, like that subscription to a streaming service you never watch.

The Secret Recipe: Using MACD Like a Pro

- MACD + Key Levels: It’s not just about the crossover. Use MACD along with support and resistance levels. If the MACD is giving you a buy signal, but you’re about to slam into a major resistance level—hold your horses. It’s like driving straight towards a brick wall—there’s going to be resistance, literally.

- The Double Confirmation: Never underestimate the power of waiting for two confirmations—an inverse head and shoulders neckline break and a MACD crossover. Sure, you might miss a few pips waiting, but it’s better than jumping in too soon and watching your money go on an unwanted rollercoaster ride.

- Momentum Rules All: The MACD isn’t just about crossovers and histograms; it’s about momentum. Use it to judge if the momentum is with you or against you. Think of it like surfing—if the wave isn’t building, it’s going to be a boring ride.

Why Combining These Patterns Can Be Your Secret Weapon

Most traders look at the inverse head and shoulders and MACD as two separate entities. But here’s the thing: when you use them together, they complement each other like peanut butter and jelly. Or, for those who prefer healthier analogies—like quinoa and a well-dressed salad.

- Inverse Head and Shoulders gives you the directional bias.

- MACD confirms the momentum behind that bias.

If either one isn’t cooperating, it’s time to reassess and find a better trade. Remember, the market will still be there tomorrow. FOMO (fear of missing out) is what leads traders to overtrade, make irrational decisions, and ultimately face unnecessary losses.

Final Thoughts: Trade Like a Ninja

Think of these strategies as your Forex ninja tactics. MACD and the inverse head and shoulders pattern both have their quirks, and while many traders know about them, only the experienced know how to use them with precision. By blending these two tools and being patient for the right confirmations, you can spot those elusive, high-probability setups.

And remember, it’s not about catching every wave—it’s about catching the best waves and avoiding the ones that leave you wiping out and feeling like you’ve made every wrong move possible. The next time you spot an inverse head and shoulders forming, dust off that MACD, check for the secret signals, and get ready—but do it like a pro, with patience, and a cup of coffee that reminds you how late it is.

Advanced Tactics for True Market Success

- Volume Divergence Analysis: It’s not just MACD. Look at volume divergence, particularly as the head forms. If volume decreases during the formation of the head, it shows that the sellers are losing steam.

- Patience Pays: Some of the best moves come from waiting for a perfect pullback after the neckline breakout, especially if MACD crosses right during that pullback.

- Look at Multiple Time Frames: Always confirm on a higher time frame. An inverse head and shoulders on the 1-hour chart confirmed by MACD on the daily chart? Now that’s a move worth getting excited about.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The