The Take-Profit Blueprint Hidden in the Inverse Head and Shoulders Pattern

“If you can spot the head, protect the shoulders, and lock in profits like a ninja—congrats, you’re halfway to outsmarting the 90%.”

Let’s be honest:

The inverse head and shoulders pattern is the financial equivalent of a plot twist in your favorite heist movie. Just when everyone’s betting on the market breaking down, bam—price reverses harder than your friend backpedaling on “just one drink.”

But most traders?

They either misidentify the pattern or forget the real moneymaker: how and where to place take profit orders.

This guide uncovers underground tactics, ninja-level exits, and the little-known secrets pros use to milk this pattern for every pip it’s worth.

We’ll cover:

How to spot legit inverse head and shoulders (IHS) patterns like a chart whisperer

Elite-level take profit strategies that outsmart your broker

Real-world case studies, expert quotes, and myths we’re about to break like weak resistance levels

How pros structure their exits to beat retail churn

Why the “Inverse Head and Shoulders” Is More Than Just a Pretty Pattern

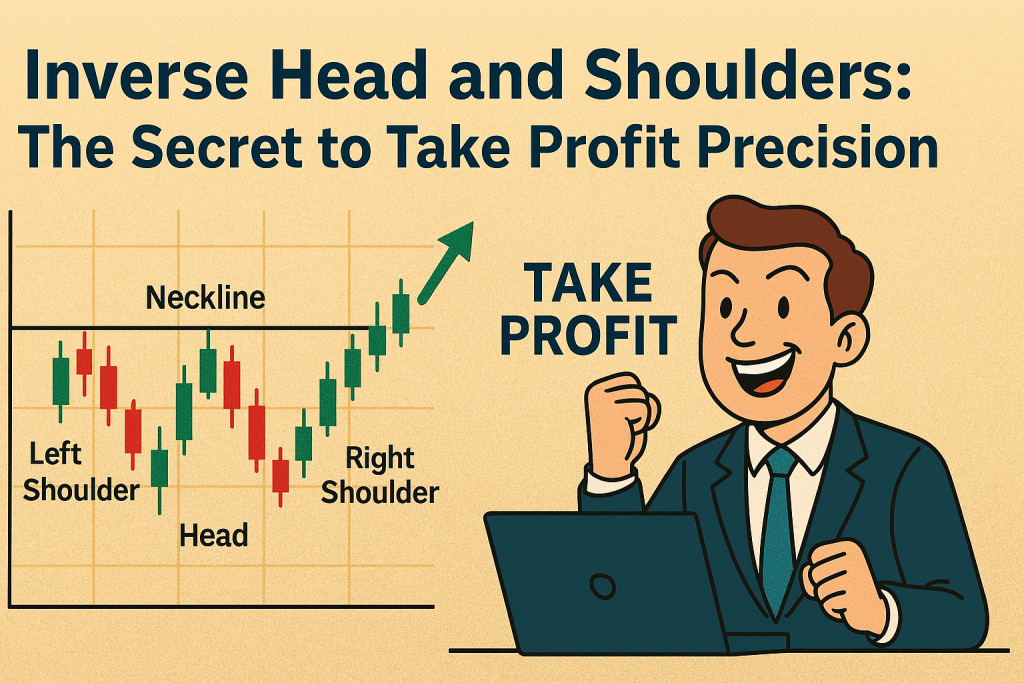

An inverse head and shoulders is a reversal pattern. You’ve heard that before.

But what if I told you that most traders miss the psychological pressure this pattern reflects?

It’s not just a price structure—it’s a narrative arc. And like every good story, this one has tension, drama, and if done right, a happy ending (aka profit).

The Setup:

Left Shoulder: Bears start selling. Price drops.

Head: Panic! Retail traders throw in the towel. New lows.

Right Shoulder: Surprise strength. Volume spikes. Bears lose control.

Neckline Break: Institutional bulls jump in like it’s Black Friday at a gold market.

???? Underground Insight:

Inverse head and shoulders patterns almost always form when smart money is reloading long positions after triggering stop hunts. Retail traders get spooked out at the lows, and pros buy from them like candy from a distracted toddler.

“Profit Like a Pro” or “Exit Like an Amateur”? Here’s the Game-Changer

Let’s play a game:

What’s worse than missing an entry on an inverse head and shoulders?

Answer:

Getting the entry right… and butchering your exit.

That’s where take profit orders come in—and trust me, this is where real traders are made or broken.

The mistake most make?

They set a take profit order at some random level like they’re playing darts blindfolded. “Let’s see if 1.24390 looks good!” (It doesn’t.)

The Forgotten Blueprint: Advanced Take-Profit Tactics from the IHS Neckline

Let’s break this down step-by-step like a dance instructor teaching the cha-cha—but for trading:

✅ Step-by-Step Guide: Take Profit Tactics for the Inverse Head and Shoulders

1. Measure the Move (Properly)

Measure from the head (lowest low) to the neckline (resistance line).

Project that same height from the breakout point.

???? Pro Tip: Don’t measure diagonally. Use vertical distance only. Your profits shouldn’t depend on your artistic interpretation.

2. Use Volume as Confirmation

A true breakout will usually come with a volume spike.

No volume? No follow-through. Be cautious.

3. Stagger Your Take Profits (Smart Scaling Out)

Set TP1 just under the projected target.

TP2 above the neckline retest level.

TP3 at the full projected move—but only if volume confirms.

4. Use Fibonacci Extensions as a Hidden Weapon

1.272 and 1.618 extensions are chef’s kiss levels.

Why? That’s where algo orders often cluster.

???? “The market doesn’t move on randomness. It moves on order flow. Learn where the orders are, and you’ll learn where price is going.”

— John Kicklighter, Chief Strategist at DailyFX

5. Time Filter Your Profits

If price hasn’t reached the projected TP in 2x the average time of the pattern formation, scale out or tighten your SL.

Hidden Strategy: Layered TP Orders Based on Market Phases

Here’s what the top 1% of traders do that the rest ignore:

They set their take profits based on market conditions, not just patterns.

Let me break that down.

Low Volatility Market? Set TP just under the neckline’s measured move.

High Volatility or News Events? Extend TP to next supply zone or use ADR (Average Daily Range) to forecast room to run.

Range-Bound Environment? TP at midpoint of the projected move. Don’t fight the chop—profit from it.

Case Study: GBP/USD Inverse Head and Shoulders in September 2024

Let’s get concrete.

In early September 2024, GBP/USD printed a textbook IHS on the 4H chart.

Retail forums were screaming “false breakout!” but guess what?

Institutions were front-running the neckline break like they had backstage passes.

Here’s what unfolded:

Entry: Neckline break at 1.2570

TP1: 1.2630 (near previous micro supply)

TP2: 1.2700 (measured move completion)

TP3: 1.2785 (Fibonacci 1.272 extension)

???? Result: Full TP sweep within 6 trading sessions, backed by stronger-than-expected UK PMI data.

And those who waited for a “perfect pullback” were still on the sidelines tweeting chart memes.

Why Most Traders Get This Pattern Dead Wrong

Here’s the myth:

“All you need is a neckline break and boom, you’re in profit.”

Reality?

That’s like saying all you need to win a poker game is a pair of aces. Sounds good—until the flop, turn, and river humble you like a monk in the Himalayas.

???? Here’s what they get wrong:

They forget volume: A low-volume neckline break is about as trustworthy as a used car salesman with a fake Rolex.

They ignore structure: They don’t look left to see previous supply zones.

They over-leverage: They set take profit orders hoping price hits them, not knowing it will.

The Ninja Checklist: How to Maximize Every Inverse Head and Shoulders Setup

Want to execute like a sniper and not a scattergun trader?

Here’s the elite checklist:

✔ Confirm volume on breakout

✔ Measure the full move from head to neckline

✔ Scale out TP across key zones

✔ Use Fib extensions as sniper targets

✔ Monitor time decay—exit if price stalls

✔ Watch sentiment: If retail is 70% long on breakout, fade euphoria and lock in gains

Why We Do This (And How StarseedFX Has Your Back)

Let’s be honest: most free education online is just that—free for a reason.

At StarseedFX, we don’t just tell you to “wait for the breakout.”

We show you where the big boys hide their orders, how algos front-run patterns, and why 90% of traders lose… so you don’t have to.

???? Want to learn game-changing tactics like these every week?

Check these out:

???? Latest Market Insights: Forex News & Economic Updates

???? Free Masterclass Courses: Forex Education Hub

???? Live Alerts + Insider Analysis: StarseedFX Community

???? Advanced Trading Plan: Custom Strategy Builder

???? Smart Trading Journal: Track Like a Pro

⚙️ Smart Trading Tool: Order & Risk Management Tech

Quick Recap: What You Now Know That Most Don’t

✅ Inverse head and shoulders isn’t just a pattern—it’s a map of market psychology

✅ Take profit orders are strategic, not decorative

✅ Real-world confirmation = volume, structure, and time

✅ Elite traders scale out—not guess out

✅ Most traders ignore Fib extensions (your new best friend)

✅ Knowing where not to take profit is as important as knowing where to

???? Essentials Summary:

Spot the IHS pattern using neckline + volume.

Calculate target move from head to neckline.

Use Fib extensions and prior supply zones to set TP.

Scale out take profit orders at strategic levels.

Adjust for volatility, market phase, and sentiment.

???? Final Thought

Next time you spot an inverse head and shoulders, don’t just slap a TP at the next round number like it’s a coin toss.

Trade it like a strategist. Exit like a pro.

And remember—patterns don’t make profits. Precision does.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The