The “Triple Top” Pattern on GBP/JPY: The Hidden Pitfall Traders Ignore (And How to Profit from It)

The Trap That Keeps Devouring GBP/JPY Traders

The British Pound/Japanese Yen (GBP/JPY) is like the drama queen of Forex. It’s fast, unpredictable, and can wipe out your account faster than you can say “margin call.” But what if I told you there’s a chart pattern that consistently tricks traders into making costly mistakes? Enter the triple top pattern—a technical formation that lures in hopeful buyers, only to send them packing with empty pockets.

Most traders see a bullish breakout when a currency pair tests resistance multiple times. But the triple top? It’s a bull trap disguised as opportunity. If you don’t know how to spot it, you’re setting yourself up for disaster.

In this article, we’ll break down:

- The psychology behind the triple top (why it fools even experienced traders)

- How to spot it early and avoid fake breakouts

- Game-changing strategies to turn this pattern into profit instead of pain

Why Most Traders Get It Wrong (And How You Can Get It Right)

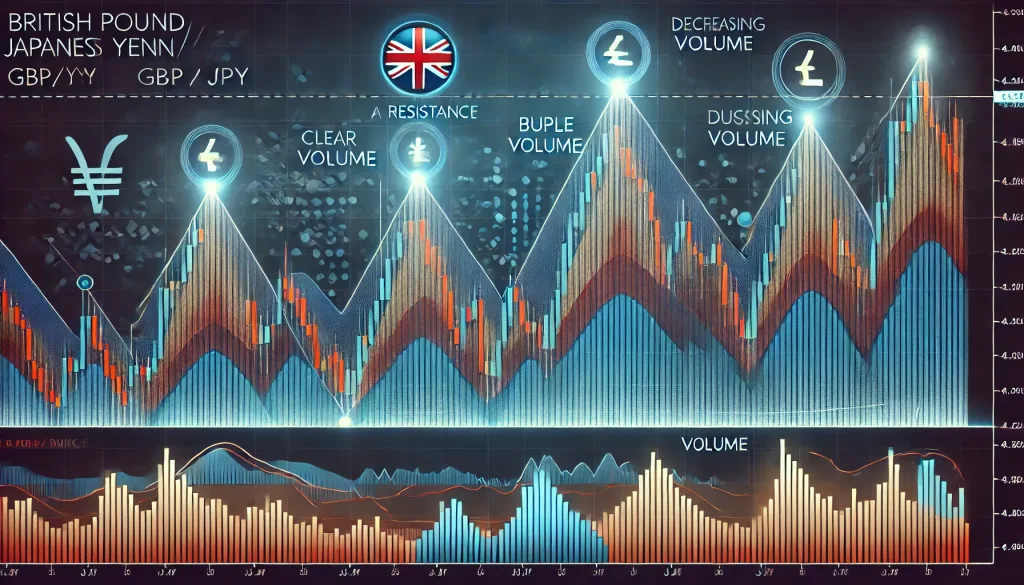

The triple top pattern forms when price tests a resistance level three times but fails to break through. Each time it approaches the level, buyers get excited, convinced that “this time it will break!” Spoiler alert: it usually doesn’t.

Here’s what happens:

- First Attempt: Buyers push the price up but hit resistance.

- Second Attempt: More traders jump in, thinking a breakout is coming.

- Third Attempt: The market almost breaks resistance—but fails again, triggering a massive sell-off.

Retail traders love to chase breakouts. Institutions? They love to bait breakouts and fade them. The triple top is often engineered by smart money to absorb liquidity before dumping price lower.

Spotting the Triple Top Before It Wrecks Your Account

How do you spot this deadly formation before it takes your money?

1. Look for a strong resistance level: If price has already rejected a level twice, be cautious. A third test is not always a breakout—sometimes, it’s a trap.

2. Watch for decreasing volume: When price approaches resistance but volume dries up, it’s a sign that buyers are running out of steam.

3. Observe fake breakouts: If price breaks above resistance slightly and then crashes back below, institutions are likely clearing liquidity before dumping price.

4. Confirm with indicators: RSI divergence (where price makes higher highs but RSI makes lower highs) is a strong confirmation that a triple top may be forming.

Elite Trading Tactics to Profit from the Triple Top

Now, here’s where the magic happens. Instead of falling for the trap, we’ll use it to trade like the banks.

1. The “Liquidity Hunt” Short Strategy

- Wait for price to break slightly above the previous high.

- Look for a sharp rejection candle (such as a pin bar or engulfing candle).

- Enter a sell position below the breakout level, placing your stop just above the false breakout wick.

- Target the previous support level for profit.

2. The “Pattern Confirmation” Reversal Trade

- Wait for price to complete the third peak and start declining.

- Enter a sell position once price closes below the neckline (the lowest point between the peaks).

- Place stop loss above the last peak and target a 2:1 risk-reward ratio.

3. The “Smart Money Fade” Approach

- Use institutional order flow techniques to identify where liquidity is building up.

- If hedge funds and banks are accumulating short positions, align your trade accordingly.

- Use Footprint charts and Order Flow analysis to track smart money movements.

Case Study: GBP/JPY’s Triple Top Crash in 2024

Earlier this year, GBP/JPY formed a textbook triple top near 190.00, luring in breakout traders. Retail traders were betting on a move to 195.00, but institutional traders were quietly accumulating shorts. Once price faked a breakout and reversed, the pair plummeted over 400 pips in just days.

If you had recognized this setup early, you could have ridden that move down for massive profits. Knowing what the big players are doing is the difference between winning and getting wiped out.

Avoiding Common Pitfalls (And Why Most Traders Fail)

- Falling for fake breakouts: Don’t jump in just because price peeks above resistance.

- Ignoring volume: Low volume near resistance = breakout weakness.

- Not using confirmation indicators: RSI, MACD, and Order Flow can give you an edge.

- Overleveraging: Even the best trade setup can fail. Use proper risk management.

Turn GBP/JPY’s Tricks into Your Trading Edge

The triple top is one of the most deceptive patterns in Forex, but now that you understand its mechanics, you can stop being the prey and start hunting with the pros.

Want more game-changing strategies?

- Stay updated with real-time market insights here

- Learn elite trading methodologies here

- Join our insider trading community here

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The