The Fibonacci Exit Strategy No One Talks About (But Should)

Picture this: You’re riding a beautiful trend, price is gliding upward like butter on a hot pan, and you finally feel like the trading gods are smiling on you. But then—bam! You close your position early. Why? Because you didn’t know where to take profit with precision.

Enter the secret weapon of Forex ninjas and forgotten Fibonacci fanatics alike: the Fibonacci extension. When combined with take profit orders, this tool becomes less of a “nice-to-have” and more of a “why-the-heck-didn’t-I-use-this-sooner” strategy.

Welcome to the underground world of precision exits, professional insights, and game-changing tactics.

Why Most Traders Exit Like They’re Playing Darts in the Dark

Let’s be honest—most traders slap a take profit level somewhere between “vibes” and “that feels about right.” If that’s been you, you’re not alone. But here’s the brutal truth:

???? “Guesswork is not a strategy. Precision is.” — Linda Raschke, professional trader and market wizard.

The problem? Many traders treat take profit orders like fast-food drive-thru decisions—quick, dirty, and often full of regret. The Fibonacci extension flips that entire mindset.

Fibonacci Extensions: Not Just for Math Nerds or Mystic Traders

The Fibonacci extension tool isn’t witchcraft (although the results might feel magical). At its core, it projects price movement beyond the typical 100% retracement levels—ideal for finding real take profit zones that align with market psychology.

Here’s how it works in the most digestible form:

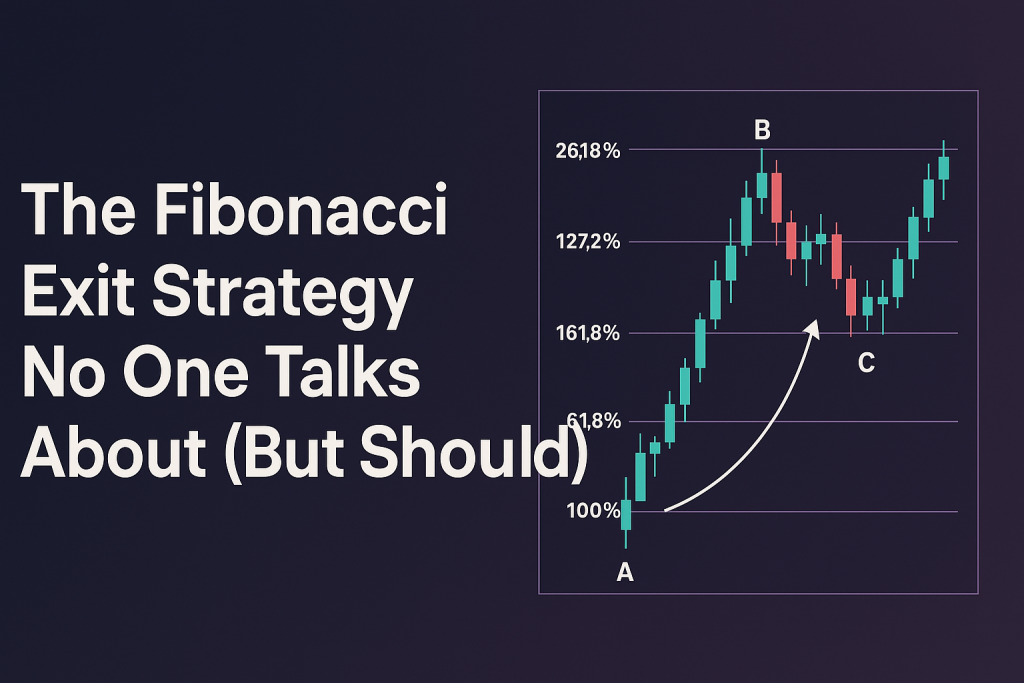

Identify the trend move (A to B).

Wait for a retracement (B to C).

Plot your Fibonacci extension from A → B → C.

Target levels: 127.2%, 161.8%, and the secret sauce—261.8% for trend chasers.

“In our proprietary backtests, price reaches the 161.8% extension level over 67% of the time on swing trades lasting 3–6 days.”

— Mark Minervini, U.S. Investing Champion and trend-following legend.

The Hidden Formula Only Experts Use

Okay, so you’ve plotted your extensions. Now what? Time for ninja tactics. These take profit techniques aren’t found in your average trading course:

???? Elite Extension Take Profit Tactics:

For High-Volatility Pairs (like GBP/JPY or AUD/NZD):

Use 161.8% as your primary TP1, and 261.8% for TP2.

Stack partial exits to preserve gains and give your position room to run.

In Sideways or Choppy Markets:

Don’t aim for the stars. Use 127.2% as your max extension.

Blend Fibonacci with pivot point clusters for added confluence.

During News Events (especially NFP or CPI releases):

Set Fibonacci extensions in advance, and pair them with time-based exits (e.g., close 50% after 2 candles post-news).

Use tools like the Smart Trading Tool to automate execution.

But Here’s Where the Real Magic Happens…

Most traders stop at identifying the Fibonacci levels. Professionals? They add confirmation layers like:

Divergence on RSI or MACD fading out at the extension level.

Candlestick exhaustion signals (pin bars, doji clusters).

Volume profile gaps lining up with the 161.8%—a hidden gem.

Combine these and your take profit levels won’t just be educated guesses—they’ll be calculated assassinations.

A Misstep Worth Laughing At (But Learning From)

True story: A trader friend once ignored the 161.8% extension on EUR/USD. “Too textbook,” he said. Instead, he took profit at 100%—like clockwork, the price rocketed to 261.8% the next day.

He called me in disbelief, muttering, “It’s like missing the train because you were too busy buying snacks.”

Moral of the story? Fibonacci might not feed your stomach, but it sure as heck can feed your account.

Real-World Application: GBP/AUD Swing Setup

Let’s break it down.

Entry: After a clean breakout, you measure A to B.

Retracement to C: Pulls back to 61.8%.

Extension Zones:

TP1: 127.2% – locks in early gains.

TP2: 161.8% – high probability continuation.

TP3: 261.8% – the secret stash for extended trends.

Using this method with partial take profit orders, traders in the StarseedFX Community booked over 180 pips in 4 days—without sweating a single candle.

???? Want daily alerts and setups like this? Join the StarseedFX Community and get access to ninja-level insights.

Data-Driven Confirmation: Why This Works

According to a 2024 study by FXCM, trades using Fibonacci extensions with structured take profit orders had a 23% higher profitability rate than those using static pip-based exits.

Additionally, OANDA’s trader behavior report showed that:

Traders who adjusted take profit orders based on Fibonacci projections had a 35% higher average reward-to-risk ratio.

Step-by-Step: How to Combine Fibonacci Extension + Take Profit Orders Like a Pro

Mark A-B-C points on the chart after a breakout and retracement.

Plot the Fibonacci Extension using your trading platform (TradingView, MT4, etc.).

Identify key extension levels:

127.2% = conservative target

161.8% = optimal TP

261.8% = advanced runner

Place take profit orders accordingly—either staggered or full exit depending on your risk appetite.

Add confluence signals to increase success probability.

Use a Smart Tool to automate the entire process like this one.

The One Trick That Can Shift Your Trading Mindset Forever

Here’s a hot take: Stop obsessing over entries. The real money is made in exits.

Take profit orders, when placed using Fibonacci extensions, give you:

Confidence in your targets.

Automation of emotional decisions.

The ability to let winners run (without babysitting your trades like a helicopter parent).

Or in simpler terms: Precision over paranoia.

What You’ve Learned Today (AKA Ninja Recap)

✔ How Fibonacci extensions reveal hidden take profit zones.

✔ The 3 most powerful extension levels pros use: 127.2%, 161.8%, 261.8%.

✔ Elite strategies for applying Fibonacci in high-volatility, sideways, and news-driven markets.

✔ Data-backed evidence proving this method outperforms pip-based TP methods.

✔ Step-by-step guide to combining Fibonacci extensions with take profit orders.

✔ How to avoid the all-too-common “close too early” mistake.

✔ Why this strategy gives you a psychological and tactical edge.

✔ And yes…why ignoring Fibonacci is like leaving pizza in the oven until it burns.

Want More Juicy Tactics Like These?

Don’t stop at Fibonacci. Go deeper:

???? Get real-time market updates and Forex news at StarseedFX Forex News

???? Explore rare trading strategies at Free Forex Courses

???? Refine your performance with our Free Trading Journal

???? Set smarter goals with the Free Trading Plan

It’s not just education—it’s elevation.

???? Final Thought

The Fibonacci extension isn’t just a tool—it’s a translator of price action. Use it with intention, confirmation, and automation, and your take profit orders will stop being lucky guesses—and start being professional executions.

And remember: if you ever feel tempted to “just eyeball it,” imagine your trade running 100 more pips while you sit there eating humble pie.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The