Fibonacci Extension Strategy for AUD/USD That Traders Miss

You Plotted What?! – Why Most Traders Stop at 100%

Most retail traders use the Fibonacci retracement tool like it’s a GPS that loses signal after a detour. They see the 61.8%, 50%, or 38.2% levels and treat them like end goals. But extension levels—specifically 127.2%, 161.8%, 200%, and 261.8%—are where the smart money plays.

“Price doesn’t stop where you want—it stops where the institutions stack their orders.”

– John Kicklighter, Chief Strategist at DailyFX

Here’s the kicker: institutional traders often use Fibonacci extension levels to place limit orders. That means if you’re only looking at retracements, you’re showing up to the party just as everyone’s leaving—and you’re stuck with the leftovers (a.k.a. late entries and stop hunts).

AUD/USD: The Underestimated Chameleon of the Forex Market

Let’s talk about the kangaroo in the room. The AUD/USD pair is one of the most volatile and reactive currency pairs—tightly linked to commodities, Chinese data, and US dollar cycles. It loves a good trend and an even better extension. But here’s what makes it spicy:

It reacts faster to Fibonacci-based technicals than most major pairs.

It respects the 127.2% and 161.8% extension levels like they were religious holidays.

It’s an emotional pair—much like a reality show contestant—making it perfect for Fibonacci-based projections.

According to the Reserve Bank of Australia, “AUD’s fluctuations often reflect global risk sentiment shifts more than domestic fundamentals.” (source)

Translation? It respects technicals even more when fundamentals are shaky.

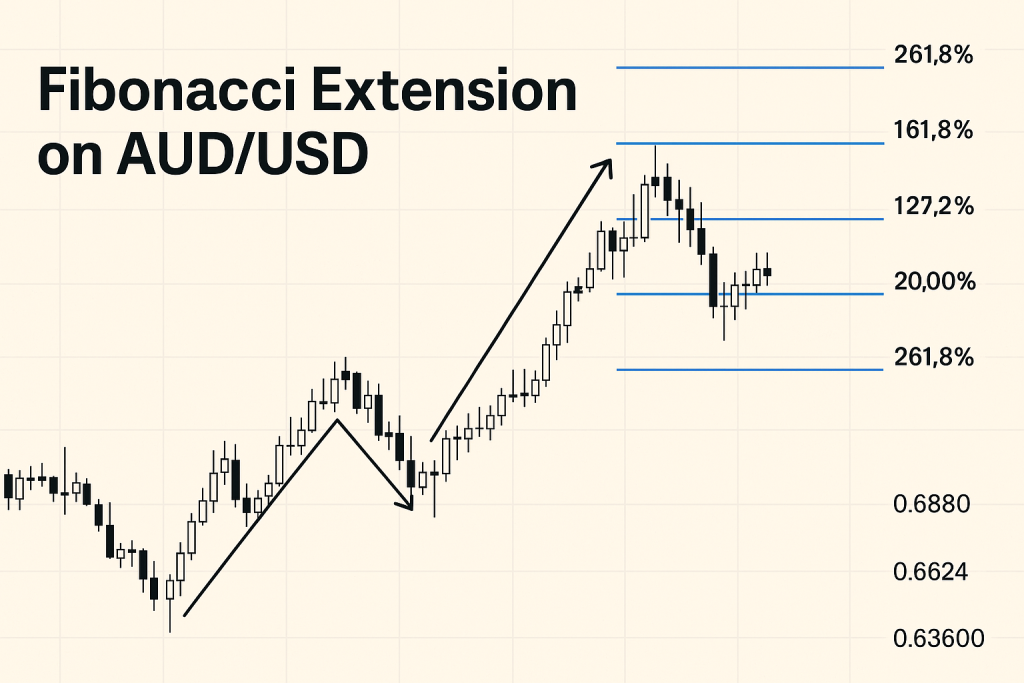

The Secret Sauce: Plotting Fibonacci Extensions Like a Ninja

Here’s your step-by-step cheat code for getting this right, especially on the AUD/USD pair:

???? Step 1: Identify a Clear Impulse Wave

Look for a strong bullish or bearish move that’s unbroken by consolidation.

Preferably on H4 or Daily chart for cleaner structure.

???? Step 2: Use the Fibonacci Extension Tool

Plot from:

Start of the impulse move (swing low),

To the swing high (or vice versa),

Back down to the pullback low (or retracement high).

MetaTrader and TradingView both have built-in tools for this.

???? Step 3: Focus on These Key Levels:

127.2% = Conservative target

161.8% = Golden Zone

200% = Aggressive move

261.8% = Institutional level (watch for reversals here)

???? Step 4: Add Volume Confirmation

Use volume profile or OBV to confirm momentum pushing through levels.

If volume spikes at the extension level? You might be front-row at a reversal concert.

The Hidden Pattern Institutions Use (That You’re Probably Ignoring)

Here’s something rarely mentioned in free content: confluence stacking.

Smart traders don’t just use Fibonacci extensions in isolation. They stack it with:

Daily Pivot Points

Previous session highs/lows

Order blocks

Volume profile nodes

When two or more of these overlap a Fibonacci extension level, it’s not just a trade setup. It’s a market ambush—with you hiding in the bushes, not running blindly into it.

“Price moves fastest between levels of low liquidity and stalls where liquidity clusters.”

– Steve Ward, Performance Coach & Institutional Trading Consultant

Real-World Case Study: The AUD/USD September 2023 Breakout

Let’s bring some receipts.

In September 2023, AUD/USD rallied from 0.6360 to 0.6505—then pulled back to 0.6420.

Using Fibonacci extension from:

Swing low: 0.6360

Swing high: 0.6505

Retracement low: 0.6420

➡ Price extended up to:

127.2% level: 0.6588 → Consolidation

161.8% level: 0.6625 → Rejection

Price reversed 15 pips below 161.8%, confirming it as a key institution level.

Traders who took profit at 127.2% slept well. Those aiming for 161.8%? They grabbed a bonus espresso.

Contrarian Insight: Stop Obsessing Over Fibonacci Retracements

Here’s a little-known secret: retracements are lagging tools, but extensions are predictive. Yet, 80% of retail education over-emphasizes retracements. That’s like preparing for a marathon by training for a 100-meter dash.

Want to find where price is likely to go, not just where it’s been? Use Fibonacci extensions like your life depends on it (okay, maybe your trading account).

The Underrated Combo Move: Fibonacci Extension + RSI Divergence

Use this combo like a pro chef uses truffle oil—sparingly but with maximum impact.

Here’s how:

Wait for price to hit a 161.8% Fibonacci extension.

Check RSI on the same timeframe.

If RSI shows divergence (e.g., price makes a higher high, RSI makes a lower high) → cue the reversal.

It’s a setup that screams “Get out before the crowd notices.”

How to Make This Even More Powerful (With Less Guesswork)

Want to get the Fibonacci magic without the geometry nightmares?

Check out these StarseedFX tools and resources:

✅ Smart Trading Tool – Automate Fibonacci projections, lot sizes, and targets.

✅ Free Trading Plan – Define your risk and goals around extension-level exits.

✅ Community Insights – Get live alerts on AUD/USD setups using Fibonacci-based strategies.

✅ Forex Courses – Deep-dive into confluence trading and advanced geometry.

Game-Changing Tactics You Can Apply Today

Always project extensions before price gets there. Don’t be the tourist who arrives after the tour ended.

Use the 127.2% as your first exit, 161.8% as your “moonshot,” and 261.8% for only the most explosive breakouts.

Stack confluence like pancakes. The more overlaps, the more confident your trade.

Don’t wait for news to tell you the trend. Extension levels often get hit before the headlines catch up.

Key Takeaways for Ninja-Level Fibonacci Mastery

???? Fibonacci extensions are predictive powerhouses—not just “extra lines.”

???? AUD/USD is ideal for Fibonacci extension due to its trend nature and strong reactions.

???? Institutional traders often park orders at 161.8% and 200% levels.

???? Stack confluence: RSI divergence + volume + extension = precision sniper entry/exit.

???? StarseedFX tools simplify, automate, and optimize your Fibonacci trading edge.

???? Want More Ninja Tactics Like This?

Dive deeper, get alerts before the crowd, and join a community of traders who know how to surf Fibonacci waves like pros (with less emotional wipeout).

???? Let’s Hear from You:

Have you used Fibonacci extensions on AUD/USD? What’s your favorite confluence? Drop your thoughts, share your setups, or ask questions in the comments.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The