The End-of-Day Bearish Flag Decoded: Ninja Tactics for Forex Traders

Trading can sometimes feel like navigating through a jungle, especially when analyzing chart patterns like the elusive bearish flag. But what if I told you this pattern could be your ticket to precision trading, particularly when applied at the end of the day? Stick around, and I’ll not only decode this strategy but also show you how to sidestep common pitfalls—with a sprinkle of humor, of course!

Why the Bearish Flag Deserves Your Attention

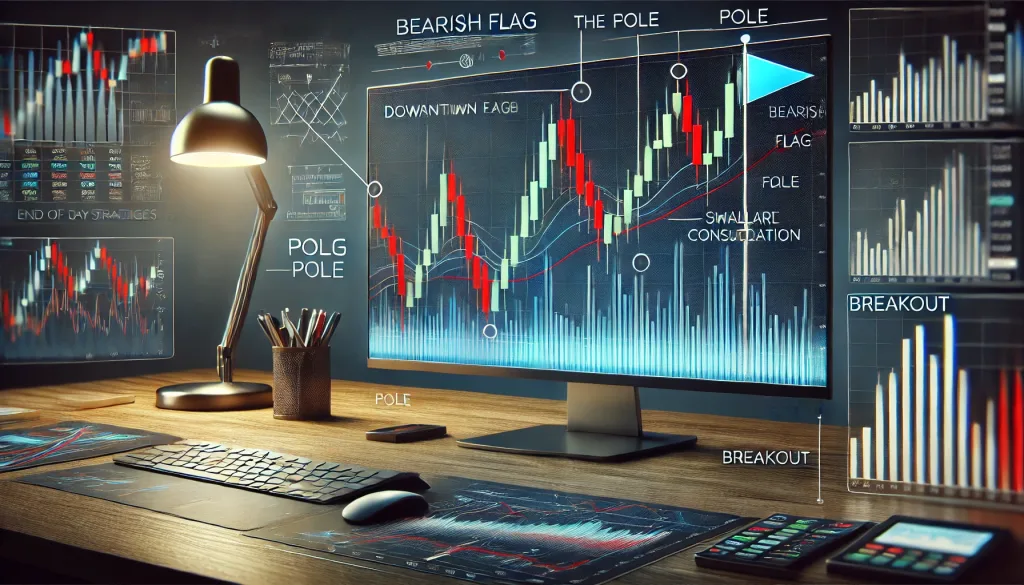

Imagine spotting a golden opportunity right before the market closes. The bearish flag is that signal—a pause in a downward trend that screams “get ready!” This pattern looks like a small, upward-sloping rectangle (the flag) following a sharp decline (the pole). Its significance lies in its predictive power: when the pattern resolves, it often leads to a continuation of the downtrend.

But here’s where it gets interesting: many traders overlook the nuances of this pattern, mistaking it for a reversal. Trust me, that’s like seeing a mirage and thinking you’ve found water.

Spotting the Bearish Flag Like a Pro

Think of identifying a bearish flag as finding Waldo in a crowd—except Waldo is wearing neon lights if you know what to look for. Here’s how you can spot one:

- The Pole: A sharp, near-vertical price drop sets the stage. Think of it as the market yelling, “SELL NOW!”

- The Flag: A gentle upward or sideways consolidation follows. If the consolidation is steeper than 45 degrees, it’s probably not a flag but wishful thinking.

- Volume Decline: Volume typically decreases during the flag formation. If it doesn’t, it might indicate indecision rather than continuation.

- Breakout: The pattern completes when the price breaks below the flag’s lower boundary. This is your go signal.

Pro Tip: Use the ATR (Average True Range) indicator to gauge potential breakout strength. Low ATR during consolidation followed by a sudden spike on breakout confirms the move.

Why Timing Matters: The End-of-Day Advantage

Trading the bearish flag at the end of the day offers several perks:

- Reduced Noise: Intraday volatility settles, making patterns clearer.

- Better Entry Points: Breakouts near the close often signal strong momentum for the next trading session.

- Risk Management: Setting stop-loss levels becomes more precise as the day’s high or the flag’s upper boundary serves as a natural stop.

Imagine entering a trade at the day’s close, only to wake up to a textbook downward gap. That’s the dream, isn’t it?

Avoiding the Bearish Flag Pitfalls

Here are common mistakes traders make and how to avoid them:

- Mistaking Fakeouts for Breakouts: Not every breakout leads to a trend continuation. Confirm with volume and other indicators.

- Ignoring Context: A bearish flag within a strong uptrend is likely to fail. Context is everything.

- Poor Risk Management: Trading without a predefined stop-loss is like driving without brakes. Use the flag’s upper boundary as your fail-safe.

Ninja Tactics to Master the Bearish Flag

Here’s how to take your bearish flag trading from novice to ninja level:

1. Combine with Fibonacci Retracements

Draw Fibonacci levels from the start of the pole to the bottom. If the flag’s retracement stays within 38.2% to 50%, it’s likely a valid pattern. Retracements beyond 61.8% often indicate weakness.

2. Leverage Economic Calendars

End-of-day bearish flags often coincide with post-news consolidation. Use tools like StarseedFX’s Forex News Today to identify high-impact events that could trigger the pattern.

3. Use Multi-Timeframe Analysis

Analyze the flag on your preferred timeframe, but always confirm on higher timeframes. For example, a bearish flag on the 1-hour chart that aligns with a downtrend on the daily chart is golden.

4. Backtest Your Strategy

Before you risk real money, backtest your bearish flag strategy. Tools like StarseedFX’s Free Trading Journal can help you analyze win rates and optimize your approach.

Real-World Example: The EUR/USD Playbook

In late 2023, EUR/USD showcased a textbook bearish flag following a dovish ECB statement. The pair dropped 150 pips in one day (the pole), then consolidated within a 30-pip range for the next two days (the flag). When it finally broke out, traders who caught the move netted another 100 pips in profits. What made it golden? End-of-day timing and a volume spike confirming the breakout.

Final Thoughts: Make the Bearish Flag Your Ally

The bearish flag isn’t just a pattern; it’s a strategic weapon when wielded wisely. By focusing on end-of-day setups, combining technical tools, and avoiding common pitfalls, you’re not just trading; you’re playing chess while others play checkers.

Key Takeaways

- Spotting a bearish flag requires understanding the pole, flag, and breakout dynamics.

- Trading at the end of the day offers clarity, better entry points, and precise risk management.

- Ninja tactics like Fibonacci retracements, economic calendars, and multi-timeframe analysis elevate your game.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The