The Hidden Playbook: How Smart Money Uses the Double Top to Trap Retail Traders

The Illusion of the Double Top—What They Don’t Tell You

Imagine walking into a store, seeing a huge sign that says “FINAL CLEARANCE!” and thinking you’ve hit the jackpot—only to realize that prices were marked up first, making that discount a complete scam. That’s exactly how the double top plays out in the Forex market—except instead of losing a few bucks, you could be handing your hard-earned cash directly to the institutions running the show.

Retail traders are told that a double top signals a strong reversal, an opportunity to short the market as price “inevitably” drops. But here’s the plot twist: Smart Money doesn’t play by retail rules—they set the trap.

How Smart Money Manipulates the Double Top

1. The Fakeout Move (Liquidity Grab)

Ever notice how price just barely breaks the double top level before crashing? That’s because institutional traders need liquidity—they hunt for retail stop losses before executing their own short positions. They do this by:

- Pushing price slightly above the resistance level

- Triggering breakout traders into buying

- Snatching stop-loss orders of early sellers

- Dumping their own short positions once liquidity is collected

2. The Smart Money Entry Point—Where the Magic Happens

Instead of entering at the obvious resistance level, institutions wait for the real move—a manipulation move known as a Breaker Block (a failed breakout that leads to a real reversal). Here’s what pros do:

- Identify where the big orders were absorbed (not where price simply hit resistance)

- Wait for price to return to this liquidity zone (it often retests before the real drop)

- Enter a short position with Smart Money Confirmation, like Fair Value Gaps (FVGs) or Order Blocks

Why Retail Traders Keep Losing on the Double Top

1. They Enter Too Early

Retail traders short too soon—right at the second top. They see a double top and think it’s time to sell, completely unaware that the real trap is still being set.

2. They Don’t Understand Liquidity Hunting

If there’s one rule in Forex trading that never fails, it’s this: price moves toward liquidity. And where do you think the most liquidity is? Above the double top! Institutions love running price up before sending it back down.

3. They Set Stops Where Smart Money Wants Them

If your stop-loss is placed right above the double top, congratulations—you’ve just donated to the institutional traders’ fund. They’ll gladly take your money before moving in the real direction.

The Smart Money Strategy: How to Trade the Double Top Like a Pro

Want to trade double tops like a hedge fund? Here’s your blueprint:

Step 1: Identify the Liquidity Zone

- Instead of shorting immediately at the double top, wait for a liquidity grab

- Watch for a wick above the resistance level followed by a sharp rejection

Step 2: Confirm Institutional Activity

- Look for Order Blocks, Breaker Blocks, or Fair Value Gaps that align with the rejection

- Use Smart Money tools like the Volume Profile or Delta Imbalance to see if institutions are absorbing orders

Step 3: Enter on the Retest (Not the Initial Move)

- Patience pays. Wait for price to come back and test the Breaker Block or Order Block before entering

- Place stops above the manipulation wick, not the double top itself

Real-World Case Study: The Smart Money Double Top in Action

Let’s break down a real example:

In August 2023, GBP/USD formed a textbook double top at 1.2830. Retail traders rushed in, expecting a reversal. Smart Money, however, had different plans:

- Price wicked above 1.2830, triggering buy stops and creating a false breakout

- Institutional traders sold into the liquidity grab

- Within 24 hours, price collapsed to 1.2710, liquidating every breakout buyer and early short seller

Lesson: If you shorted at the fake breakout point, you’d be printing money. If you entered too soon, well… let’s just say the market donated your funds elsewhere.

Avoiding the Double Top Trap—Final Takeaways

✔ Stop looking for ‘perfect’ chart patterns—Smart Money doesn’t trade patterns, they create them.

✔ Wait for the liquidity grab before entering—patience is your secret weapon.

✔ Use Smart Money concepts like Order Blocks, Fair Value Gaps, and Breaker Blocks to confirm real entries.

Want to see this strategy in action? Join our StarseedFX Community where we break down these trades live with institutional insights: https://starseedfx.com/community

—————–

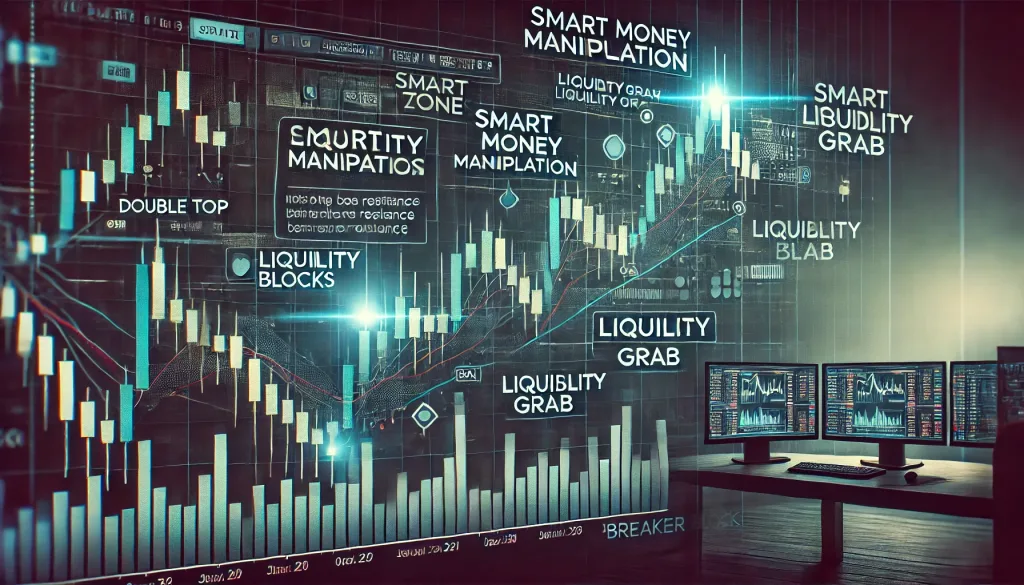

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The