The Double Top Day Trading Pattern: A Strategy for Those Who Know Better

If you’ve ever found yourself staring at a chart, trying to decode the market’s cryptic language, you know the frustration that comes with seeing what might just be a double top. And no, we’re not talking about a botched attempt at a latte art design. We’re talking about that elusive chart pattern that traders either love or hate—often both. This is where things get interesting, and I promise, this pattern has more depth than just a couple of peaks that look like the silhouette of a camel.

The double top is like the market’s way of giving you a “final warning.” When it appears, it’s the market essentially saying, “Buddy, the trend’s about to change. Better buckle up!” But the thing about the double top is that it can be a little tricky—kind of like buying shoes that are on sale only to realize you’ve got them in two different sizes. In this article, I’m going to walk you through the little-known secrets and advanced tactics that separate successful traders from those just hoping for a lucky break.

The Double Top Breakdown: More Than Just Two Hills

The double top is one of those sneaky little formations that, if you’re not careful, can lead you into a false sense of security. Imagine a scenario: the market is climbing, reaching a peak, and then falls, only to climb again to the same level—a level it seems to have trouble breaking. This is where most traders jump in prematurely, mistaking this as a “breakout.” But here’s the real magic: the double top is notorious for being a major reversal signal, often leading to a downturn. Miss this, and you’ll feel like you just hit the ‘sell’ button instead of ‘buy’ and watched your gains crumble faster than a cookie on a diet day.

The double top is your cue to act, but not like everyone else. Successful day traders don’t see a double top and immediately hit the panic button; instead, they look for confirmation. The secret sauce here is waiting for the neckline break—the line that connects the initial dip between the two peaks—before making your move. It’s like waiting for that second shoe to drop before you know it’s time to bail.

The Psychology Behind the Double Top: Know the Mindset

To really understand the double top, you have to put yourself in the shoes of traders on the other side. They are the ones clinging on for dear life, believing that this second peak is a continuation of the prior uptrend. Essentially, it’s the “denial phase” of trading. These traders are the equivalent of people who refuse to wear jackets on a cold day because they “swear it’s not that cold.” The reality is that when the market tests that level twice and fails, it’s not just a coincidence—it’s a signal.

But here’s where the real edge comes in: don’t jump the gun until you’ve watched volume movements. One of the most advanced tricks in the book is observing declining volume on that second peak. If the market is reaching a double top, but the volume is lower than before, it’s the equivalent of the market running out of gas. This is a huge tell that the trend is about to reverse. Kind of like when your mom gives you that long sigh before saying, “I’m not mad, just disappointed.” You know what’s coming, right?

Ninja Tactics for Day Traders: How to Dominate with Double Tops

- Wait for the Neckline Break: Patience is key. Instead of rushing in, wait for the price to convincingly break the neckline. Think of this like waiting for that green light before crossing the road—you wouldn’t just dash out there, and neither should your trades.

- The Stop-Loss Sweet Spot: Place your stop-loss just above the second peak. This minimizes risk and maximizes your upside potential. It’s kind of like strategically hiding your emergency chocolates—you put them in a spot where it’s unlikely anyone else will find them.

- Volume is Your Best Friend: Watch the volume—if the second peak comes with less volume than the first, it’s an early indicator that the bulls are losing steam. Trust me, you don’t want to be the last one holding the bag when the party ends.

Common Pitfalls and How to Outsmart the Crowd

Pitfall #1: Misidentifying the Pattern

Most new traders confuse a double top with a range or consolidation pattern. A true double top requires a clear drop between peaks—not just a pause. It’s like thinking you’re eating a gourmet meal when, in fact, it’s just microwaved leftovers. Don’t fall for it.

Pitfall #2: Getting Emotional

Emotion is the enemy of execution. If you see the price nearing the previous high, don’t panic—wait for confirmation. A seasoned trader knows that it’s not about what the market could do; it’s about what it actually does. And that’s where you make money.

Advanced Insights: Seeing the Hidden Opportunities

Contrary to popular belief, the double top isn’t just a bearish reversal signal. In certain conditions, it can also serve as an entry point for a new type of trend. Here’s the secret: If the price manages to close above both peaks, the market can often switch into a hyper-bullish phase—this is what we call a “fakeout.” The fakeout is like when your cat pretends not to be interested in the string you’re dangling and then pounces the moment you look away. Smart traders stay on their toes for these moments, especially when the volume spikes.

Insider Knowledge: Leveraging the Double Top with News Events

Economic news releases can act as catalysts for completing the double top. Imagine this: an important employment figure is due, and the market is approaching that second peak. Traders in the know realize that if the news disappoints, it’s the push needed to trigger the reversal. It’s like that last piece of pie at Thanksgiving—everyone’s waiting, but only the prepared one gets the prize.

Make sure you’re keeping track of news through a reliable service. Our Forex News Today platform at StarseedFX has all the exclusive information you need to time your entries and exits like a pro. After all, news releases are where the action really happens—don’t get caught flat-footed.

—————–

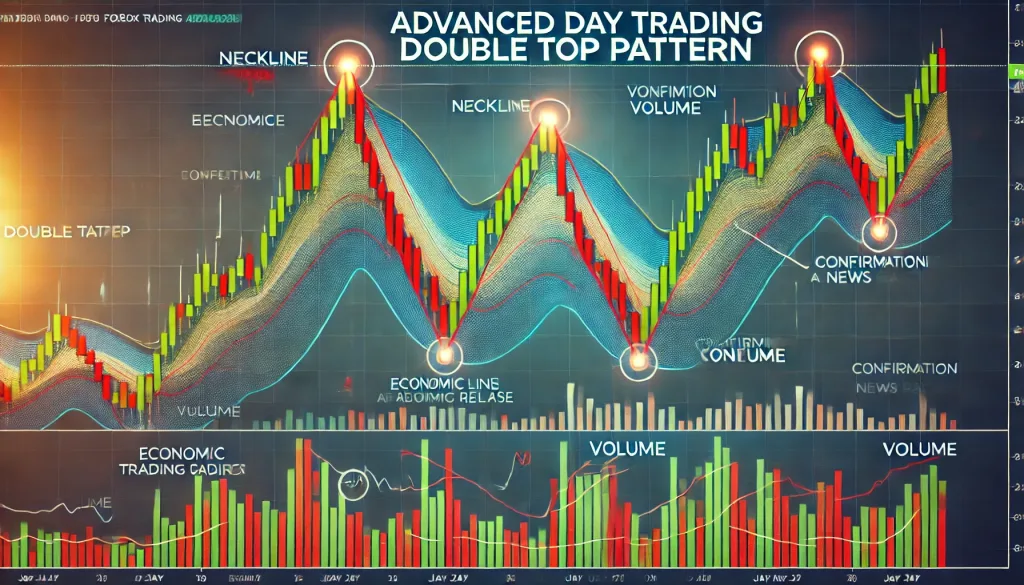

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The