Diamond Top Secrets: Price Action Tactics for Forex Success

The Diamond Top Price Action Playbook: Mastering Hidden Forex Patterns with a Twist

In the wild, ruthless world of Forex trading, patterns rule the jungle. And while every trader and their neighbor is obsessing over the head-and-shoulders or double bottoms, a rare gem often gets overlooked: the Diamond Top. This chart pattern, when used effectively in price action trading, can be your secret weapon for spotting reversals and seizing opportunities. But let’s face it—trading isn’t just about patterns; it’s about understanding, timing, and, occasionally, laughing at your own mistakes (like that time you “invested” in Dogecoin during a meme frenzy).

Let’s dig into the Diamond Top pattern and uncover how to use it like a pro while sprinkling some humor to keep things lively—because who said trading insights can’t be entertaining?

What Is a Diamond Top? (Hint: It’s Not Your Engagement Ring)

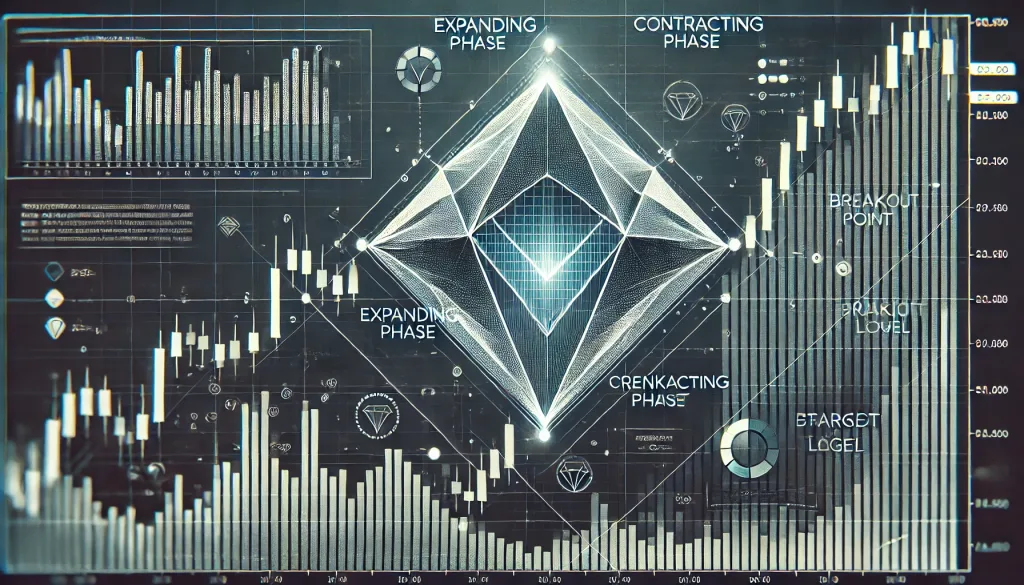

Imagine a symmetrical diamond sitting atop your price chart. This pattern forms when the price action creates a widening formation followed by a narrowing one, resembling a diamond shape. It’s a rare but powerful reversal pattern that often signals an impending downturn. Think of it as the market’s way of saying, “Okay, party’s over—time to sober up and get bearish.”

Key Characteristics:

- Formation: The pattern starts with higher highs and lower lows (the expanding phase), followed by lower highs and higher lows (the contracting phase).

- Breakout Direction: Typically, breakouts occur downward, signaling bearish reversals.

- Volume: Watch for decreasing volume as the pattern forms and a spike when the breakout happens.

Why Most Traders Miss the Diamond Top

You know how some people skip the broccoli on their plate, only to later learn it’s a superfood? The Diamond Top is like the broccoli of price action patterns. Many traders overlook it because it’s less common and harder to spot than, say, a triangle or a rectangle. But when identified correctly, it can save you from false breakouts and bad trades faster than you can say “Stop Loss Activated.”

The Secret Sauce: How to Trade the Diamond Top

1. Spot the Pattern Like a Pro

Finding a Diamond Top requires more than just squinting at your screen. Here’s a checklist to help:

- Step 1: Identify a strong upward trend leading into the pattern (this sets the stage for a reversal).

- Step 2: Look for the diamond’s expanding phase (higher highs and lower lows).

- Step 3: Watch for the contracting phase (lower highs and higher lows).

- Step 4: Confirm the breakout direction (usually downward).

Pro Tip: Use higher timeframes (like H4 or Daily) to spot Diamond Tops more clearly. Trying to find one on a 5-minute chart is like trying to find Waldo in a crowd of zebras.

2. Set Your Entry and Exit Levels

Trading isn’t about gut feelings; it’s about precision.

- Entry: Place a sell order below the breakout level (the support line of the diamond).

- Stop Loss: Set it just above the last high of the diamond.

- Take Profit: Aim for a distance equal to the height of the diamond pattern from the breakout point. For instance, if the height is 50 pips, your target should also be 50 pips.

3. Don’t Ignore Volume—It’s the Tell-All Clue

Volume often decreases as the pattern develops and spikes during the breakout. If the volume doesn’t confirm the breakout, hold your horses—it could be a false alarm.

Diamond Top Trading Strategies That Work

The Breakout Ninja Tactic

Here’s where you channel your inner ninja. Instead of placing your sell order right at the breakout level, wait for a retest. Why? Because markets love playing games. After a breakout, prices often retrace to test the broken support level before continuing their journey south.

- Why It Works: Retests confirm the breakout’s validity and reduce your risk of being caught in a fake-out.

- How to Execute: Use a pending order slightly below the retested level.

The Divergence Double-Check

Combine the Diamond Top with divergence signals from indicators like RSI or MACD for added confirmation. If the price forms higher highs while RSI shows lower highs during the expanding phase, you’ve got a divergence screaming, “Reversal incoming!”

- Pro Tip: Don’t rely solely on one indicator. Use divergence as a supporting tool, not the sole decision-maker.

Risk Management: The Diamond’s Hidden Edge

Risk management isn’t just a buzzword; it’s the difference between thriving and crying over your trading account. Keep your risk per trade at 1-2% of your total capital. Remember, even the best setups can fail—but with proper risk management, you live to trade another day.

Real-World Example: When the Diamond Top Sparkled in Action

Back in 2023, the USD/JPY pair formed a textbook Diamond Top on the daily chart. After a strong upward trend, the pattern developed over several weeks. The breakout happened on August 15, and traders who identified the setup saw a 150-pip move to the downside. Those who combined the pattern with divergence and volume analysis maximized their profits while others chased trends like lemmings heading for a cliff.

Don’t Overcomplicate It

Trading the Diamond Top doesn’t require an MIT degree or psychic abilities. It’s about observation, patience, and a little humor to survive the occasional trading drama. Master this pattern, and you’ll have a powerful tool in your price action arsenal. And remember, even if a trade goes south, at least you’re not the guy who bought Bitcoin at $69,000 because a TikToker said it’d hit $1 million next week.

Key Takeaways

- The Diamond Top is a rare but potent reversal pattern that signals bearish moves.

- Combine it with volume analysis and divergence for higher accuracy.

- Always prioritize risk management—because diamonds may be forever, but your trading capital isn’t.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The