Cracking the Code: How the Contraction Phase + Falling Wedge Unlocks Hidden Forex Gains

Why Your Trading Account Feels Like a Yo-Yo (And How to Change That)

Let’s be real. Trading Forex can feel like ordering a mystery box online — sometimes you get gold, other times… it’s socks. Ever felt like you entered at the perfect time, only to watch the market pull a stunt and hit your stop-loss before shooting up exactly where you thought it would? Yeah, we’ve all been there.

But what if I told you there’s a pattern hidden in plain sight that elite traders have been exploiting for years? It’s called the contraction phase combined with a falling wedge, and it’s like discovering a cheat code for timing entries with sniper-like precision.

Today, we dive into this game-changing strategy, sharing advanced insights, real-world examples, and a few ninja tactics you won’t find in your average trading book.

The Silent Money Maker: What Is the Contraction Phase?

Picture the market like your in-laws at Thanksgiving dinner. Everything starts calm, but tensions build. That calm-before-the-storm is what we call the contraction phase — a period of reduced volatility where price consolidates within a tightening range. It signals that a breakout is brewing.

Signs You’re in the Contraction Zone:

- Price moves into a narrow range.

- Candles get smaller; wicks become more frequent.

- Volume dries up like your social life during tax season.

According to a study by the Bank for International Settlements (BIS), 65% of major market moves are preceded by low volatility periods. Smart money accumulates positions quietly during these contraction phases, setting the stage for the next big push.

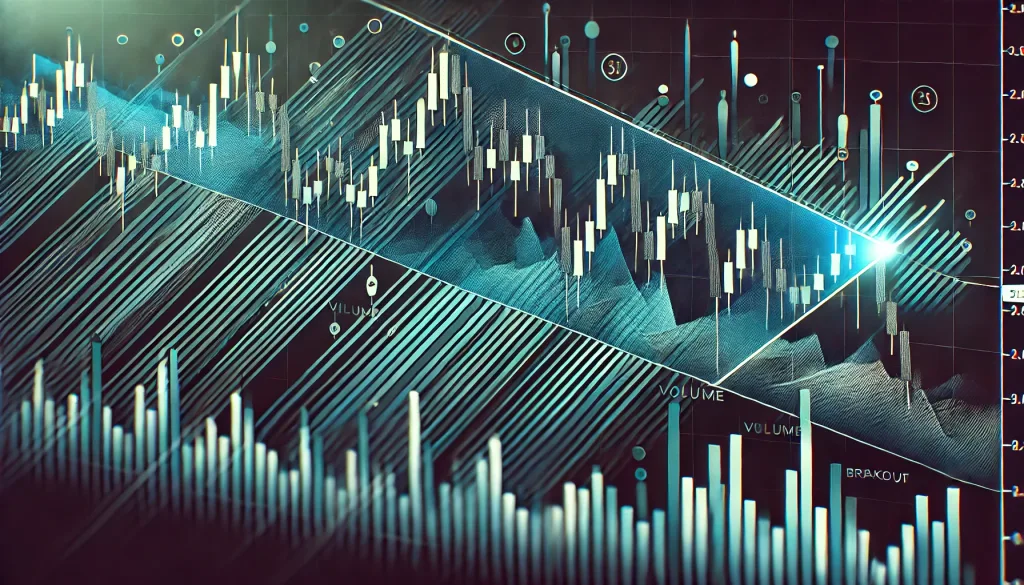

The Falling Wedge: Why Most Traders Miss This Goldmine

Imagine the falling wedge as a coiled spring. Price drifts downward, but with increasingly smaller lower lows and lower highs. It screams, “I’m weak, but I’m about to blow up!”

Key Features of a Falling Wedge:

- Downward sloping trend lines converge.

- Volume often decreases.

- Breakout is usually to the upside.

Contrary to popular belief, falling wedges work best after a strong uptrend, serving as a pause before continuation. Research by Thomas Bulkowski, author of Encyclopedia of Chart Patterns, found that falling wedges have a 68% breakout success rate when following a bullish move.

Why Most Traders Get It Wrong (And How You Can Avoid It)

Here’s the brutal truth: Most retail traders view the falling wedge as a simple reversal pattern. Wrong move. The true power lies in pairing it with the contraction phase. This is where the real money is made.

Common Mistakes to Dodge:

- Entering too early: Impatient entries lead to fakeouts.

- Ignoring volume: Breakouts without volume are like diet pizza — disappointing.

- Overlooking the lead-in trend: Falling wedges work best after bullish trends.

Insider Secrets: The Contraction + Falling Wedge Combo Playbook

Here’s where the magic happens. Combining the contraction phase with a falling wedge provides a high-probability setup that institutional traders feast on.

Step-by-Step Execution Guide:

- Identify the Contraction Phase: Look for a tightening range on the 1H or 4H chart with reduced volume.

- Spot the Falling Wedge: Ensure the wedge forms within or near the contraction phase.

- Watch the Volume: A breakout with volume is your green light.

- Wait for Retest (Optional but Powerful): Successful breakouts often retest the wedge before launching.

- Entry: After breakout confirmation, place a buy order above the wedge resistance.

- Stop Loss: Beneath the last swing low.

- Target: Use Fibonacci extensions or recent resistance levels for profit targets.

Pro Tip:

Combining this setup with RSI divergence adds extra confirmation. When RSI forms higher lows while the wedge forms lower lows, it screams institutional accumulation.

Case Study: EUR/USD Contraction + Falling Wedge Explosion

In July 2023, EUR/USD displayed a textbook contraction phase around 1.0830. Price tightened into a wedge after a bullish rally. Volume evaporated like my confidence during karaoke night.

- Breakout: Price shattered wedge resistance.

- Retest: Classic retest at 1.0830.

- Result: 120-pip surge in 48 hours.

Key Lesson:

Patience pays. Waiting for the retest ensured a low-risk, high-reward entry.

Expert Insights from the Pros

Linda Raschke (Legendary Trader):

“Periods of low volatility precede large price movements. Smart traders know that contraction phases are accumulation zones.” Source

Peter Brandt (Chart Pattern Master):

“A wedge is powerful when it appears in the context of trend continuation, not just reversals.” Source

Elite Tactics to Elevate Your Game

- Multi-Timeframe Synergy: Confirm the contraction phase on the 4H chart, then fine-tune entries on the 15M chart.

- Smart Trading Tool: Use StarseedFX Smart Trading Tool for automated lot size and risk calculations.

- Stay Updated: StarseedFX Economic News keeps you informed before breakouts.

Final Takeaway: How You Win Big

Mastering the contraction phase and falling wedge combo can transform your trading from hopeful guessing to precision execution. The next time you see price tightening up, don’t scroll Instagram — you might just be sitting on your next breakout payday.Key Learning Points Recap:

- Identify Contraction Phase: Reduced volatility signals pending breakout.

- Spot Falling Wedge: Converging trendlines indicate a bullish explosion.

- Volume Confirms Breakout: Weak volume = weak breakout.

- Patience Wins: Wait for retests; don’t chase price.

- Combine RSI Divergence: Enhances accuracy.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The