Why the Chaikin Oscillator and Bearish Flags Are a Trader’s Secret Weapons

The Bearish Flag: Like That Unwanted Guest Who Refuses to Leave

Imagine you’re hosting a dinner party. Everything’s going great—the wine’s flowing, the vibe is on point. Then, there’s always that one guest. You know the one. The person who lingers until 2 a.m., recounting the glory days of high school football and eating the last slice of pizza. That, my friends, is the bearish flag: an unwanted pattern that sneaks in when you thought the trend was your friend. And just like with that dinner party guest, if you don’t know how to handle it, things can spiral quickly.

A bearish flag appears after a sharp downtrend, when prices pause for a moment. It tricks traders into thinking the trend might reverse, before slamming them back down like a bad joke—except nobody’s laughing, and it’s your money on the line.

But what if I told you that this annoying guest comes bearing opportunities? If you know how to play it, the bearish flag can actually become one of the strongest indicators for short trades. Let’s uncover some secrets to harness this unwelcome pattern to your advantage.

Chaikin Oscillator: Your Lie Detector for Market Momentum

Speaking of tricky guests, have you ever caught someone exaggerating—like, “I could totally lift that car!”? The Chaikin Oscillator is basically the lie detector test of the Forex world. It helps you figure out if there’s real muscle behind a price movement or if it’s just all talk and no action.

Developed by Marc Chaikin, the oscillator is calculated by subtracting a longer-term moving average of the Accumulation/Distribution Line from a shorter-term one. Now, I know what you’re thinking—”math homework flashbacks!” But don’t worry, it’s simpler than it sounds. The Chaikin Oscillator helps you get a peek behind the curtain of the market’s momentum. Is the trend gaining strength, or are we just stuck in a dead-cat bounce?

Here’s the insider tip: using the Chaikin Oscillator alongside the bearish flag, you can literally see whether the market is being honest with you. When a bearish flag forms and the Chaikin Oscillator turns negative, it’s like finding that your lingering guest just opened your fridge to grab a cold one—proof that they’re settling in for the long haul, and so is the bearish trend.

The Hidden Formula Only Experts Use

Bearish flags and the Chaikin Oscillator might seem intimidating, but pros use them to spot opportunities that less experienced traders often miss. Want to know how?

Picture this: The market’s in a solid downtrend, then suddenly enters a small, upward-sloping consolidation (that’s the flag part). Meanwhile, your trusty Chaikin Oscillator starts nosediving faster than your mood when you realize there’s no coffee left. When these two events align, experienced traders know to get ready—it’s time to look for a break below the flag’s support.

Why Most Traders Get It Wrong (And How You Can Avoid It)

The issue with bearish flags is they often masquerade as reversals. Rookie traders think they see hope in the slight uptick, only to be blindsided as the trend resumes its march downward. It’s like when you think that guest is finally leaving, but instead, they just head to your couch for a power nap. Rookie mistake.

The key is not to be fooled by the small rally. Combine the bearish flag with the Chaikin Oscillator—if the oscillator remains weak, you can bet the rally is more of a hiccup than a genuine change of heart.

Elite Tactics for Spotting Real Opportunities

So, how can you use this to your advantage? Here’s a quick checklist:

- Identify the Flag: Look for that momentary price rally after a strong downtrend—an upward-sloping channel of price consolidation.

- Consult the Chaikin Oscillator: If the Chaikin Oscillator is negative, it’s giving you a high-five that the bears are still in charge.

- Watch for the Break: Once the price breaks below the support of the flag, it’s a signal that things are about to resume their trip down.

- Manage Your Risk: Set your stops just above the flag’s upper boundary. No, really, don’t forget this one—it’s like wearing a seatbelt on a rollercoaster that looks a little too rickety.

How to Predict Market Moves with Precision

One of the reasons traders love the Chaikin Oscillator is its ability to give clues about the health of market momentum. Imagine your market moves like a car, and the Chaikin Oscillator as the engine’s sound—you can often tell if the market is losing steam before it stops moving altogether.

For the bearish flag, this is crucial. When you see the oscillator diverge while the price consolidates, it’s like catching that guest yawning—a clear sign things are going to come to a halt. You can then position yourself to short the market when it turns out that the bears still have more in them.

The Forgotten Strategy That Outsmarted the Pros

There’s an old trick that not many traders remember these days, and it involves combining the Chaikin Oscillator with volume analysis. You see, a bearish flag isn’t just about price action. Smart traders also pay attention to volume.

When volume drops off during the formation of the flag, it’s like the markets are sighing—taking a small breather before resuming the trend. But if the Chaikin Oscillator starts falling before the price action does, that’s your secret signal. It’s the trading equivalent of knowing the punchline of the joke before everyone else—you’re ahead of the curve.

How to Use Our Tools for Next-Level Trading

Want to take these strategies up a notch? We’ve got you covered:

- Stay Informed with Real-Time News: Catch all the latest Forex news and economic indicators at StarseedFX’s Forex News Today.

- Expand Your Knowledge: Dive deeper into these concepts and discover more ninja-level tactics with our Free Forex Courses.

- Join the Community: For daily alerts and expert analysis, join our StarseedFX community. It’s like having a team of trading experts to chat with—minus the late-night pizza hogger. Learn more.

- Plan and Track Your Trades: Maximize your performance using our Free Trading Plan and Trading Journal.

- Smart Trading Tool: Optimize order management with our Smart Trading Tool for quick calculations and insights.

—————–

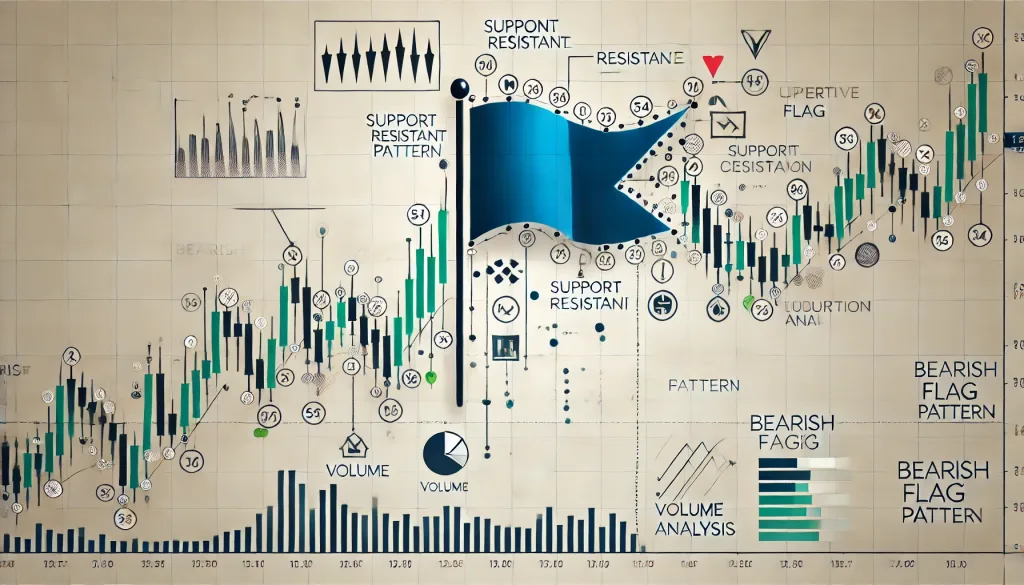

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The