Bullish Pennant + Stop Loss Orders: The Ninja Blueprint for Forex Traders

The “Too-Good-To-Miss” Pattern Traders Keep Misusing

Picture this: you’ve just spotted a textbook bullish pennant on the 15-minute chart of GBP/USD. Your heart’s racing. You’re already mentally calculating profits, picturing yourself upgrading your setup with six monitors and a chair fit for a Bond villain. But then… wham! The market fakes you out like a magician pulling a pigeon out of a coffee mug. You’re stopped out. Again.

Sound familiar?

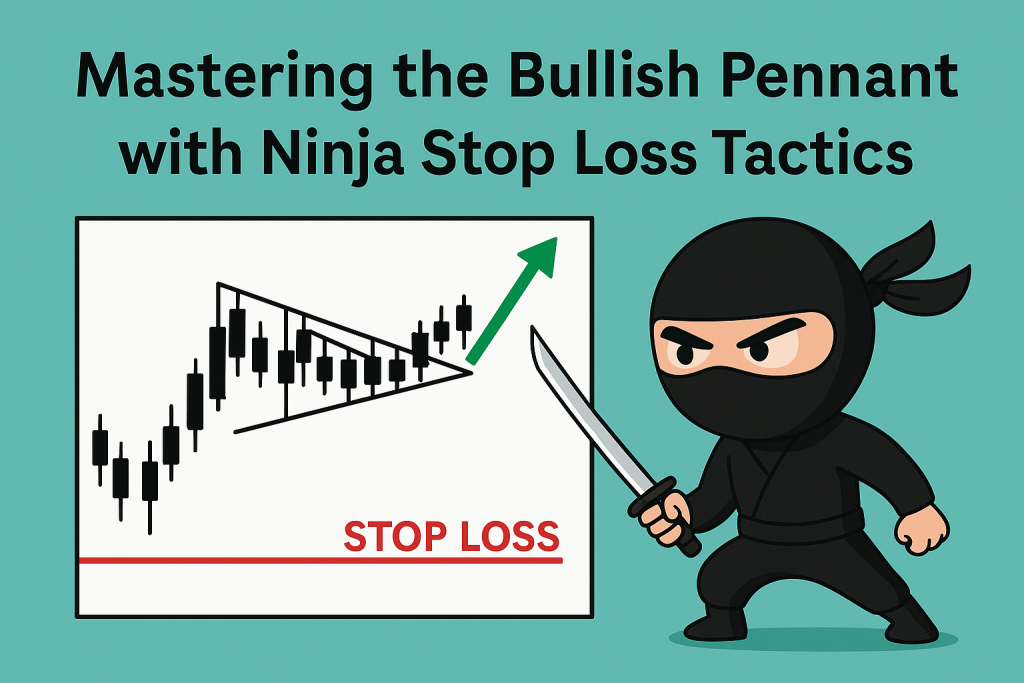

You’re not alone. Most traders use bullish pennants like a lucky charm, completely ignoring the critical partner that makes or breaks the setup: stop loss orders. Think of the bullish pennant as a race car and the stop loss as your seatbelt. Without the latter, a sharp turn could throw you off the trading track.

In this guide, we’re lifting the curtain on advanced, little-known tactics to trade the bullish pennant pattern like an insider, using elite stop loss placement strategies to protect capital and boost win rates. Spoiler alert: these techniques might just save you from a few chart-induced heart attacks.

The Secret Geometry Behind the Bullish Pennant

The bullish pennant isn’t just another flag on the Forex field—it’s a mini-compression zone with psychological tension so thick, you could slice it with a Fibonacci retracement. Formed after a strong upward movement (the flagpole), it consolidates in a symmetrical triangle that screams, “I’m not done yet!”

But here’s what separates the pros from the Pinterest traders:

- Volume dries up during consolidation—indicating hesitation.

- Breakouts are often explosive, but only if the market respects the prior trend.

- Fakeouts are common when stop losses are too obvious (cue the emotional damage).

“Chart patterns are like poker tells. The pros know when they’re bluffing.” — Linda Raschke

Why Most Traders Get It Wrong (And How You Can Avoid It)

Let’s drop a truth bomb: 72% of retail traders place their stop loss either just below the pennant’s lower trendline or the most recent low (Source: IG Client Sentiment Report 2024). It’s the Forex version of leaving your door open with a sign that says, “Please rob me.”

The problem isn’t the pattern—it’s the positioning.

When stops are predictable, institutional players (read: the guys with faster internet and deeper pockets) trigger them intentionally. It’s called a “liquidity grab,” and it’s one of the oldest tricks in the trading book.

Here’s the fix: stop being predictable.

Elite Traders Use What We Call the “Z-Shift Method”:

- Identify the true support zone by analyzing multi-timeframe structure.

- Place your stop loss 1.5x the ATR below the structure, not just the pennant.

- Time your entry after volume confirms breakout—not before.

- Add a trailing stop mechanism once price breaks out and closes above the pennant.

This method isn’t just about defense—it’s a silent offense. You’re letting the market prove itself before giving it your money.

Underground Trend: The Hidden Role of Market Sentiment in Pennant Breakouts

Most retail traders stare at charts like they’re watching a soap opera. The pros, meanwhile, read sentiment like spoilers—they already know how the episode ends.

According to a study by the Bank for International Settlements (BIS), price patterns like bullish pennants are 37% more reliable when sentiment indicators (like the Commitment of Traders report or retail positioning ratios) align with the breakout direction.

Here’s a ninja move: combine your chart pattern with retail sentiment data.

- If 80% of retail traders are long, and you see a bullish pennant—be suspicious.

- If retail is heavily short, and you see the pennant—now we’re cooking with gas.

Try layering this with economic calendar catalysts (such as NFP or CPI reports). It’s like adding nitro to your trade engine.

The Forgotten Trick: Stop Loss Clusters as Entry Signals

You heard that right. Sometimes, stop loss levels are actually your best entry points.

Big players hunt for stops to generate liquidity for their positions. By identifying likely stop zones—like below the pennant’s low or under swing lows—you can reverse engineer entry levels just before the market surges.

Here’s how to spot it:

- Look for wicks piercing below support, followed by engulfing candles.

- Watch volume spike on fakeouts—this is institutional money gobbling up your neighbor’s poorly placed stop loss.

- Add a Bollinger Band squeeze or a Chaikin Money Flow divergence to confirm it’s not a trap.

“Liquidity zones are like piñatas. Smart money hits them hard to spill the candy.” — Mark Minervini

How to Turn the Bullish Pennant into a Risk-Controlled Weapon

Let’s get tactical. Here’s your step-by-step guide for trading the bullish pennant with surgical precision:

Step 1: Confirm the Flagpole

- Look for a steep move with 2x average volume.

- Skip choppy trends—no pole, no pennant.

Step 2: Validate the Pennant

- Look for converging trendlines forming a tight triangle.

- Volume should decrease—low drama before the breakout.

Step 3: Calculate the Breakout Target

- Add the length of the flagpole to the breakout point.

Step 4: Use the Z-Shift Method for Stop Loss

- Don’t place your stop just under the pennant.

- Use 1.5x ATR below structure support (not pattern support).

Step 5: Add Exit Strategy

- Use trailing stops to lock in profits.

- Partial profits at 1:1, let the rest ride to 2:1 or 3:1 RR.

Real-World Example: EUR/USD, June 2024

In June 2024, a textbook bullish pennant formed on the 1-hour chart of EUR/USD just before the ECB rate decision. While most traders jumped in after the breakout, savvy pros waited.

They placed stop loss orders below the H1 structure with ATR logic, not just under the triangle. When a brief fakeout occurred—guess what? Retail traders got flushed. Institutions entered. Boom—120 pips up.

Lesson? It pays to be patient. It pays to think like the hunter, not the hunted.

How Our Community Nails These Trades (And How You Can Too)

Want to catch moves like this before they happen?

Join the StarseedFX Community for daily alerts, live setups, and smart-money insights: ???? https://starseedfx.com/community

Also, take advantage of our:

- Free Trading Plan – https://starseedfx.com/free-trading-plan/

- Smart Trading Tool – https://starseedfx.com/smart-trading-tool/

- Forex News Today – https://starseedfx.com/forex-news-today/

These aren’t your grandma’s indicators—we’re talking about automated strategies and predictive analytics built for modern markets.

Elite Tactics Recap: What You’ve Just Learned

- Stop using cookie-cutter stop loss placements. Institutional traders feast on them.

- Use Z-Shift Method with 1.5x ATR beneath multi-timeframe structure.

- Combine sentiment data with chart patterns for superior edge.

- Look for stop loss liquidity clusters as entry traps.

- Use volume, volatility, and context to confirm breakouts.

- Follow news cycles to sync your pennant strategy with fundamentals.

Before You Go, Ask Yourself:

Are your stop loss orders protecting you, or are they donation links for the market?

Ready to flip the script and start thinking like smart money? Share your experience below or test out the Z-Shift Method this week—and tell us how it transformed your trade!

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The