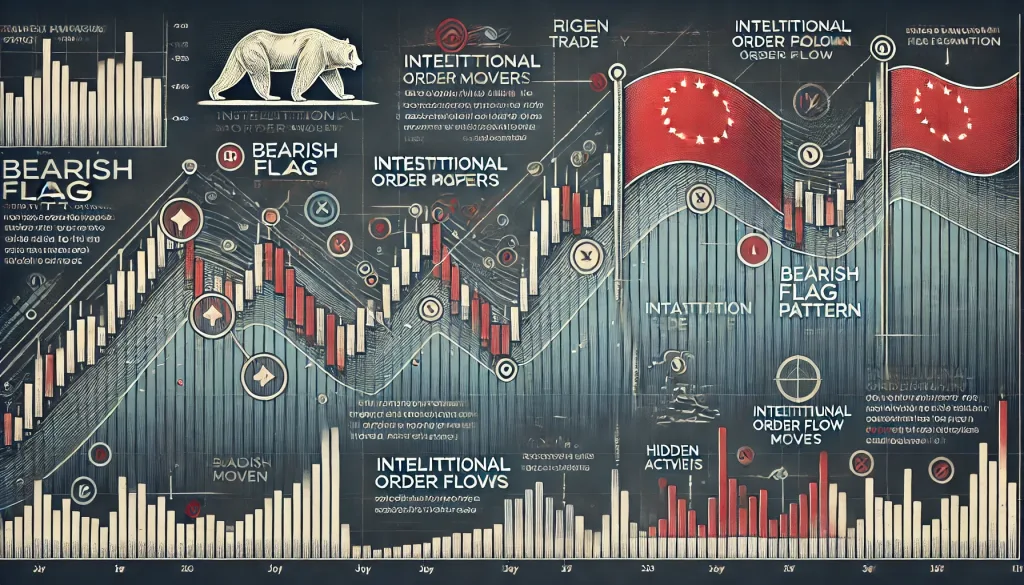

The Hidden Bearish Flag Strategy Institutions Don’t Want You to Know About

The Art of Spotting a Bearish Flag Amid Institutional Order Flow

Imagine you’re watching your favorite show, and suddenly, the protagonist makes a disastrous decision, one that you knew was going to end badly. That’s pretty much what it feels like watching retail traders misinterpret a classic bearish flag formation—except this time, there’s real money on the line.

If you’re here, you’re probably curious about those sneaky bearish flag patterns and how institutional order flow plays into this narrative. Think of this article as the insider’s guide to the hidden world of big money moves, where you’ll find elite tactics and advanced concepts that can help you sidestep the pitfalls that catch most traders. Here, we’re diving deep into bearish flags and the power of institutional order flow. If you want to learn why this pattern is more than just a pretty chart formation, stay tuned. Let’s unravel the secret game being played behind those market moves.

A Trick or a Treat for Smart Traders?

We’ve all seen a bearish flag before—those neat little channels that seem to be forming a comforting upward trend after a sharp fall. But what if I told you the seemingly innocent upward channel is about as safe as buying a low-quality ‘flash sale’ product you didn’t need in the first place? Yep, exactly. Retail traders fall for this pattern like moths to a flame, without understanding what’s really going on behind the curtain: institutional order flow.

What Exactly is a Bearish Flag?

Okay, so let’s break it down, ninja-style: A bearish flag is a continuation pattern that forms after a sharp downward price movement (known as the ‘flagpole’). Prices will consolidate and make a slightly upward-sloping channel (the ‘flag’) before dropping again. And while many retail traders think, ‘Look! Price is reversing!’ what they’re really seeing is institutional traders taking a breather before pushing the price down even further.

Think of it like a beach ball being held underwater by a group of well-muscled lifeguards. It might look like it’s trying to rise, but only because those institutional players are toying with it. Spoiler alert: it’s about to get dunked again.

The Hidden Puppet Master

Here’s where things get interesting. What many traders don’t realize is that behind those lovely textbook patterns are massive volumes of institutional money—the puppet masters who decide if your trading day is about to end in tears or high-fives.

When you spot a bearish flag, the critical question isn’t “Can I spot the pattern?” but rather, “Who is behind the pattern, and how are they influencing it?”

Watch the Volume

One trick that can help you see through the illusion is volume analysis. During a bearish flag, the institutional players will often let the market breathe a bit, so the volume typically declines during the flag formation. They’re basically letting retail traders take the bait. Once enough small fish have joined the party, they push down again with a vengeance. The volume spikes on the breakout as institutions slam the hammer down, and the unwitting retail traders’ accounts—well, let’s just say the sitcom plot twist happens, but there’s no happy ending.

But here’s where the magic happens: if you start seeing volume increasing while the flag is still forming, chances are the ‘boys in the big banks’ are already preparing their next move. As retail traders see an upward channel and jump in hoping for a reversal, they’re essentially walking right into a bear trap.

Why Retail Traders Misinterpret the Bearish Flag

Most retail traders love flags—they’re easy to spot, easy to trade, and when they work, it feels glorious. But here’s the truth bomb: just because it looks simple doesn’t mean it’s easy. Institutions know that thousands of eager retail traders are looking at the same flag, getting ready to trade, and they use that against them.

Institutions don’t see a bearish flag as a signal; they see it as an opportunity to absorb as much liquidity as possible. They’ll pump the price up just enough to give that hopeful “reversal” illusion—then bam! A heavy drop catches everyone with their hand in the cookie jar.

Ninja Tactics for Outwitting Institutions

If you want to avoid becoming cannon fodder for the big players, you’ll need to adopt a few counterintuitive strategies:

- Volume Analysis: As we mentioned earlier, volume is the real litmus test for understanding institutional intent. Declining volume during the flag means the institutions are taking a chill break, gearing up for the next drop. Don’t be fooled into thinking it’s bullish.

- Order Flow Indicators: Using tools like order flow software can give you an actual peek behind the curtain. You can see whether large orders are entering the market, and more importantly, whether they’re using the consolidation as a liquidity grab. If the “big guns” are placing heavy orders, there’s probably a sequel to the downward move.

- Don’t Trust Reversals During a Bearish Flag: When prices form an upward-sloping channel after a fall, you need to look at it with suspicion. Instead of jumping into the false breakout, try waiting for a decisive breakout downwards (preferably on high volume) and then enter in the direction of the original move. It’s like waiting for the true hero to show up in the third act of a bad action movie—you’ll get your moment.

- Institutional Footprints: Keep an eye on the economic news and big money sentiment. Institutions typically have their own game plan. If you’re seeing huge bearish sentiment around major economic releases, it’s likely these players are using the bearish flag as a gateway for an even larger position.

The GBP/USD Bearish Flag that Fooled the Masses

Remember the big drop in GBP/USD back in June 2023? If you caught the bearish flag that formed on the four-hour chart, congratulations—you likely saved yourself a lot of tears. What we saw was a textbook example of institutional order flow at work. The flag formed, many retail traders called a reversal, but those in the know—the ones watching the order flow—could see it was simply institutional traders using the opportunity to gather liquidity before the next leg down. When the price eventually tanked, the ones who saw the trick were already sipping their celebratory latte.

Why Most Traders Get it Wrong

A lot of traders think they’re up against other retail traders. They’re not. They’re up against entire trading desks filled with smart analysts who know exactly where retail stops are hiding. They can see the emotions, the desperation, and—let’s be honest—the foolish optimism when a price forms a hopeful upward channel.

But don’t worry; now that you know what to look for, you can start acting like one of the big players. Take a step back. When you see a bearish flag, ask yourself: “What’s really going on here? Who’s behind the move, and how can I ride their coattails instead of getting caught in the mess?”

Think Like the Institutions

So here’s your big takeaway: The next time you spot a bearish flag, remember that it’s not just a pattern. It’s a beacon signaling what institutional traders are up to. By reading the volume, analyzing the order flow, and adopting some sneaky ninja tactics, you’re not just a spectator—you’re part of the behind-the-scenes action.

And remember, if you want more insights, real-time alerts, and insider strategies that keep you ahead of the game, check out our services at StarseedFX: from advanced methodologies to live trading insights, we’ve got the tools you need to elevate your trading game.

Until next time, happy trading—and may your bearish flags always fly low (in a good way).

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The