The Hidden Power of ATR in LTCUSD: How Volatility Becomes Your Best Friend

Imagine trying to ride a rollercoaster… blindfolded.

That’s what trading LTCUSD without the Average True Range (ATR) feels like—equal parts thrilling, nauseating, and almost guaranteed to leave you screaming (probably into a pillow). But what if I told you that ATR isn’t just some dusty volatility indicator—it’s your VIP backstage pass into Litecoin’s mood swings?

Let’s pull back the curtain on one of crypto’s most underestimated weapons.

Why Most Traders Get Wrecked on LTCUSD (And How ATR Changes the Game)

LTCUSD is that friend who says, “Let’s just chill tonight,” and then drags you into a 3 a.m. karaoke battle in a nightclub you’ve never heard of. It’s fast, it’s unpredictable, and if you’re not using volatility intelligence like ATR, you’re basically trying to leash a dragon with spaghetti.

Here’s the kicker: Most traders misjudge volatility. They set fixed stop-losses and targets based on vibes and caffeine—not math.

But ATR doesn’t guess.

It measures the real movement over time, allowing you to:

Size your trades based on current volatility (goodbye, one-size-fits-all risk!)

Spot explosive breakouts or fakeouts before they burn your wallet

Time your entries like a sniper—not a stormtrooper

The Forgotten Strategy That Outsmarted the Pros: ATR-Based Dynamic Stops

If you’re still using 50-pip stops across all trades like it’s 2007, it’s time for an intervention.

Here’s what the pros do differently:

They set stop losses as a multiple of ATR. For example:

“Set SL = Entry – (1.5 x ATR)”

“Set TP = Entry + (3 x ATR)”

Let’s break it down step by step:

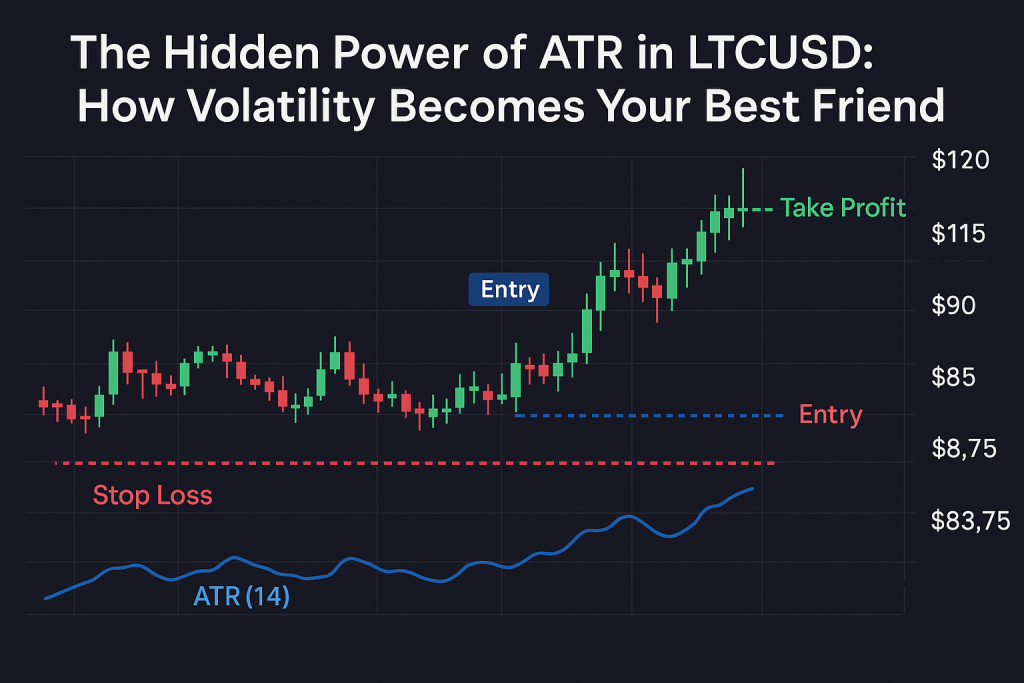

???? ATR-Based Trade Setup on LTCUSD (Real Example):

Check ATR(14) on LTCUSD daily chart – say it’s 7.5

Entry: LTCUSD is consolidating at $95 with potential breakout

Stop Loss: $95 – (1.5 x 7.5) = $83.75

Take Profit: $95 + (3 x 7.5) = $117.5

Result? You’re no longer reacting—you’re strategically planning based on market reality.

The One Trick Quants Use to Hunt Volatility Swings

Volatility clustering isn’t just a fancy term traders use to sound smart on Twitter. It’s a phenomenon where high-volatility periods are followed by… wait for it… more volatility.

LTCUSD thrives on this.

By plotting ATR spikes, you can pre-empt large moves. It’s like watching your dog’s tail wag before they dash across the park. You don’t wait for the bark—you read the signs.

???? Step-by-Step Guide to Using ATR Clusters:

Look for sudden ATR spikes from a base of low volatility

Wait for a tight price compression (e.g., triangle or flag)

Enter on breakout — confirm with volume

Ride the wave like a crypto-surfing legend

Why Static Stop-Losses Are Like Wearing Flip-Flops in a Snowstorm

Let’s talk pain.

Have you ever set a $5 stop on LTCUSD, only to get wicked out right before it moonwalks 15% in your direction?

Yeah, we’ve all been there. That’s not trading—it’s emotional self-harm.

By anchoring your stops and targets to real volatility, ATR shields you from:

False breakouts

Low-probability entries

Over-tight stop losses

Pro Tip: Combine ATR with Bollinger Bands or RSI divergences for insane sniper entries.

The Underground Strategy: ATR + Time-Based Filters

Here’s a little-known secret: combining ATR with time-of-day filters can drastically boost your edge in LTCUSD.

LTC/USD on crypto exchanges tends to move more violently during the New York–Asia overlap (roughly 7–10 p.m. UTC).

So what do the pros do?

They only trade high ATR breakouts during these windows.

That’s like surfing only when the tide’s perfect—not during lunch when everyone’s napping.

Counterintuitive Insight: When Low ATR Is Actually a Goldmine

Most traders think low ATR = avoid the market.

Wrong.

Low ATR often precedes massive breakouts—think of it as the calm before the Litecoin storm.

When LTCUSD prints 14-day ATR lows, the market is quietly building tension.

You don’t run away. You get your coffee, tighten your watchlist, and prepare to strike like a coiled snake.

Here’s how to set up:

Mark ATR lows historically

Check what % moves followed

Backtest with breakout strategies (triangles, channels, flags)

???? According to a 2023 study by CryptoQuant, 63% of ATR troughs on LTCUSD led to 10%+ moves within 5 days. That’s alpha.

Expert Insights From the Field

“ATR remains one of the most underused yet powerful tools in crypto trading. It doesn’t predict the direction—it defines the battlefield.” — John Carter, founder of Simpler Trading

“When volatility is weaponized properly, ATR turns chaos into opportunity. Especially in wild pairs like LTC/USD.” — Linda Raschke, Market Wizard & veteran trader

Case Study: How One Trader Turned a Losing Month Into a Breakout Run

Let’s talk about Mina, a trader in our StarseedFX community.

She was bleeding on LTCUSD trades—tight stops, premature exits, emotional swings.

Then she implemented one change: ATR-based dynamic risk.

In 3 weeks:

✅ Her win rate went from 43% to 68%

✅ Her average R:R increased to 2.5:1

✅ Her confidence? Back from the dead

She now uses ATR(10) on the 4-hour timeframe, synced with RSI divergences and Bollinger Band squeezes.

How StarseedFX Helps You Master the ATR + LTCUSD Game

Ready to ride the wave with more precision than ever? Here’s what you can plug into right now to level up your ATR-LTCUSD trading:

???? Live Market News: Get real-time updates and understand what’s driving volatility spikes

???? Free Forex Courses: Master ATR, Bollinger, and breakout synergies

???? Community Access: Join real traders like Mina crushing it with live alerts and analysis

???? Smart Trading Tools: Automate your ATR-calculated lot sizes and risk parameters

???? Trading Plan + Journal: Track your setups, measure progress, and dominate your edge

Elite Tactics Recap: What You’ve Just Learned

Here’s a TL;DR worthy of screenshotting:

Use ATR to set dynamic stops and targets

Spot volatility clusters for breakout entries

Trade high ATR setups during optimal hours

Capitalize on low ATR ranges as pre-breakout goldmines

Combine ATR with RSI/Bollinger for sniper accuracy

Track everything using StarseedFX’s Smart Tools

Final Thought: From Chaos to Clarity—ATR Isn’t Just a Tool. It’s a Translator.

If LTCUSD is a wild animal, ATR is your interpreter.

It doesn’t tell you where to go—but it whispers how fast the wind is blowing. That alone changes everything.

So next time you’re tempted to enter a trade on gut instinct alone, ask yourself:

“What does ATR say?”

Then act like a pro. Or at least like someone who doesn’t buy shoes just because they’re 70% off.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The