Master ATR & Three White Soldiers for High-Confidence Trades

ATR + Three White Soldiers: Unlocking Your Trade Strategy with a Smile

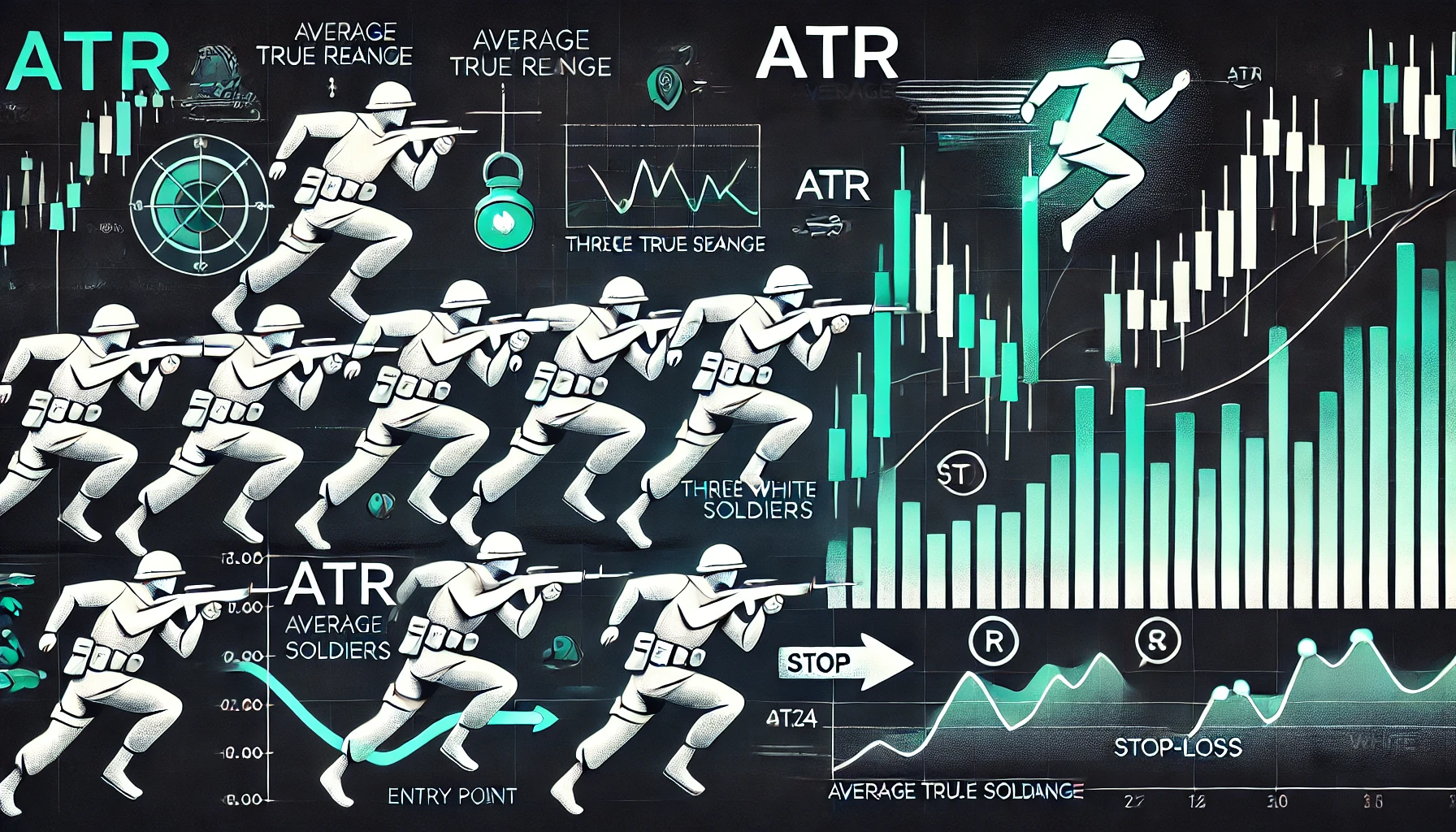

Let’s talk about one of my favorite double-act performers in the world of Forex indicators: the ATR (Average True Range) and Three White Soldiers. Think of them as the dynamic duo in a buddy-cop movie—one measures the volatility (ATR, the analyst), and the other signals a reversal (Three White Soldiers, the bold action hero). Together, they can give you that edge that turns a potential missed opportunity into a chart-topping blockbuster trade.

So, grab a cup of coffee, sit back, and let’s dive into this adventure of price action, candles, and hidden market insights. No capes required, but feel free to wear one if it gets you in the zone.

What Is ATR, and Why Should You Care?

ATR (Average True Range) measures the level of volatility in the market. Imagine trying to make decisions in a relationship—one moment, your partner’s super chill, and the next, they’re flipping out over you forgetting to replace the toilet paper. That’s market volatility for you. ATR helps you keep track of those unpredictable moments so that you’re not caught off guard.

With ATR, you’re not predicting market direction. Instead, you’re assessing how much the market could potentially move within a specific period. Think of it as trying to figure out whether today’s workout will be a brisk jog or a full-on marathon—useful knowledge if you want to avoid a metaphorical heart attack.

Meet the Three White Soldiers

The Three White Soldiers is a bullish candlestick pattern made up of three consecutive long-bodied green candles. Each of these soldiers advances further than the last, signaling that buyers have seized control of the market. It’s like seeing your friend finally get off the couch and decide to chase that dream job—momentum builds, and there’s no turning back.

When these three “soldiers” march in formation after a downtrend, it’s an indication that a reversal is likely underway. And when combined with our friend ATR, you’ve got a real strategy to work with, not just a “feeling” about the market.

The Secret Recipe: ATR + Three White Soldiers

Now, you might be asking, “How do we use these two powerhouse indicators together?” Well, dear reader, here’s where the real magic happens.

- Step 1: Identify the Three White Soldiers Pattern

- First, look for the Three White Soldiers pattern after a downtrend. This indicates that buyers are getting ready to storm the gates. We’re looking for three green candles in a row, each with higher closes than the last.

- Think of these soldiers like three caffeine-charged friends dragging you off the couch to go for a morning run. Once you see them, you know it’s go-time.

- Step 2: Check the ATR

- Next, pull up your ATR. You want to see whether the market is experiencing an increase in volatility. The idea here is simple: rising ATR suggests increased interest and momentum. Think of ATR as the soundtrack to your favorite action movie—if the music is picking up, you know something big is about to happen.

- If ATR is low and suddenly starts rising during the appearance of the Three White Soldiers, you’re potentially looking at a setup that’s worth acting on.

- Step 3: Set Your Entry and Stop Loss

- Set your entry just above the high of the third candle. You want to confirm that the bullish momentum is still intact before diving in. For your stop loss, use ATR to set a realistic buffer. Placing a stop too close would be like going into a boxing match with your chin sticking out—you don’t want to get knocked out on the first jab.

Why Most Traders Get It Wrong (And How You Can Avoid It)

Here’s where it gets interesting—the Three White Soldiers pattern can sometimes give false signals, especially when traders don’t pay attention to ATR. If you rely solely on candlestick patterns without considering volatility, it’s like trying to guess if a movie will be a blockbuster without ever watching the trailer. The context is everything.

Another common mistake? Ignoring the broader trend. While Three White Soldiers might suggest bullish momentum, ignoring the larger market structure could leave you facing a nasty reversal. Remember, we’re looking for the right clues—think Sherlock Holmes, not a toddler trying to fit a square peg in a round hole.

Game-Changing Ideas for ATR and Three White Soldiers

- Use ATR to Confirm Momentum: When volatility is increasing alongside the appearance of Three White Soldiers, this is a strong signal that you could be catching a genuine trend reversal. It’s like deciding to invest in a company after seeing not only strong earnings but also a CEO that actually knows what they’re doing.

- Wait for Pullbacks: Instead of entering immediately after spotting Three White Soldiers, wait for a slight pullback. This can help confirm that the new trend is holding up and reduce the chances of getting burned by a false breakout. It’s like waiting to see if those New Year’s resolutions actually stick beyond January.

- Check Timeframes: Use multiple timeframes for confirmation. Look at higher timeframes like the daily or weekly to understand the broader trend, while using the ATR and Three White Soldiers setup on the 4-hour or 1-hour chart. This gives you the full story instead of just the headline.

Real-World Examples and Expert Quotes

Alexander Elder, author of “Trading for a Living,” says, “The best traders watch what the market is doing and adjust their strategies accordingly.” This is exactly what the combination of ATR and Three White Soldiers allows you to do—watch the market’s behavior (ATR) and act when it’s time (Three White Soldiers).

In a real-world example from just last year, the EUR/USD pair formed a Three White Soldiers pattern after an extended downtrend. At the same time, ATR spiked, indicating increased interest and momentum in the market. Traders who waited for confirmation with ATR found themselves in a strong upward move that lasted for several weeks—talk about a parade worth joining!

Steve Nison, the pioneer of Japanese candlestick charting, often emphasizes, “Candlesticks are most powerful when used with other forms of technical analysis.” ATR fits the bill perfectly here, providing that much-needed context to avoid diving into trades without a safety net.

Avoiding Pitfalls: What Not to Do

- Don’t Ignore Volume: Sometimes the Three White Soldiers can appear without significant volume backing them up. This can be a sign that the move isn’t as strong as it looks. Make sure there’s enough volume or increased ATR to confirm the move is genuine.

- Beware of Overbought Conditions: If you see the Three White Soldiers appearing after a very strong uptrend, it may be a sign of overextension. It’s like staying out for just one more drink, knowing you already have to be up at 6 AM—it rarely ends well. Use ATR to gauge whether the trend still has room to run or if it’s running on fumes.

Combining ATR and Three White Soldiers gives you a powerful toolset for identifying and confirming trend reversals. It’s not about trying to get every single trade right—it’s about setting yourself up for success by understanding both the candlestick story and the volatility landscape.

So next time you see three strong green candles marching up your chart, check the ATR to see if the move has the juice to back it up. With this combo, you’re trading with confidence and clarity—not just guessing and hoping for the best. Now, grab your trading journal, get comfortable, and start watching for those setups—the market is full of surprises, but with the right strategy, you’ll be ready for all of them.

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The