Price Oscillator Meets the Dead Cat Bounce: How to Turn a Misstep into Market Magic

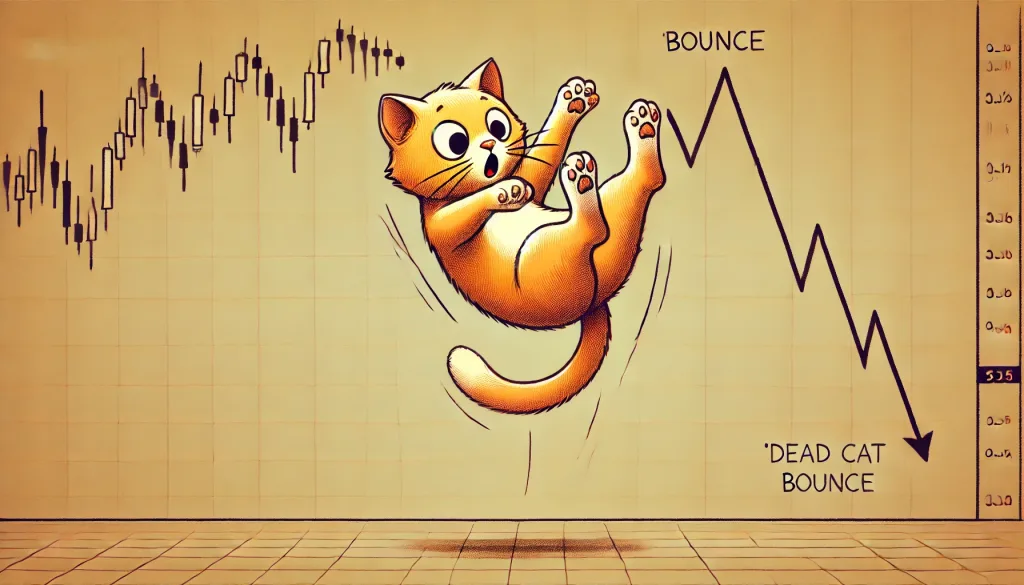

Imagine you’ve just adopted a fluffy feline named “Bounce.” You toss it a toy, it chases it, leaps—and thuds ungracefully to the floor. Ouch. It’s that awkward, almost tragic scene that sums up what we in the financial world call a “dead cat bounce.” This market scenario occurs when an asset experiences a brief recovery amidst a downtrend, giving hope to traders that—spoiler alert—soon vanishes. The trick is knowing how to ride the brief bounce before it flattens out like poor Bounce.

So how do we avoid being a Bounce ourselves? Enter the Price Oscillator: a tool as stealthy as a cat and twice as cunning. Today, we’re going to dig into the interplay between price oscillators and the dead cat bounce, uncovering little-known secrets to help you stay on your feet and cash in on those ephemeral market recoveries.

The Price Oscillator: More Than Just a Fancy Gauge

Price oscillators often feel like the “speedometers” of Forex—you know when you’re cruising too fast or way too slow. The Price Oscillator is a nifty indicator that helps traders see the variance between two moving averages, typically a short-term one against a longer-term one. Think of it like checking how your favorite movie reviews compare on two different websites: what’s trending now, and how has it stood the test of time?

It’s crucial when dealing with dead cat bounces to use this tool to evaluate whether the asset has a genuine chance of clawing its way back, or whether it’s just tumbling headfirst. Price Oscillators help us cut through the drama—is the recent bounce a genuine turning point, or just a panic-driven head fake? Spoiler: it’s usually the latter.

The Bounce Trap: Avoiding the Cat Nap of Doom

A dead cat bounce can feel like spotting your ex at a party—you think there’s hope, only to realize you’re better off maintaining social distance forever. The Price Oscillator can help you gauge if a bounce has any teeth or if it’s more like Bounce the cat slipping off the kitchen counter. To better understand it, you want to identify divergence.

Divergence occurs when the price movement of an asset and an indicator, like the Price Oscillator, don’t match up—kind of like seeing someone smile at you while giving you a side-eye. For instance, if prices are climbing slightly but the oscillator shows a flat or declining value, it’s an ominous sign—that’s your dead cat in action, and that’s when you look away.

Dead Cat Bounces & Oscillators: The Odd Couple

The oscillators don’t lie. If the price action looks like it’s rebounding from rock bottom, but our oscillator—wise beyond its years—tells us momentum hasn’t picked up, that’s a bounce setting itself up to fail. On the other hand, should the oscillator and price both show renewed energy—think of Bounce standing upright after the fall, ready for another adventure—you might indeed have a reversal worthy of some action.

But let’s keep it real: most traders see the dead cat bounce and react like someone buying those gym memberships in January—hopeful, but often too impulsive. Instead, we’re all about learning the hidden rhythm here, finding that underground trend and understanding why it’s mostly just a fake-out rally. And the oscillator is that whisper in your ear that says, “Don’t get tricked by the hype, buddy.” Sometimes, that’s all we need.

The Expert’s Shortcut: Why Price Oscillators Are the Key

If you’ve heard of the moving average convergence divergence (MACD), the Price Oscillator functions similarly, only without the added melodrama. We’re looking at the difference between a faster and slower average to find out if this latest rally will stick, or if Bounce is about to hit the ground again.

One of the little-known secrets here is that timing is everything. During a dead cat bounce, watch for the point where the price oscillator crosses the zero line. It’s like Bounce suddenly landing on its feet and leaping off the sofa. If it crosses decisively, that’s a genuine recovery signal.

But most traders miss this. They’re focused on price alone, which is like picking a football team solely on jersey color—exciting maybe, but not what’s going to win you the match.

How to Flip a Dead Cat Bounce to Your Advantage

So, here comes the ninja move. Rather than reacting to a brief rebound (aka, buying on hope), leverage the Price Oscillator to identify when the dead cat is actually lifeless. At this point, you can begin positioning for a sell. This isn’t mean-spirited; it’s strategic. Dead cat bounces often give you two bounces—the initial move up, and then a smaller wave.

What if you could be ready for the second, smaller bounce and trade accordingly? The Price Oscillator shows diminishing momentum, and you know the game is up. Position for a downtrend, and you’ve gone from hopeless optimism to calculated precision—because real traders know that when dead cats bounce twice, the second fall is just shy of inevitable.

Underground Trendspotting: Patterns in Dead Cats

A surprising pattern that many experts overlook is that dead cat bounces are often followed by a short, explosive move. But don’t confuse this with a proper bullish reversal—it’s just the traders’ own psychology taking hold.

Watch the oscillator—the bounce is rarely sustainable if the price hasn’t truly shifted momentum. Look for confluence: the oscillator needs to be showing growing energy just as the price begins to peak. If you see divergence—price moving up but oscillator down or stagnant—get ready to hit that short button.

Real-Life Example: Trading the Bounce Like a Pro

Take for instance the GBP/USD during the Brexit saga—wild moves, false breakouts, and yes, dead cat bounces aplenty. Traders saw what looked like a comeback for the pound—in reality, these were short-lived recoveries during the wider downtrend.

An oscillator reading made it clear: despite the price jumps, momentum stayed in negative territory. It was a telltale sign that these “rallies” were, in fact, weak—they were dead cat bounces, moments where it seemed like the pound would regain lost ground, only to fall right back down.

Trading those oscillations, armed with our trusty Price Oscillator, could have kept you on the winning side. Using the tools to look behind the curtain helped many traders profit instead of falling into the hype and succumbing to loss.

Why Most Traders Get This Wrong

Traders usually rely on price action alone. They see a candle bouncing and assume it’s the beginning of something great. Spoiler alert: it’s not always like that. It’s like when you buy a lottery ticket because you “feel lucky”—sure, it’s thrilling, but the odds aren’t on your side.

The key to price oscillators is not only using them but interpreting their whispers—when they’re telling you momentum is off, it’s a clear sign to beware. Don’t be one of the hopefuls banking on Bounce, be the cat-owner who knows that, frankly, Bounce wasn’t made for high jumps.

Dead Cats Can Be Useful Too

Dead cat bounces can be some of the trickiest moves to navigate. Many traders end up losing because they’re chasing what seems like a recovery. But, armed with the knowledge of the Price Oscillator, you’re no longer the chaser—you’re the one waiting, calculating, and leaping only when you’re sure the move has legs (or paws).

So, use the Price Oscillator, look for divergences, and spot when that cat’s about to fall flat again. Leverage the bounce, but don’t fall for the hype. Remember: even in Forex, there’s humor to be found—sometimes, it’s just the comedy of watching a dead cat, hoping for miracles.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The