The Pivot Point + TWAP Strategy No One Talks About (But Should)

Where Most Traders Get It Wrong (Hint: It Involves Time)

Picture this: you’ve mapped your pivot points like a seasoned chart wizard, placed your entry near S1 or R1 with the swagger of a Wall Street cowboy… and still, your trade sinks faster than your hopes after seeing NFP results go the wrong way. Why? Because most traders completely ignore time.

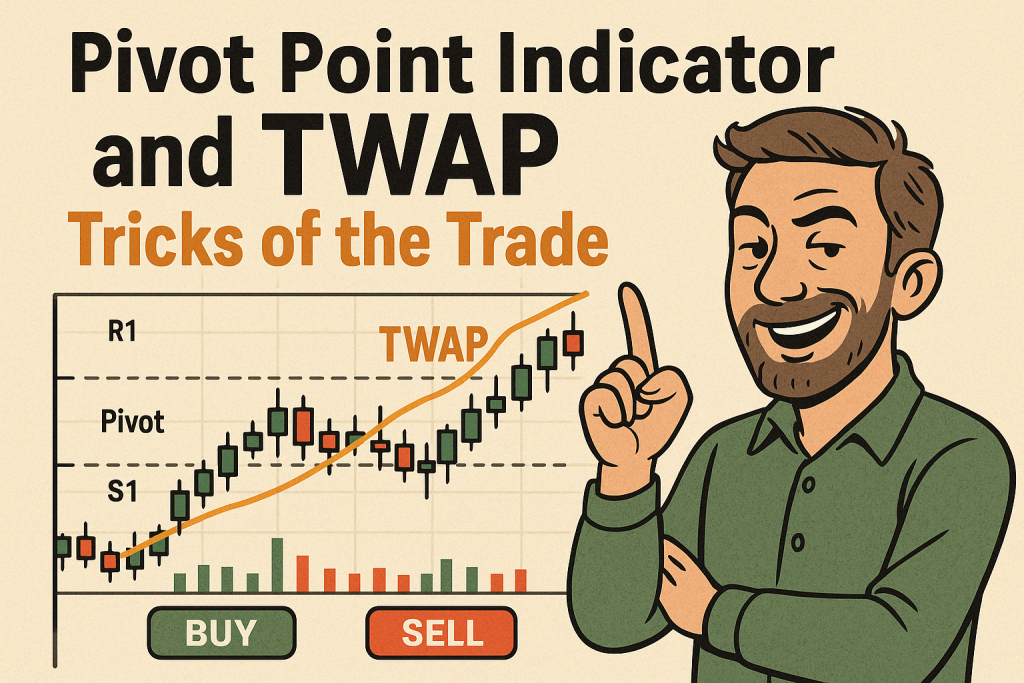

Enter TWAP—the Time-Weighted Average Price. When blended with pivot points, this dynamic duo becomes one of the most overlooked yet lethally precise combos in the trading playbook.

Main Keywords: pivot point indicator + TWAP

Focus Key Phrase & Synonyms:

- Pivot point and TWAP strategy

- TWAP pivot trading technique

- Time-weighted pivot indicator method

Why You’ve Been Blindfolded in Broad Daylight

Let’s start by dismantling a myth that’s quietly sabotaging your strategy: “Price is king.”

Yes, price matters. But timing is the royal advisor whispering which direction the king should march. The pivot point indicator gives us horizontal clues—levels of resistance and support derived from the previous day’s high, low, and close. But TWAP? TWAP tells us when the market’s decisions are happening.

TWAP = (Sum of price × volume) / Total volume over a specific time period.

So what happens when you combine time-sensitive market consensus (TWAP) with spatial roadmaps (pivot points)?

You get a surgical edge. And no, not the kind of surgical edge that scalpers brag about on Reddit. We’re talking about precision entries and exits that could make a Swiss watch jealous.

The Hidden Timing Code: Using TWAP as Your Market Pulse

TWAP is often used by institutional traders to gauge whether their massive buy or sell orders are affecting the market. But here’s the kicker: TWAP isn’t just for the big guys.

In intraday trading, if price dips below TWAP but stays above a key pivot support (say S1), it means sellers have firepower—but buyers still hold the line.

That’s your ninja moment.

TWAP + Pivot Entry Signal Checklist:

- Price hovers near Pivot Level (S1/R1)

- TWAP confirms trend direction (price below TWAP in downtrend, above in uptrend)

- Wait for volume confirmation—this is often skipped by retail traders but is key to avoiding fakeouts.

“The market is a story in motion. TWAP reads the pace, pivots read the plot twists.” – Raj Malhotra, ex-JPM trader & educator

The Contrarian Setup That Flips the Script

Let’s say price breaks below S1 and is hugging the lower band like it owes it money. Most retail traders go short.

But what if TWAP is flattening out or even slightly rising?

Institutions may be absorbing orders. The market’s breathing—not collapsing.

In this setup:

- Avoid shorts below S1 if TWAP is flat or rising

- Look for mean-reversion trades with stop below S2

- Target mid-pivot or even TWAP for exit

“Retail traders see red candles and panic. Pros see liquidity harvesting opportunities.” — Kathy Lien, Managing Director, BK Asset Management

The One Strategy Institutions Hope You Don’t Use

This setup has flown under the radar—mainly because it’s hiding in plain sight:

TWAP Bounce off Pivot Confluence

- Plot pivot points (daily or weekly depending on your timeframe)

- Overlay TWAP on your 5-min or 15-min chart

- Look for confluence zones: e.g., TWAP touches R1, and price bounces on increased volume

Result:

- Clean entry

- Minimal slippage

- High institutional alignment

Example from February 2025 (EURUSD):

- Price pulled back to Daily Pivot at 1.0890

- TWAP curved upward and touched pivot

- Price launched to R2 within 3 hours, gaining +47 pips

Why Most Algorithms Are Obsessing Over TWAP Right Now

TWAP isn’t just a legacy tool from algos past—it’s the blueprint many HFT and quant strategies are built on. In fact, according to a 2024 study by Refinitiv, over 61% of intraday execution algorithms in Forex included a TWAP or modified TWAP model.

Moreover, algorithmic execution desks at banks like UBS and Credit Suisse report that their models heavily weigh TWAP vs. market volume.

So if TWAP is the heartbeat of institutional trading—and you’re ignoring it—you’re basically boxing blindfolded.

The 3-Step TWAP + Pivot Flow Strategy

Here’s a simplified but deadly accurate process:

Step 1: Frame Your Context

- Use Daily Pivot points to set the structure.

- Apply TWAP to your intraday chart (5-min recommended).

Step 2: Wait for Agreement

- Look for price respecting key pivot zones (S1/R1, Central Pivot)

- Confirm TWAP alignment (above for longs, below for shorts)

Step 3: Trigger With Confluence

- Enter only when you have volume confirmation AND candlestick pattern (e.g., hammer at S1 with TWAP lift)

- Place stop just beyond pivot level

- First target = TWAP. Second target = next pivot level

Bonus Tip: Add RSI divergence for extra confirmation—especially around TWAP slope changes.

Hidden Opportunities Most Retail Traders Miss

- TWAP often flattens before major reversals—it’s like watching a poker player’s eye twitch before they bluff.

- During news events, ignore initial volatility and wait for price to return to TWAP. That’s where the real intent shows up.

- Combining Weekly Pivots + Intraday TWAP filters out noise and improves higher timeframe alignment.

According to the Bank for International Settlements, daily Forex turnover in 2022 hit $7.5 trillion—and much of that liquidity clusters around institutional zones like pivots and TWAP. That’s where the sharks swim.

How StarseedFX Can Give You the Institutional Edge

Want to trade like you’re on the inside without needing a Bloomberg Terminal or six monitors?

Here’s what we offer:

- Live TWAP-Pivot Trade Alerts in our StarseedFX Community

- Custom Trading Plan & Journal to map and track your TWAP confluence trades

- Free Forex Education courses that go beyond the basics into elite-level strategy

- Smart Trading Tool that calculates lot sizes and helps time pivot entries precisely

Stay ahead of the herd, not behind it. Visit StarseedFX Forex News Today to catch market-moving developments before the crowd.

Elite Tactics Recap – What You’ve Learned Today

- TWAP isn’t just for algos—it’s a timing tool for smarter entries.

- Pivot points map market psychology; TWAP reveals the tempo.

- Institutions use this combo. Retail should too.

- Volume and structure must align with TWAP + Pivot for highest probability trades.

- TWAP flattening = hidden reversal opportunity.

- News volatility fades, but TWAP tells the true story.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The