Decoding the Volume Profile: Market Depth Unveiled

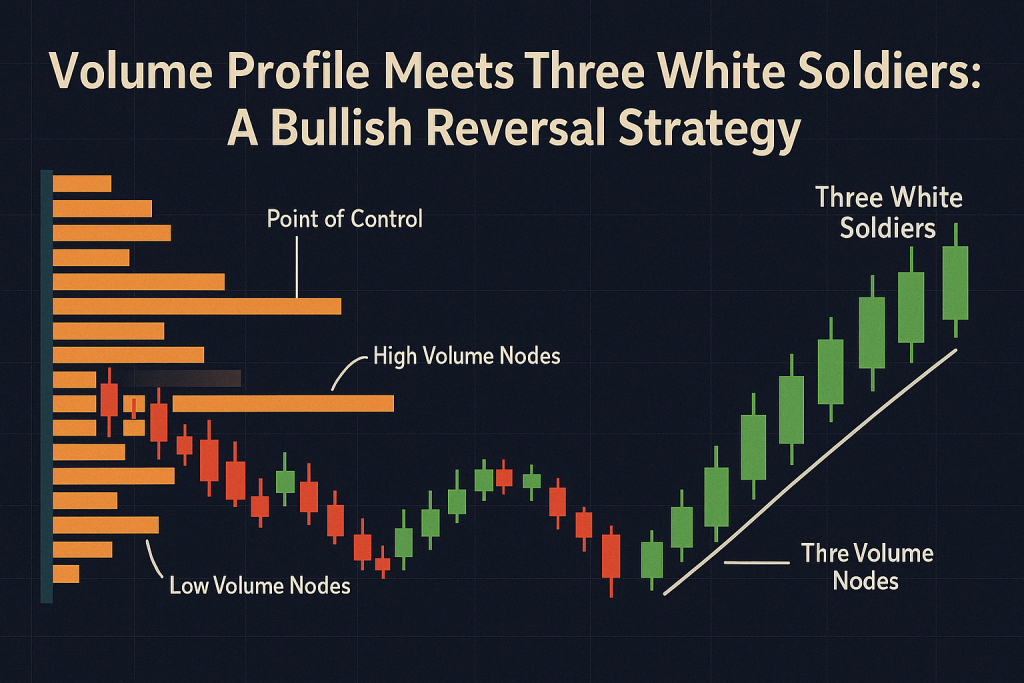

The Volume Profile is a powerful tool that displays trading activity over a specified time period at specific price levels. Unlike traditional volume indicators that show volume over time, the Volume Profile reveals where trading activity is concentrated, highlighting key support and resistance levels.

Key Components of Volume Profile:

Point of Control (POC): The price level with the highest traded volume, indicating a fair price area where buyers and sellers are most active.

Value Area (VA): Typically encompassing 70% of the total volume, this area represents the range where most trading occurred, providing insights into market consensus.

High and Low Volume Nodes: Areas with significantly higher or lower trading volumes, indicating potential support/resistance zones or areas of price rejection.

By analyzing these components, traders can identify strategic entry and exit points, anticipate potential price movements, and make informed decisions based on market behavior.

Three White Soldiers: A Beacon of Bullish Reversal

The Three White Soldiers pattern is a bullish candlestick formation that signals a potential reversal from a downtrend to an uptrend. It consists of three consecutive long-bodied candlesticks that open within the previous candle’s real body and close progressively higher.

Characteristics of the Pattern:

Sequential Bullish Candles: Each candle opens within the previous candle’s body and closes near its high, indicating sustained buying pressure.

Minimal Shadows: Short or non-existent upper wicks suggest that bulls maintained control throughout the trading session.

Volume Confirmation: An increase in volume during the formation of the pattern adds credibility to the potential trend reversal.

This pattern is most reliable when it appears after a prolonged downtrend, signaling a shift in market sentiment and the emergence of bullish momentum.

Synergizing Volume Profile with Three White Soldiers

Combining the insights from the Volume Profile with the Three White Soldiers pattern can enhance the reliability of trading signals and improve decision-making.

Strategic Integration:

Identify Support Zones: Use the Volume Profile to locate high-volume nodes or the POC, which often act as support levels.

Pattern Confirmation: Observe the formation of the Three White Soldiers pattern near these support zones, indicating a potential bullish reversal.

Volume Analysis: Ensure that the pattern is accompanied by increasing volume, reinforcing the strength of the reversal signal.

Entry and Exit Points: Enter the trade after the confirmation of the pattern and set stop-loss orders below the identified support levels to manage risk.

By aligning these two analytical tools, traders can gain a comprehensive view of market dynamics, enhancing the precision of their trades.Investopedia+2Medium+2Xs+2

Implementing the Strategy: A Step-by-Step Guide

Analyze the Volume Profile: Identify key support and resistance levels based on trading volume distribution.Medium+3Jumpstart Trading+3Xs+3

Monitor for Pattern Formation: Look for the emergence of the Three White Soldiers pattern near identified support zones.Forex+9Babypips.com+9Strike+9

Confirm with Volume: Ensure that the pattern is supported by increasing volume, indicating strong buying interest.

Execute the Trade: Enter the trade after the pattern is confirmed, setting appropriate stop-loss and take-profit levels based on market conditions.

Continuous Monitoring: Keep an eye on market developments and adjust your strategy as necessary to adapt to changing conditions.

Conclusion: Enhancing Trading Acumen

Integrating the Volume Profile with the Three White Soldiers pattern offers traders a robust framework for identifying and capitalizing on bullish reversals. By understanding the nuances of market volume and candlestick formations, traders can make more informed decisions, manage risks effectively, and enhance their overall trading performance.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The