How Smart Money Masters NFP: Insider Tactics the Pros Don’t Share

The Market Doesn’t Wait for You to Catch Up

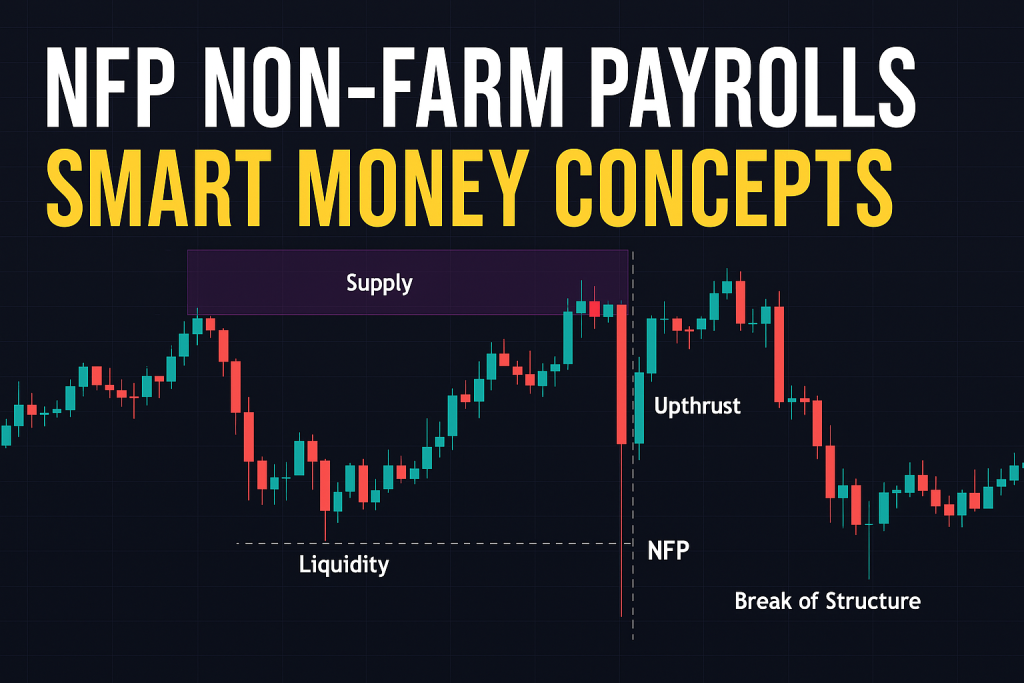

Imagine missing the NFP release because you were busy reheating leftover pizza, only to return and see your trade plummet like your motivation on a Monday. Ouch. The “nfp non farm payrolls” report isn’t just a fancy acronym with Wall Street street cred; it’s one of the most market-shaking news releases in the game. But what if I told you the pros aren’t reacting to the news—they’re already positioned before the headlines even hit? Enter: Smart Money Concepts.

Why Everyone Freaks Out During NFP (Except Smart Money)

Every first Friday of the month, traders gather around their charts like it’s a ritual. Non-farm payroll numbers drop, and chaos ensues. Spikes, slippage, emotional damage—you name it.

But smart money? They’re sipping espresso, watching retail traders react like they just discovered fire.

Smart Money Concepts (SMC) are built on the idea that institutional players — hedge funds, banks, prop firms — manipulate price zones on purpose. Retail traders get played like background extras in a thriller. The real money’s in the story behind the chart.

The Hidden Blueprint: How Smart Money Preps for NFP

Before the NFP report hits the fan, institutions have:

- Engineered Liquidity Pools: Think of these as honey traps. Areas above equal highs or below equal lows are prime hunting grounds.

- Created Fakeouts (a.k.a. inducement moves): Retail jumps in, thinking it’s a breakout. Institutions eat their stops, reverse price, and profit.

- Stacked Buy/Sell Stops: These aren’t just casual orders. They’re mapped zones to exploit volatility.

Case in Point: On March 8th, 2024, just before NFP, EUR/USD tapped into a 4-hour order block formed days prior. Retail traders saw a bearish engulfing pattern and shorted. Result? Price exploded upwards 80+ pips post-release. Textbook smart money trap.

Where Retail Traders Get It Wrong (And How You Won’t)

Here’s where most traders faceplant:

- Chasing NFP After the Fact: Like arriving to a house party after the pizza’s gone.

- Ignoring Liquidity: If you’re not trading where the big money is, you’re just noise.

- Overleveraging into News: That’s not bravery; that’s begging your broker to margin call you.

Elite Tactic: Instead of placing market orders before NFP, mark institutional zones (order blocks, fair value gaps) on the daily and 4H charts the day before. Let price come to you.

The Dirty Little Secret of Smart Money Entries During NFP

Institutions love volatility because it allows them to mask their positions. They enter within:

- Order Blocks (OB)

- Imbalance Zones (FVG – Fair Value Gaps)

- Breaker Blocks

These are their sniper nests. You don’t see them on your MACD or RSI.

Step-by-Step SMC Playbook for NFP:

- Mark Key Liquidity Zones (above/below prior highs/lows)

- Identify Premium/Discount Levels (based on recent structure)

- Spot Order Blocks on 1H/4H charts

- Wait for Price Reaction – no chasing

- Enter on a Confirmation (like a change of character – CHoCH)

- Set SL just beyond engineered liquidity

- Target inefficiencies or next major liquidity pool

What They Don’t Teach You on YouTube

YouTube may tell you to scalp the initial 5-minute NFP candle. That’s like trying to pet a wild lion because it looks sleepy. Don’t.

Contrarian Insight: Often, the first move post-NFP is a fakeout. Institutions use this to trap breakout traders. The real move happens 15-30 minutes later. Why? Because that’s when the manipulation ends and real flow begins.

Pro Tip: Use the 15-minute timeframe with a session separator. Mark Asia & London range, then see where NFP breaks structure relative to smart money zones.

Smart Money Doesn’t React to NFP—They Script It

According to Michael J. Huddleston (aka Inner Circle Trader), institutions don’t chase price, they create it. NFP is their playground. The trick isn’t predicting the number—it’s following the setup.

As per a 2023 BIS study, over 80% of major Forex volatility events are preceded by institutional order flow accumulation. That means while you’re watching Bloomberg, smart money is already pulling the strings.

The Forgotten Metric: Time & Price Confluence

SMC isn’t just about zones. It’s about when price reaches those zones. For NFP:

- Time Window: 8:15AM to 8:45AM EST (pre & post release)

- Confluence Tools: Use Fibonacci extensions + OB alignment for sniper precision

Real-World Gem: On June 2nd, 2023, GBP/USD dropped into a bullish FVG right at 8:18AM, tapped a 0.786 Fib extension, then rallied 120 pips by 9:30AM.

How to Practice This Without Blowing Your Account

Demo it like your future depends on it—because it does. Use replay mode, tag each NFP setup using this checklist:

- Liquidity sweep?

- OB/FVG respected?

- CHoCH present?

- Time alignment correct?

Refine until your entries look like you knew the outcome before the release.

Bonus: Want the Blueprint? We Got You.

If you’re hungry for exclusive data, next-gen tools, and hidden smart money gems, you need to explore:

- Forex News Hub – Real-time updates that institutions follow.

- Free Forex Courses – Master SMC with examples and edge cases.

- StarseedFX Community – Elite analysis, alerts, and live trading breakdowns.

- Smart Trading Tool – Automate your sizing and reduce the chaos.

Don’t just trade. Trade smart.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The