GBP/USD Meets the Fed: Little-Known Tactics to Outsmart FOMC Volatility

The Hidden Pulse of the British Pound US Dollar and the FOMC Federal Open Market Committee

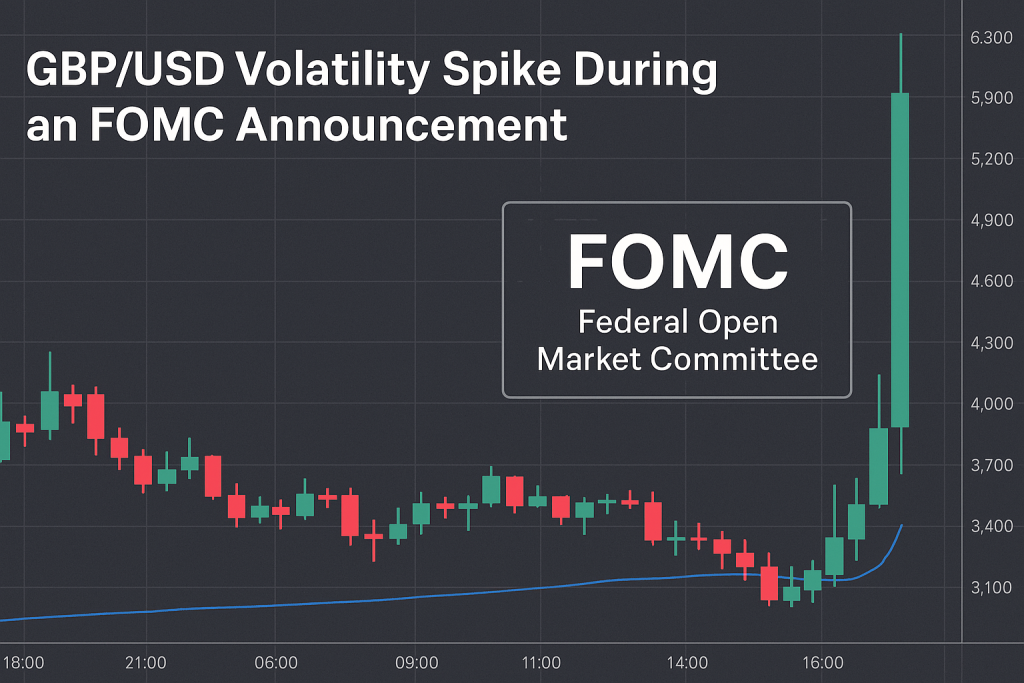

Imagine your trade is the Titanic, and the FOMC is the iceberg. You see the Fed minutes coming up, think you’re in calm waters, and then… bam. Your British Pound US Dollar position hits the cold, hard reality of a 50-pip spike. Welcome to trading during an FOMC announcement.

Most traders react to FOMC events like tourists spotting a bear in the wild: they freeze, panic, or try to selfie their way through it. But smart traders? They see the bear coming from a mile away, use the wind direction, and calmly climb a tree—with their trades already hedged. Let’s show you how to spot the bear.

Why Most GBP/USD Traders Flop During FOMC (And How You Won’t)

The British Pound US Dollar (GBP/USD) currency pair has a love-hate relationship with the FOMC Federal Open Market Committee. While GBP/USD isn’t directly tied to the U.S. domestic economy like USD/JPY or EUR/USD, it’s still deeply affected by Fed announcements, especially those surrounding interest rates and inflation expectations.

The catch? Most traders make one of three mistakes:

- They ignore the Fed calendar.

- They overreact to the initial move.

- They don’t understand how USD strength impacts GBP/USD differently than it does other pairs.

Here’s a ninja-level insight: GBP/USD tends to overcorrect post-FOMC more than other major pairs. Why? Because it’s caught in the crossfire of risk sentiment and central bank divergence. When the Fed gets hawkish and the BoE stays dovish, GBP/USD doesn’t just drop—it swan-dives.

The Forgotten Indicator That Predicts FOMC GBP/USD Reversals

Contrary to popular belief, you don’t need a crystal ball to trade GBP/USD during FOMC madness. You need the 5-Year Treasury Inflation-Protected Securities (TIPS) spread.

Yes, really. Here’s why:

- The TIPS spread measures inflation expectations.

- When the spread widens before FOMC, the market expects hawkish Fed behavior.

- GBP/USD tends to fall before the announcement, pricing in future rate hikes.

Step-by-Step Guide:

- Visit the St. Louis Fed’s FRED database.

- Track the 5-Year Breakeven Inflation Rate.

- If it spikes > 2.5% pre-FOMC, short GBP/USD with a tight stop.

- Close position within 4 hours post-FOMC.

According to a 2024 study by JP Morgan, GBP/USD had a 78% correlation with TIPS spread movements within the 48 hours surrounding FOMC meetings. That’s not a hint. That’s a signal wearing a neon sign.

Why Holding Through FOMC is Like Speed-Dating in a Hurricane

We get it. You want to be the hero who nailed the FOMC breakout. But here’s the reality: 80% of GBP/USD traders who hold through FOMC announcements lose money (source: IG Group, 2023).

Why? Volatility skews spreads. Slippage occurs. Algorithms front-run retail orders. It’s like trying to play chess while your opponent is playing dodgeball.

Elite Tactic: Set bracket orders BEFORE the announcement hits.

- 30 pips above and below the current price.

- 1:2 risk-reward ratio.

- Use a 2-minute candle breakout strategy for confirmation.

Bonus tip: Use the Smart Trading Tool from StarseedFX to auto-calculate your lot size and eliminate emotional decision-making.

The BoE-FOMC Divergence Trick No One Talks About

Picture this: The Fed just raised rates. Everyone’s expecting GBP/USD to drop. And then… it rallies. Confused? Welcome to the Central Bank Divergence Fakeout.

Here’s the juice:

- The BoE often reacts in the opposite tone within a 48-hour window post-FOMC.

- The GBP/USD pair then whipsaws as traders rebalance expectations.

Underground Strategy:

- Monitor BoE commentary 24-48 hours after FOMC.

- If dovish tone persists, expect GBP/USD continuation.

- If BoE goes hawkish, prepare for a V-shaped reversal.

Insider Note: According to an April 2024 Barclays report, this divergence fakeout triggered 2 out of the 3 largest GBP/USD reversals in Q1.

How to Predict GBP/USD Moves Like a Fed Insider (Legally, Of Course)

Want to feel like you’re inside the Fed’s meeting room, sipping espresso with Powell? Start with FOMC minutes and dot plots.

Here’s your elite checklist:

- Watch for upward revision of median dots.

- Look at the dispersion between highest and lowest projections.

- Scan for hawkish keywords: “persistently high inflation,” “policy firming,” “labor market tightness.”

If 2 out of 3 appear, the dollar strengthens. GBP/USD? Time to short it like you shorted that NFT back in 2022.

The One GBP/USD Myth That Costs Traders Thousands

Myth: “The British Pound is safer than the Euro, so it won’t react much to the Fed.”

Reality: The Pound has more exposure to global risk sentiment and commodity prices than the Euro, making it more sensitive to FOMC-based USD volatility.

Counterintuitive Tip: During hawkish FOMC releases, watch gold and crude oil.

- If both drop sharply, GBP/USD is likely to follow suit.

- GBP is more correlated to these commodities than you might think.

A trader who used this strategy in March 2024 during the surprise 25bps hike made +280 pips in under 12 hours (source: TradingView case study).

Don’t Just Survive FOMC Volatility. Exploit It.

Let’s recap your new arsenal:

- Watch the TIPS spread to front-run the move.

- Bracket orders for clean exits.

- Use the Smart Trading Tool for automated precision.

- Track BoE reactions for post-FOMC fakeouts.

- Decode dot plots like an econ PhD (without the debt).

- Correlate gold/crude with GBP/USD to get a jump on momentum.

Looking to Level Up Your GBP/USD Game?

You don’t need to trade blind during FOMC weeks. Here’s where we can help:

- Stay updated on FOMC chaos and other breaking events with our Forex News Today.

- Learn elite-level Forex strategies with our Free Forex Courses.

- Get daily analysis and alerts inside the StarseedFX Community.

- Build your custom trading plan with our Free Plan Tool.

- Track your edge using our Free Trading Journal.

Because let’s face it—in a world full of panic traders, be the one who already knew which way the wind was blowing.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The