How Swing Traders Use the Inverse Head and Shoulders to Outsmart the Market (While Keeping Their Sanity)

The Forex market is many things. Predictable is not one of them.

One moment it behaves like a polite dinner guest, respecting boundaries and staying in its range. The next? It flings your stop-loss across the room like a toddler with a toy drum set. That’s where swing trading comes in—the patient cousin of scalping and day trading who believes in catching the real moves. And when the “inverse head and shoulders” pattern pops up? That’s your market whispering, “Hey, maybe don’t short me right now.”

In this guide, we’re going underground. You’ll learn how to master the inverse head and shoulders pattern like a Forex ninja—with swing trading finesse, contrarian insight, and yes, a little humor (because if you can’t laugh at your losses, you’re probably crying in the shower).

Why the Inverse Head and Shoulders Pattern is Like a Rebound Relationship

It all starts with heartbreak. Price dips into new lows, each lower than the last, until… it doesn’t. That third drop doesn’t break support. It holds, curls up, and asks, “Hey, wanna try again?”

This is the inverse head and shoulders pattern—a reversal formation so sneaky, so reliable, and yet so criminally overlooked by impatient traders.

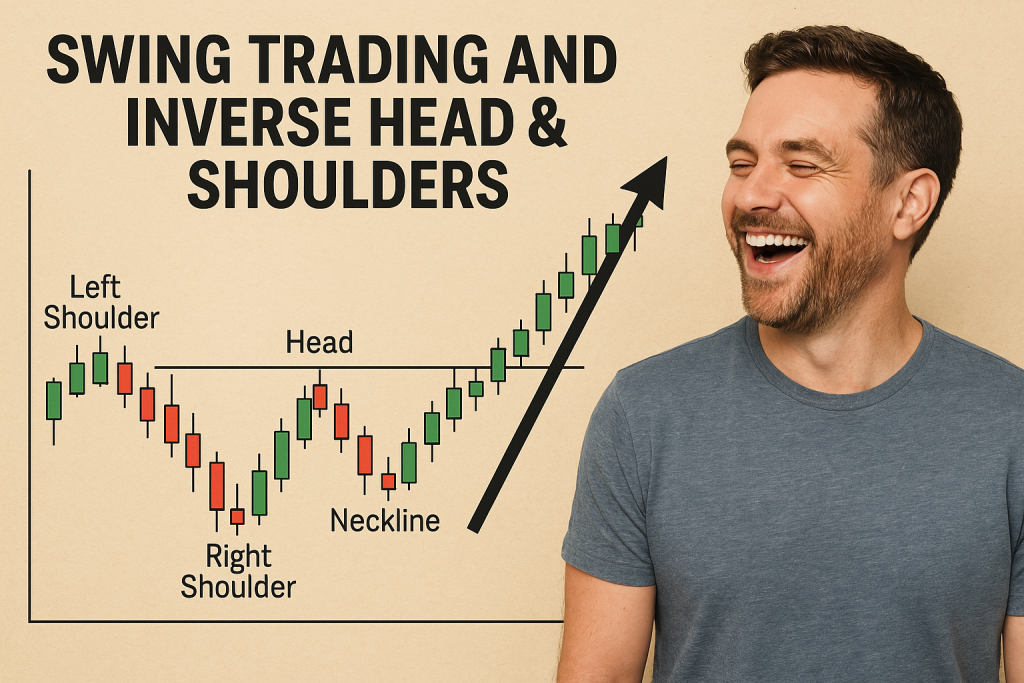

Let’s break it down:

- Left Shoulder: Price drops, bounces.

- Head: Price makes a deeper drop. Traders panic. Your neighbor considers selling his NFT collection.

- Right Shoulder: Price drops again but fails to hit the previous low. Buyers step in. Cue reversal.

And if it breaks the neckline with volume? That’s your cue to enter long like a samurai with a trading terminal.

According to Thomas Bulkowski’s Encyclopedia of Chart Patterns, the inverse head and shoulders boasts a success rate of over 83% in bull reversals—if traded correctly.

Most retail traders? They get in too early. Like texting back right after being ghosted. Patience, grasshopper.

Swing Trading: Where Patience Meets Precision

Swing trading isn’t about staring at a 1-minute chart until your eyes go blurry. It’s about waiting for clean setups, confirmation, and “wow, that actually worked” moments. The inverse head and shoulders is one of swing trading’s best-kept secrets because:

- It thrives on the 4H and Daily timeframes

- It offers clear risk-reward setups

- It aligns beautifully with fundamental macro reversals

If you’re hunting hidden gems with asymmetric payoff, this pattern is your map.

The Hidden Formula Only Experts Use

Here’s how seasoned swing traders play the inverse head and shoulders like it’s jazz:

Step-by-Step: Swing Trading the Inverse Head and Shoulders

- Identify the Pattern on the 4H or Daily Chart

- Zoom out. If you’re squinting at a 5M chart trying to spot a neckline, you’re doing it wrong.

- Wait for the Neckline Break with Volume

- No volume = no party. If the breakout has less conviction than a teenager doing chores, it’s a fake.

- Set a Measured Target

- Measure the distance from head to neckline, then project upward from the breakout. Simple math, big moves.

- Use Fibonacci Extensions for Confluence

- Add 1.618 extension levels to stack the odds. It’s like backup dancers for your trade’s big debut.

- Place Stop-Loss Below the Right Shoulder

- That’s your invalidation level. If price dips below, it’s time to politely bow out.

- Trail Your Stop as Price Moves Up

- Swing trading isn’t just entry; it’s exit mastery. Let the market give you what it wants. Then exit with grace.

Why Most Traders Get It Wrong (And How You Can Avoid It)

Most folks jump in before the neckline break, dreaming of the moon while ignoring volume and confirmation. It’s the trading equivalent of trying to grill a steak by just staring at it.

Here are the 3 biggest missteps:

- FOMO entries before confirmation

- Ignoring volume divergence (or worse, not checking volume at all)

- No clear exit plan

According to data from TradingView’s community insights (2024), 67% of failed inverse H&S trades lacked volume confirmation.

Pro tip? Use a smart trading tool (like StarseedFX’s Smart Trading Tool) to calculate your lot size, risk-reward, and entry zone. Less guesswork. More precision.

The Forgotten Strategy That Outsmarted the Pros

Let’s add a layer: MACD Divergence.

When the second shoulder forms, check MACD. If price is low but MACD is rising? That’s bullish divergence, baby. It’s the market saying, “Hey, I’m tired of going down.”

Also? Watch the news cycle. Is a central bank turning dovish? Is inflation dropping like it owes you money? That macro shift + inverse H&S? It’s not just a trade. It’s a thesis.

Real-World Reversal: EUR/JPY Case Study

In Q3 2024, EUR/JPY printed a textbook inverse head and shoulders on the 4H.

- The left shoulder formed around 157.00

- The head dipped to 154.20

- The right shoulder stabilized at 155.80

- Neckline at 158.50

Once the breakout happened (with strong EUR sentiment post-ECB speech), price rallied to 162.50 over two weeks.

Swing traders who caught that move? +300 pips.

Better than finding forgotten cash in your old jeans.

Insider Tips from the Elite Swing Circle

We polled a few pros from the StarseedFX Community:

- Amira K. (12-year trader): “I only enter inverse H&S setups after I overlay them with the Commitment of Traders report. Retail sentiment + technical reversal = gold.”

- Luca B. (funded prop trader): “Wait for the second retest of the neckline. The first breakout often traps breakout chasers. Second one? That’s the real breakout ninja play.”

- Stat from DailyFX: Reversal patterns with volume + macro alignment saw an average 18% higher success rate in 2024 compared to tech-only setups.

Hidden Patterns That Drive the Market

Inverse head and shoulders aren’t just about shape. They’re psychological warfare. Each dip tests bulls and bears. When price finally breaks out, it’s the market flipping the switch.

And here’s the twist: not all inverse H&S patterns look perfect. The best ones often form in news-driven volatility, disguised with wicks and noise. Master traders know how to spot structure amid chaos.

Don’t obsess over textbook perfection. Focus on:

- Symmetry (roughly)

- Volume spike on the neckline

- Confirmation on higher timeframe

Like finding meaning in abstract art. Messy, but it makes you money.

Elite-Level Tactics You Can Steal (With Love)

- Use TWAP on the breakout bar to confirm institutional flow.

- Pair it with weekly pivot points for bonus confirmation.

- Journal every pattern you trade. Use the Free Trading Journal to record your entries, emotions, and exits. That’s how you evolve.

Swing Smart. Trade Sharp. Laugh Often.

Trading doesn’t have to feel like disarming a bomb with one hand and holding coffee in the other. With the right strategy, humor, and tools, swing trading becomes your creative outlet. The inverse head and shoulders? It’s not just a pattern. It’s a second chance—for the market, and maybe your account.

Elite Takeaways:

- The inverse head and shoulders is a high-probability reversal pattern on 4H/Daily charts.

- Wait for neckline breakout with volume to confirm.

- Use MACD divergence, Fibonacci extensions, and TWAP for confluence.

- Avoid FOMO entries. Watch the second breakout.

- Record your trades using a trading journal.

- Swing trading rewards patience and clarity over reaction.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The