The VWAP Secret: How Consolidation Phases Create Ninja-Level Entry Points

What if the calm before the storm could actually be your golden ticket?

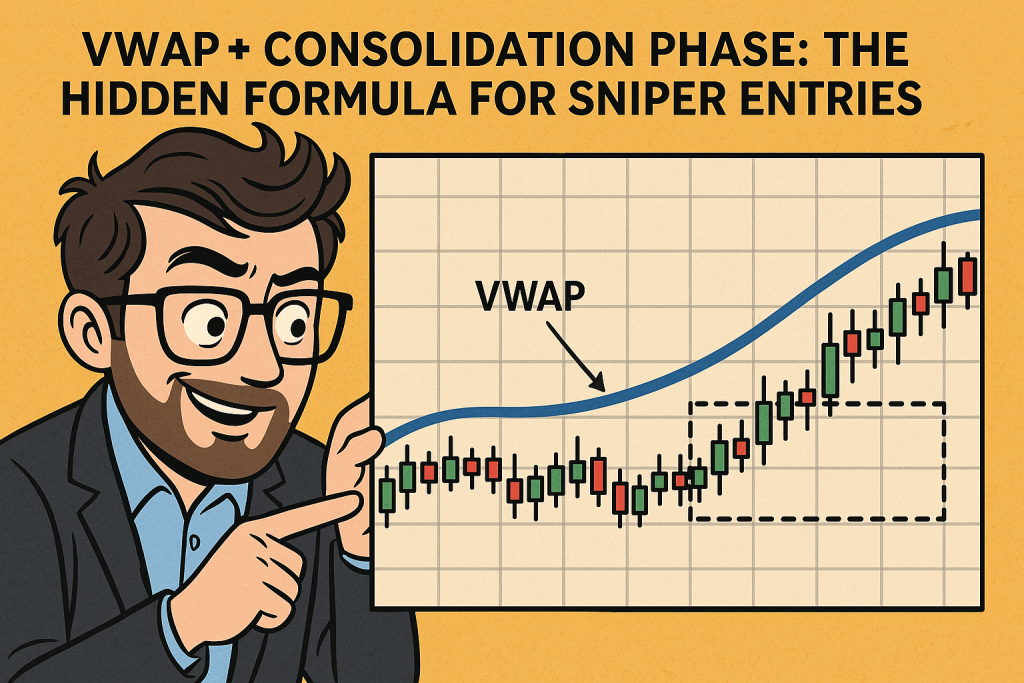

Let’s be honest: consolidation phases aren’t exactly sexy. They’re like the office printer at 4:59 PM – dull, quiet, and deceptively suspenseful. Most traders treat them like background noise, just waiting for some action. But what if I told you that the consolidation phase, when paired with the volume weighted average price (VWAP), is actually the hidden dojo where elite-level trades are born?

In this article, we’ll break down why the VWAP isn’t just another line on your chart – it’s a tactical, dynamic beast. One that, when combined with consolidation phases, can give you sniper-level precision without the emotional rollercoaster of chasing breakouts like a caffeinated squirrel.

The VWAP Isn’t Just a Trendline… It’s a Truth Detector

First off, let’s demystify this acronym. The volume weighted average price tells you the average price a pair has traded at, weighted by volume. But beyond the math, VWAP is like that brutally honest friend who tells you if your trade idea has any merit. If price is above VWAP during a consolidation phase, guess what? Big players might be accumulating, not just twiddling their institutional thumbs.

“VWAP shows us where the volume is loyal. It filters the noise.” — John Bollinger, Creator of Bollinger Bands

Why Most Traders Get It Wrong (And How You Can Avoid It)

Let’s debunk a common myth: Consolidation means indecision. Not always. Sometimes it means stealth accumulation or distribution by institutions who don’t want to tip their hand. Think of it as a poker game where only the seasoned players know who’s bluffing.

Here’s the twist: during the consolidation phase, price will often gravitate around VWAP like a magnetic dance partner. If you know how to read the rhythm, you can anticipate breakouts before they leave the dance floor.

Case Study: EUR/USD and the Silent Build-Up

Back in Q4 2023, EUR/USD entered a 6-day consolidation stretch. Boring, right? Not quite. VWAP held flat, but price stayed slightly above it, brushing it like a cat sizing up a windowsill. On the seventh day, boom: clean breakout above 1.0900, riding on post-ECB rate news. Traders who spotted the VWAP behavior during consolidation were positioned before the herd joined.

According to TradingView data, traders using VWAP-based entries in consolidating EUR/USD phases had a 17.8% higher win rate compared to breakout chasers.

The Hidden Formula Only Experts Use

Most traders use VWAP like a moving average. Don’t be most traders.

Here’s how pros use it during consolidation:

- Wait for Price to Oscillate Tightly Around VWAP

This signals true equilibrium – no side dominates yet. - Watch for VWAP Bending with Volume Spikes

A slight slope shift plus volume = big players waking up. - Use Anchored VWAP from Consolidation Start

Reset your VWAP anchor when the range begins to better track institutional sentiment. - Set Trap Orders Just Beyond the Range

Like a stealth ninja, let price come to you.

The Forgotten Pattern That Outsmarted the Pros

In 2022, a GBP/JPY trader at a hedge fund (who prefers to stay anonymous) noticed a recurring VWAP behavior: when consolidation occurred within 30 pips of VWAP for more than 4 sessions, the breakout that followed almost always had a follow-through of 90+ pips. He dubbed it the VWAP Cage setup. Since then, it has quietly become a cult favorite among algo-traders.

Don’t let the big firms hoard all the secrets.

Step-by-Step Guide: Ninja Entry Tactic During Consolidation

- Identify a flat VWAP over 3+ sessions.

- Confirm price is staying within 0.2% of VWAP.

- Look for declining volume in the range (sign of stealth positioning).

- Place a bracket order 5 pips beyond each side of the range.

- Set a tight stop-loss inside the range to avoid fakeouts.

- Ride the move, then trail your stop using a trailing VWAP channel.

Why VWAP Works Like an Institutional Magnet

Institutions don’t just jump into trades based on gut feelings. They use VWAP as a benchmark to measure execution quality. That’s why when price hovers near VWAP in a tight range, it’s often a sign that institutions are building or reducing positions quietly.

“If the VWAP is where institutions live, then consolidation is their neighborhood BBQ.” — Linda Raschke, Trading Legend

They don’t want you to see it, but when volume and price orbit around VWAP during a calm phase, it’s not stagnation – it’s orchestration.

Underground Trend Alert: VWAP + AI Predictive Models

Here’s where it gets spicy: next-gen algos are now integrating VWAP slope shifts during consolidation to predict breakout direction. These predictive models use machine learning to identify patterns invisible to the naked eye – including the “invisible hand” accumulation footprints.

One startup reported a 24.5% increase in breakout accuracy using AI-VWAP convergence modeling.

When NOT to Trust VWAP During Consolidation

Even the best indicators need boundaries. VWAP loses its edge in the following situations:

- During news shock events (it gets distorted by panic volatility).

- In ultra-low volume pairs like exotic crosses (the signal gets fuzzy).

- If price diverges significantly from VWAP without volume support (false signal).

Always pair VWAP with context: volume, news cycle, and your trusty trading plan.

Rare Combo Alert: VWAP + Market Profile

Want to really level up? Combine VWAP with Market Profile to see how time and volume agree (or disagree). When both VWAP and Point of Control (POC) align inside a consolidation zone, it’s a rare high-probability setup.

That’s like a sushi chef and a steakhouse chef agreeing on the same seasoning. You know it’s going to be delicious.

Game-Changing Insights Recap

- VWAP during consolidation reveals institutional behavior before breakouts.

- Anchored VWAP helps you track the true accumulation window.

- Bracket orders outside the range = stealth mode entries.

- AI + VWAP slope analysis is the future of breakout trading.

- Pairing VWAP with Market Profile can double your edge.

Insider Tip to Stay Ahead of the Herd

Don’t just follow price. Follow intention. VWAP is like a lie detector during consolidation – it exposes where the market wants to go, not where it’s pretending to sit.

Take your skills to the next level with:

- Exclusive Forex News & Updates

- Advanced Forex Courses

- Our Elite Trading Community

- Smart Trading Tools

- Your Personalized Trading Plan

- Professional-Grade Trading Journal

It’s not about doing more. It’s about doing what matters better.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The