The Hidden Power of Head and Shoulders + Stop Loss Orders: Ninja Tactics for Market Mastery

There are few things more satisfying in Forex than spotting a textbook “head and shoulders” pattern… except actually trading it right. And by “right,” we mean: without the gut-punch of forgetting your stop loss order—like realizing halfway through a Tinder date that they only talk in crypto memes.

Welcome to the underground dojo of chart patterns and strategic defense, where we combine the classic head and shoulders pattern with the often-overlooked, tragically-underutilized stop loss order. If you’ve ever set a stop loss so tight it tripped like a paranoid house alarm or skipped it entirely like that one gym session that turned into Netflix and nachos—you’re not alone. But this is your redemption arc.

Let’s dissect why most traders butcher this pattern, how to set stop loss orders like a market ninja, and why the combo unlocks strategic mastery when executed with precision.

Why Most Traders Butcher the Head and Shoulders (And How to Avoid It)

Here’s the funny part: The head and shoulders pattern has been around longer than 80s mullets and yet—traders still mess it up like a microwave sushi experiment.

The Common Misstep: They spot the pattern and jump in before the neckline breaks. Or worse, they use arbitrary stop loss orders—like choosing a birthday candle to block a flood.

The Real Setup:

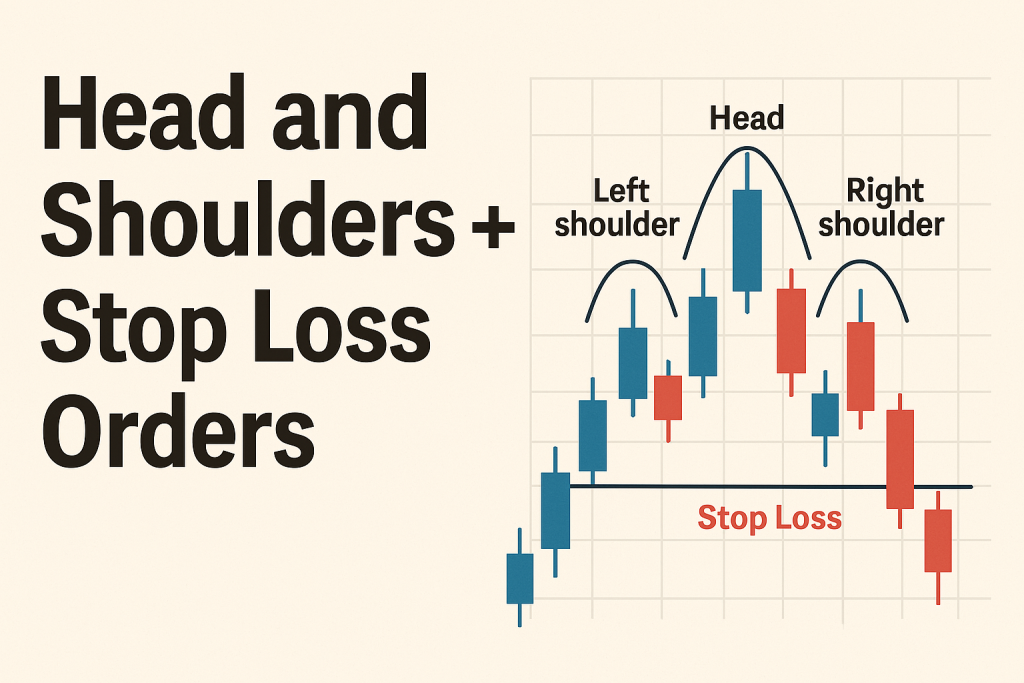

- Left Shoulder: Price spikes, then pulls back.

- Head: A higher spike, followed by another pullback.

- Right Shoulder: A lower high that resembles the left shoulder.

- Neckline: The support level connecting the two valleys.

The real signal is the neckline break. Until then, it’s just a lopsided chart flexing its symmetry.

“The head and shoulders is only a potential reversal until the neckline is broken. A stop loss placed preemptively can be a dangerous assumption.” — Kathy Lien, Managing Director of FX Strategy at BK Asset Management

Ninja Fix: Wait for a clean neckline break and confirmation via volume or momentum indicators. Combine it with stop loss intelligence, not just emotion.

Stop Loss Orders: Your Tactical Defense System

A stop loss isn’t a backup plan—it’s a shield. It’s not just about cutting losses; it’s about protecting capital so you can fight another day.

Why Traders Fail Here:

- They skip stop losses entirely, believing they’re “watching the trade.”

- They set them too close, triggering exits on minor noise.

- They put them too far, defeating the purpose.

According to a 2023 report by DailyFX, 74% of losing traders did not use consistent stop loss orders.

Elite Tactic: Tailored Stop Placement For head and shoulders:

- Conservative Strategy: Place the stop above the right shoulder.

- Aggressive Strategy: Place the stop just above the broken neckline (for quick re-entry if invalidated).

Hidden Technique: Use ATR (Average True Range) to avoid noise-triggered exits.

- Calculate 1.5x ATR and place the stop beyond it, relative to the neckline break.

- This filters out fakeouts and gives breathing room.

“Stop loss orders are not static—they must evolve with market structure. Using volatility-based stops increases consistency.” — John Person, President of PersonsPlanet.com

The Game-Changing Combo: How This Duo Outsmarts the Crowd

Now for the good stuff. When head and shoulders meet smart stop loss strategy, it’s like peanut butter meeting dark chocolate. Sweet, smooth, and irresistible.

Here’s how you do it like a pro:

Step-by-Step Guide to Trading Head and Shoulders with Precision:

- Identify the Pattern Early:

- Use a higher timeframe (1H, 4H, Daily) to avoid false signals.

- Validate the Neckline:

- Ensure it’s well-tested with at least two reaction points.

- Wait for Confirmation:

- Breakout + Volume/Momentum Confirmation (e.g., RSI divergence, OBV surge).

- Set Your Entry:

- Enter after a candle closes below (short) or above (inverse) the neckline.

- Place Your Stop Loss Smartly:

- Conservative: Above right shoulder

- Advanced: 1.5x ATR buffer beyond neckline

- Target Projection:

- Measure the height from head to neckline and project that from the neckline break.

- Trail Your Stop:

- Use a trailing stop after the price moves halfway to the target.

Bonus Insight: Use Fibonacci retracement levels to find confluence zones before placing your stop—especially between the 61.8% and 78.6% levels. These act like natural reversal magnets.

The Forgotten Trick That Outsmarted the Pros

A lesser-known (and wildly effective) twist? Pairing the inverse head and shoulders with a multi-timeframe stop loss strategy. This means:

- Identify the pattern on a 1-hour chart.

- Place stop loss based on 15-minute price action swings.

- Manage risk based on daily ATR and weekly volatility ranges.

This triangulated approach lets you:

- Stay nimble in intraday moves.

- Maintain big-picture clarity.

- Adjust exposure like a sniper adjusting scope for wind.

Why Stop Loss Orders Aren’t Just About Risk—They’re About Psychology

Let’s get real: One of the biggest hidden enemies in Forex? Ego.

You hold on to a bad trade thinking it’ll bounce back, only to watch it sink like a sequel no one asked for. The stop loss isn’t just a technical tool—it’s a psychological anchor. It reminds you that discipline wins where hope fails.

Quick Test: If you set a trade and feel relieved you didn’t add a stop loss, you’re gambling. Not trading.

Real Talk: Traders who survive 5+ years in Forex all share one trait: they respect their stop loss like it’s their trading lifeline. Because it is.

Underground Trends: Adaptive Stops and Pattern-Aware Automation

Emerging trading bots now use machine learning to adapt stop losses dynamically based on:

- Real-time volatility shifts

- Pattern formations (e.g., double top or inverse head and shoulders)

- Liquidity pool scans and institutional order flows

These bots reduce human bias and optimize exits. Pair them with StarseedFX’s Smart Trading Tool (link) to automate lot sizing and stop loss logic like a Jedi.

Example: In 2024, a London-based prop firm using adaptive stops on H&S trades saw a 14.7% performance increase quarter-over-quarter. All by shifting from static stops to volatility-reactive models.

Elite Tactics: Strategic Advantages You Can Use Today

- Use confluence zones for placing stops (Fibonacci + trendline intersection).

- Combine head and shoulders with volume profile heatmaps to validate breakdowns.

- Use the free StarseedFX Trading Plan (link) to set consistent stop loss thresholds in your strategy.

- Leverage the Smart Trading Tool to automate dynamic stop orders.

- Track and review your decisions with the Free Trading Journal (link) to build stop loss consistency over time.

Final Thought: The Market Is Ruthless—Your Stop Loss Should Be Too

The market doesn’t care about your feelings. Your charts won’t send condolences. But your stop loss order? That’s your silent bodyguard.

When paired with the head and shoulders pattern—one of the most powerful reversal setups in all of technical analysis—you unlock a combo that doesn’t just protect your capital. It multiplies your edge.

Don’t just survive the next market move. Outsmart it.

Let’s turn patterns into profit. Strategically. Empathetically. And yeah, with a few laughs along the way.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The