AUDUSD and the Three White Soldiers: The Hidden Pattern Smart Traders Use to Front-Run the Market

Why Nobody Talks About This Powerful AUDUSD Pattern (But You’ll Wish They Had)

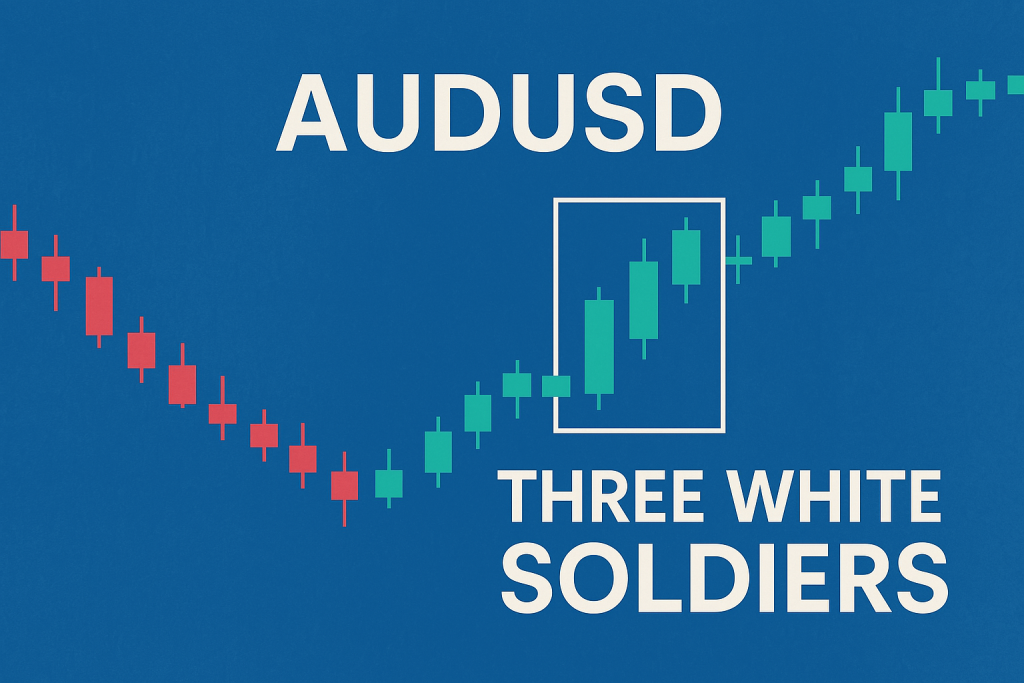

Let’s cut to the candlestick chase: the “Three White Soldiers” pattern on the AUDUSD chart isn’t just pretty price action. It’s a wake-up call wrapped in bullish intent, silently screaming, “Hop on, or stay broke.” And yet, like that gym membership you paid for in January, most traders ignore the signs. Big mistake. Huge.

Here’s the twist: this candlestick formation has been quietly signaling major moves in AUDUSD over the past year—especially when paired with fundamental catalysts and hidden volume shifts. If you’re serious about stepping into elite territory, buckle up. We’re diving deep into a pattern that most traders misunderstand, misuse, or miss entirely.

The Real Meaning Behind Three White Soldiers (And Why It’s More Than Just Three Green Candles)

Let’s get something straight. Not every trio of bullish candles is a “Three White Soldiers” setup. That’s like calling a few spicy tweets a full-blown market correction. To qualify as the real deal:

- Candles must be long, bullish, and consecutive.

- They should open within the previous candle’s real body.

- Volume should increase steadily across all three.

- They must follow a pronounced downtrend.

In AUDUSD, these soldiers often show up after a macro-induced drop—think weak jobs data, a surprise RBA pivot, or a sudden USD rally from unexpected Fed hawkishness. Then, out of the ashes: boom—three bullish beasts marching upward with precision.

Elite Tip: Pair this with divergence on the RSI or MACD and you’re stacking confluence like a Vegas blackjack pro counting cards.

Why Most Traders Get It Wrong (And How You Can Trade It Like an Insider)

Here’s the kicker: many retail traders jump in right after the third candle closes, only to get slapped by a pullback. That’s like chasing a bus after it already left—and tripping over your own shoelaces.

Instead, follow these ninja tactics:

- Wait for the minor dip. Institutions often test support around the midpoint of the second candle. This is where the magic entries happen.

- Use a Fib retracement from the low before the soldiers to the top of the third candle. Look for a 38.2% pullback—it’s the zone where whales quietly reload.

- Watch volume. If it increases during the minor dip, it’s likely accumulation—not distribution.

Pro Tip: When this pattern forms near an AUDUSD support zone backed by fundamentals (e.g., rising commodity exports or China trade data), odds of continuation skyrocket.

The Hidden Pattern Within the Pattern: What the Smart Money Actually Sees

Let’s nerd out a bit. Inside those three candles is a microstructure shift—one that smart money uses to reverse-engineer retail emotions. According to a 2024 study by the Bank for International Settlements (BIS), algorithmic traders now account for over 80% of short-term volume in G10 FX pairs, including AUDUSD. They exploit pattern-recognition algorithms to front-run moves.

So how do you stay ahead?

- Overlay the COT Report data (Commitment of Traders). If institutional longs are building during the formation, you’re on the right side of the fence.

- Use the Smart Trading Tool from StarseedFX to calculate optimal lot size and risk at these entries.

When a Three White Soldiers setup aligns with rising institutional net longs and positive economic surprises out of Australia, it’s no longer a pattern—it’s a launchpad.

Data That Doesn’t Lie: Real AUDUSD Case Studies

- March 2024 – After a soft U.S. CPI print, AUDUSD formed a textbook Three White Soldiers pattern near 0.6500. The move? A clean 170-pip rally in four days.

- September 2023 – Following a dovish RBA statement, AUDUSD plummeted. But just days later, a Three White Soldiers sequence emerged from the 0.6360 zone. Paired with rising copper prices, it kicked off a two-week rally.

- January 2023 – A China reopening surprise fueled AUD strength. Traders who spotted the pattern on the 4H timeframe caught the pair riding from 0.6820 to 0.7045.

The Underground Entry Formula: What They Don’t Teach in Courses

Here’s your weaponized checklist:

- Confirm the pattern: All three candles meet the visual and volume rules.

- Run a Fib retracement: From prior swing low to end of third candle.

- Mark confluence: Look for zones where RSI divergence, volume spikes, or previous supply flips to demand.

- Drop to lower timeframes (M15 or M30): Wait for a bullish engulfing or hammer off the Fib level.

- Fire with precision: Use tight stops under the 50% Fib and trail based on ATR.

Bonus: Add the Chaikin Money Flow to see if smart money is quietly stepping in.

Contrarian Corner: When NOT to Trust the Three White Soldiers on AUDUSD

Even elite patterns can lie—especially when:

- It appears during low liquidity hours (like post-NY session, pre-Asia).

- There’s no macro catalyst or divergence backing the move.

- Volume is weak or declining across the three candles.

If it feels like the pattern is “trying too hard” without backup, it probably is. It’s the Forex version of that guy who shows up to a pool party wearing goggles but can’t swim.

What the Experts Say

“The Three White Soldiers remains one of the most misunderstood bullish reversal patterns in retail trading. Used with volume and macro context, it’s deadly accurate.” — Kathy Lien, Managing Director at BK Asset Management.

“Candlestick patterns must be integrated with real-time data and sentiment flow. On AUDUSD, combining Three White Soldiers with China’s industrial output data adds serious edge.” — Ashraf Laidi, Chief Global Strategist at Intermarket Strategy.

Why StarseedFX Traders Spot These Patterns Before the Crowd

Because they know where to look, and they have tools the average trader doesn’t. Here’s what gives them the edge:

- Access to real-time market data: Forex News Today

- Education in advanced methodologies: Free Forex Courses

- Daily analysis & trade alerts from elite traders: StarseedFX Community

- Precision trade planning: Free Trading Plan

- Real performance metrics: Free Trading Journal

Key Takeaways: Mastering the Three White Soldiers on AUDUSD

- The pattern isn’t just visual—it’s contextual. Volume, macro events, and RSI/MACD confirmation matter.

- Smart money uses this to trap retail traders. Get on the right side with confluence.

- Institutional data (COT, CMF, fundamentals) makes this pattern a high-probability setup.

- Use Fib pullbacks for sniper entries—not impulsive ones.

- Tools and education give you the real edge—not just hope.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The