???? Ninja Secrets of the NZDUSD Descending Triangle (That No One Talks About) ????

Let’s face it—trading the NZDUSD isn’t for the faint-hearted. It’s like trying to surf during a hurricane while someone changes the tide settings in real-time. Now toss in a descending triangle, and you’ve got a cocktail that’s half opportunity, half disaster… unless you know exactly what to look for.

Welcome to the underground dojo of descending triangles, where we slice through market noise, dissect false breakouts, and reveal tactics so sharp, you’ll wonder why they’re not in textbooks (spoiler: the pros don’t want you to know).

Why the NZDUSD Is the Ninja Pair Nobody Talks About

The NZDUSD doesn’t move with the grace of the EURUSD or the brute force of GBPJPY. Instead, it slinks through market cycles like a stealthy fox at a central bank garden party.

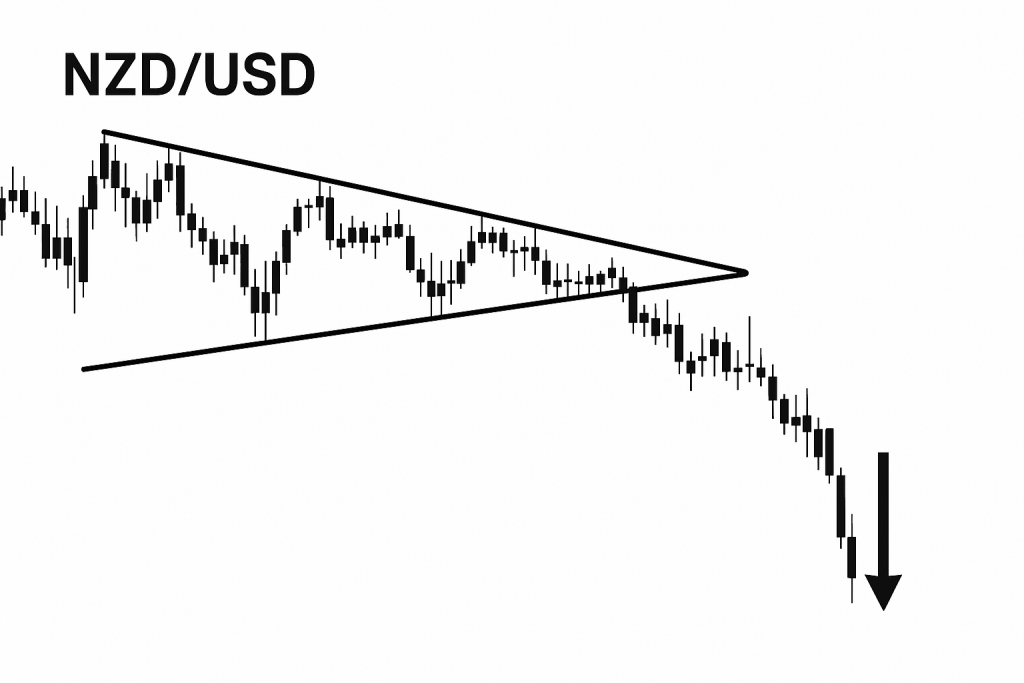

Now, enter the descending triangle—a pattern so often misunderstood that many traders treat it like that dusty gym membership: full of potential, rarely used correctly.

But here’s the twist: in the NZDUSD, this pattern has an unusually high probability of breakout continuation—especially when paired with fundamental catalysts like RBNZ rate decisions or US non-farm payrolls.

“Most retail traders misunderstand consolidation. They think it’s stagnation. But in pairs like NZDUSD, it’s a setup—an ambush,” — Kathy Lien, Managing Director of FX Strategy, BK Asset Management

The Hidden Geometry of the Descending Triangle

A descending triangle has one job: trap you in comfort before smashing through your hopes like a wrecking ball through drywall.

Key Characteristics:

Flat support (horizontal floor)

Lower highs (ceiling getting closer, like in-laws after two cups of wine)

Volume decline during consolidation (classic trap signal)

Breakout typically downward, but context is king (NZDUSD loves fakeouts pre-Asia session)

Why it works on NZDUSD:

The pair is heavily influenced by commodity prices (especially dairy—yes, milk can move millions).

Reacts dramatically to Chinese data.

Market participants are often caught on the wrong side of early New York session positioning.

“The Compression Squeeze”: The Underground Tactic Smart Traders Use

Let’s get spicy: smart money doesn’t wait for the textbook breakout. They watch for the compression squeeze—a subtle behavior in the triangle’s final leg.

Here’s the 5-step cheat code:

Identify 3 or more lower highs with clean touches on a horizontal support.

Wait for volume to thin like my patience when MetaTrader crashes mid-trade.

Watch for a liquidity sweep below the support—then a pullback that fails to reclaim the level.

Enter short on the second rejection candle.

Use a tight stop above the last failed high. Profit target? Measure the height of the triangle and project downward.

“The best trades aren’t obvious. They’re hidden in indecision. That’s where you find the edge,” — John Kicklighter, Chief Strategist, DailyFX

Case Study: NZDUSD Breakdown During the Q4 2024 Commodity Slump

???? Event: Global dairy prices fell 6% in October 2024.

???? Technical: Descending triangle formed on the H4 chart.

???? Retail Positioning: Over 72% were long (source: MyFXBook).

???? Result: Breakdown below 0.5910, with a 120-pip continuation.

???? Insider Note: Institutions exploited retail stop clusters beneath the triangle base.

That’s a blueprint. Not theory—real market behavior backed by stats.

Why Most Traders Get This Pattern Wrong

Let’s break it down like a Netflix series plot twist:

They enter too early — before the market commits. Like showing up to a blind date in full tux when it’s actually a coffee shop meetup.

They ignore volume — no fuel, no breakout.

They skip the context — not checking macro news is like walking blindfolded through a minefield with a magnet on your head.

The One Simple Trick That Can Change Your Trading Mindset

Stop treating patterns as guarantees. Treat them like probability frames within macro narratives.

Before trading any NZDUSD descending triangle, ask:

What’s happening fundamentally (RBNZ/Fed/China)?

What’s retail sentiment saying (hint: go opposite)?

Where are the liquidity pools?

A triangle is not a signal. It’s a map. Learn to read it like a treasure hunter, not a tourist.

Advanced Tactics for Master-Level Execution

A. Use TWAP or VWAP to Validate Breakouts

– If the price breaks below the triangle AND below the VWAP, the move is more likely to stick.

B. Divergence Check with RSI

– Add RSI or MFI. If momentum aligns with the breakout, you’ve got a verified setup. If not—ditch it faster than a hot coffee spill on your lap.

C. Time the Breakout with Session Overlaps

– Best breakouts occur during London to NY overlap or right after Asia opens, when volume flows hit.

Insider Resources to Dominate This Pattern

Want to turbocharge this knowledge?

✅ Stay ahead with exclusive economic indicator updates: Forex News Today

???? Master triangle tactics with our Free Forex Courses

???? Get live alerts on descending triangle setups in the StarseedFX Community

???? Track your triangle trades like a pro with our Free Trading Journal

???? Use our Smart Trading Tool to size your position with ninja precision

Elite Summary – Strategic Advantages You Now Own

Spot compression squeezes within NZDUSD descending triangles.

Use macro context to validate technical patterns.

Exploit liquidity traps below triangle bases.

Confirm with volume, VWAP, and retail sentiment metrics.

Time entries during high-volume session overlaps.

Got a Descending Triangle War Story?

We want to hear your best (or worst) trades using this pattern. Drop your stories below—funny, tragic, or victorious. We’re all in this forex dojo together.

???? TL;DR (Too Long? Download this into your brain):

Descending triangles on NZDUSD are gold mines if used correctly.

Most traders fail because they don’t combine pattern with macro analysis.

Use compression squeezes, volume cues, and liquidity traps to front-run breakouts.

Tools like VWAP, RSI, and session timing = game-changers.

Stay one step ahead with StarseedFX’s free tools and elite resources.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The