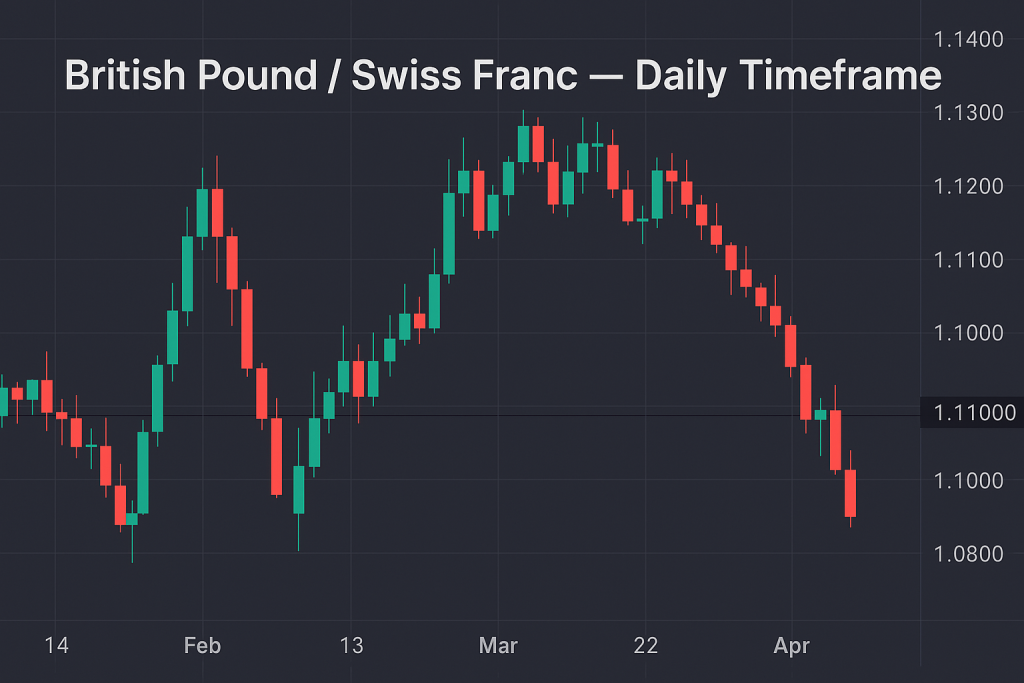

The Hidden Code of GBP/CHF on the Daily Timeframe: Ninja Tactics for a Swiss-Pound Smackdown

Let’s talk about the British Pound Swiss Franc currency pair, aka GBP/CHF. Specifically, what happens when you zoom out and explore this majestic creature through the Daily Timeframe. If you’ve ever felt like your trades get whacked faster than a whack-a-mole on espresso, this article is going to hand you the mallet—with laser-guided precision.

Because here’s the deal: most traders approach GBP/CHF on lower timeframes and get eaten alive by fakeouts, tight consolidations, and enough chop to make a sushi chef proud. But what if I told you the Daily Timeframe reveals a secret rhythm that filters out the noise and exposes high-probability setups that even seasoned traders overlook?

Welcome to the advanced dojo of GBP/CHF trading. Humor intact. Mind sharp. Let’s go ninja.

Why GBP/CHF on the Daily? (Hint: It’s Not Boring, It’s Brutal in a Suit)

GBP/CHF isn’t your average currency pair. It’s like the quiet genius in the back of the class who builds a rocket out of junkyard parts while everyone else is doodling trendlines.

This pair is infamous for tight ranges, sudden spikes, and elegant mean reversion behavior. Combine that with the Daily Timeframe’s ability to filter out noise, and you’ve got a perfect setup for:

- Swing trades with tighter risk-to-reward logic

- Strong reaction to macroeconomic indicators

- Predictable reversal zones based on historical confluence

According to BIS 2022 FX Market Data, GBP/CHF trades see a daily turnover of $88 billion, but most of that movement is algorithmic and mean-reverting in nature—which is a goldmine on the daily chart.

“Most traders underestimate the power of time compression. The daily chart isn’t just slower; it’s smarter. You’re reading the novel instead of skimming the tweets.” — John Kicklighter, Chief Strategist at DailyFX

The Forgotten Strategy That Outsmarted the Pros

Enter: Mean Reversion Meets Momentum Divergence (MRMD)

Here’s the problem: traders often bet on breakouts. But GBP/CHF LOVES to trap breakout traders and swing back into the range like a boomerang on Red Bull.

Here’s the MRMD Setup (Daily Timeframe only):

- Identify Horizontal Support/Resistance Zones on the Daily (Zoom out 12-18 months).

- Look for MACD or RSI Divergence when price approaches these zones.

- Confirm with Volume Drop-Off or doji candle patterns.

- Enter on the next bullish/bearish engulfing candle.

- Stop Loss: 1 ATR below/above the signal candle.

- Target: The midline of the range, or the opposite range extreme.

Bonus Tip: Use the StarseedFX Smart Trading Tool to calculate precise lot size and optimize your risk per trade: https://starseedfx.com/smart-trading-tool

Why Most Traders Get It Wrong (And How You Can Flip the Script)

Here’s the kicker: traders treat GBP/CHF like EUR/USD with a funny accent. But this pair is driven heavily by risk sentiment and bond yield spreads.

Case in point: In Q1 2024, GBP/CHF surged nearly 3.5% without any major GBP or CHF news. Why? The Swiss 10-year bond yield dropped below 0.5% while UK gilts stayed steady. Carry trade dynamics kicked in—but most retail traders missed the move entirely.

“Currency moves don’t always wait for headlines. Smart traders read bond markets like the morning paper.” — Kathy Lien, Managing Director, BK Asset Management

What To Do Instead:

- Track UK-Swiss 10Y Yield Spread on TradingView (free tip: overlay them in one pane).

- Enter long when UK yields widen against CH yields and price is bouncing off daily support.

- Go short when the spread narrows and price fails near resistance.

The Hidden Patterns That Drive GBP/CHF

While GBP/CHF may not trend like GBP/JPY, it forms clean harmonic structures and compression triangles.

Unconventional Pattern to Watch: Falling Expanding Wedge at the End of a Range

What it means:

- Price makes lower lows and lower highs

- But each wave gets wider

- Momentum indicators start diverging

This often appears before explosive reversals.

Playbook:

- Wait for a false breakdown out of the wedge

- Enter once price reclaims wedge bottom

- Target the start of the wedge structure

This setup played out 3 times in 2023 on GBP/CHF, producing average gains of 140-180 pips.

Why the Daily Timeframe Is Your Secret Weapon

Yes, it’s slower. Yes, it requires patience. But the Daily Timeframe offers:

- Noise reduction: Less false signals

- Cleaner structure: High-quality setups

- Time for analysis: You don’t need to babysit the chart

- Alignment with institutional flows: Daily closes matter to hedge funds

Think of it like gourmet cooking versus fast food trading. One is mass-produced noise. The other is Michelin-star quality with a side of discipline.

Case Study: How One Trade on the Daily TF Made 4.8R in 6 Days

Pair: GBP/CHF

Date: October 2023

Setup: MRMD with RSI Divergence + Daily Support Zone at 1.1020

- Entry: Bullish engulfing off support

- Stop: 55 pips (1 ATR below)

- Target: Previous resistance at 1.1280

- Outcome: 265 pip move in 6 days

Moral of the story? While others scalped for crumbs, we feasted on the main course.

StarseedFX Tools You Shouldn’t Trade Without

Want to make GBP/CHF your new best friend? Use:

- Forex News Today for real-time yield news

- Free Forex Courses to master mean reversion + divergence

- Smart Trading Tool to automate entries and exits

- Free Trading Plan for long-term consistency

- Community Membership for live alerts on GBP/CHF setups

Quick Recap: Ninja Tactics for GBP/CHF on the Daily

- Use Daily Support/Resistance + Divergence to time entries

- Watch UK-CH Yield Spreads for institutional positioning clues

- Trade compression wedge breakouts for high R-multiple opportunities

- Don’t chase breakouts—let price come to you

- Leverage Daily TF for clarity, not boredom

Elite traders don’t trade more. They trade smarter. And funnier.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The