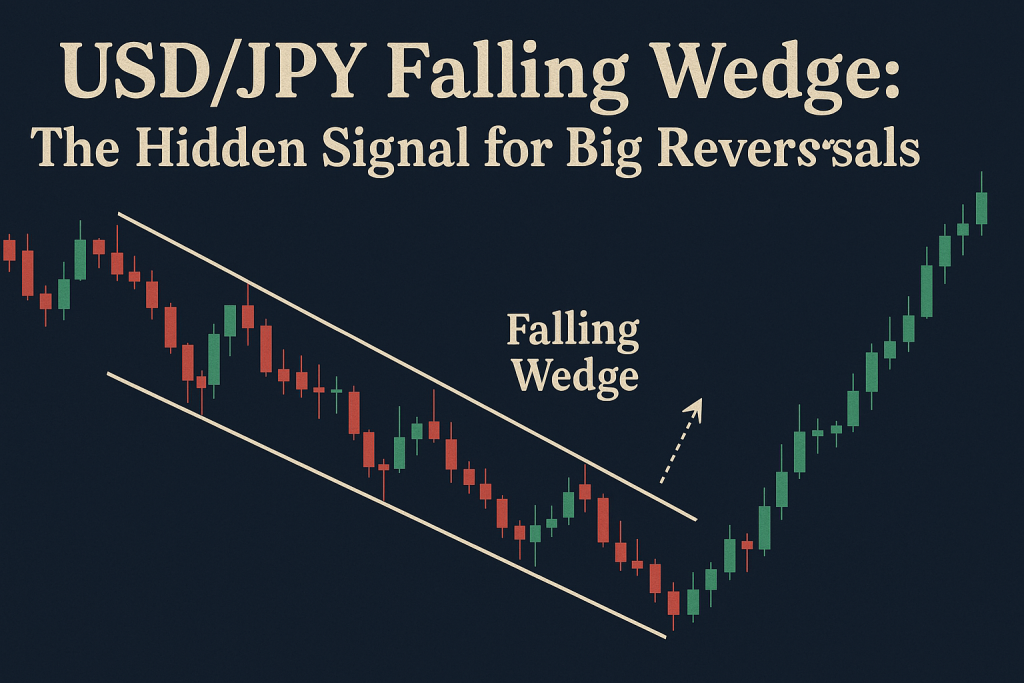

The Falling Wedge in USD/JPY: The Secret Weapon Smart Traders Won’t Shut Up About

The Currency Pair That Whispers Before It Roars

You know that one friend who speaks in whispers but drops truth bombs like a philosopher-ninja hybrid? That’s the US Dollar Japanese Yen pair when it starts forming a falling wedge pattern. It doesn’t scream. It hints. And if you’re sharp enough to listen, you might just catch the next big move before it hits the headlines—or your stop loss.

Let’s decode this misunderstood pattern and unlock the high-probability setups hiding in the shadows of USD/JPY’s price action.

Why the Falling Wedge Isn’t Just a Pretty Shape

Imagine a triangle went on a diet—that’s your falling wedge. It slopes downward, looks bearish, but here’s the twist: it’s usually bullish. Yes, the price is falling, but like a spring being compressed, it’s preparing to launch.

According to Thomas Bulkowski, legendary chart pattern analyst and author of Encyclopedia of Chart Patterns, falling wedges boast an average breakout success rate of 68% (source: ThePatternSite.com).

In USD/JPY, these wedges can be particularly explosive. Why? Because the yen is sensitive to risk sentiment, and the dollar responds to Fed policy like a cat to tuna. When the stars align, this pair doesn’t just move—it stampedes.

The Myth That’s Tanking Your Trades

Myth: A falling wedge during a downtrend is always continuation.

Reality check: In USD/JPY, context is king. If the pair is in a long-term uptrend and dips into a wedge, it’s often a reversal waiting to happen. Most traders miss this and bail early—like leaving a concert before the encore.

Insider Tip: Look for falling wedges forming near key demand zones. This is where institutional buyers often wait to pounce. Want a shortcut to spotting these zones? Use StarseedFX’s Smart Trading Tool.

Why Most Traders Get It Wrong (And How You Can Outsmart Them)

Here’s what the herd does:

- Spots the wedge.

- Waits for breakout.

- Buys the second the candle closes above the upper trendline.

- Watches price retest and panic sells.

The Ninja Way?

- Step 1: Wait for breakout and retest.

- Step 2: Confirm with volume or momentum shift (Stochastic RSI or MACD crossover).

- Step 3: Enter on the retest bounce, not the breakout.

Why? Because patience isn’t just a virtue. It’s an entry edge.

The Secret Sauce: Hidden Divergence + Falling Wedge = Precision Entry

Combine the wedge with hidden bullish divergence on RSI or MACD, and you’re looking at sniper-level precision.

Example: In March 2024, USD/JPY formed a falling wedge just below the 147.50 support. RSI showed higher lows while price printed lower lows (hidden bullish divergence). Outcome? A 300-pip rally over the next 6 days.

Pro Tip: Hidden divergence is often missed because most traders only look for classic divergence. Be the outlier. Use this secret combo to front-run moves like a hedge fund intern who actually read the research.

The Unconventional Playbook: Trading the Wedge Before It Breaks

Yeah, you read that right. Sometimes, the best entry is before the breakout.

Here’s how:

- Identify wedge boundaries.

- Drop down to the 1-hour chart.

- Watch for micro double bottoms or bullish engulfing candles forming near the lower wedge line.

- Enter with tight stop just below the wick.

You’re essentially anticipating the breakout, which sounds risky—until it works. (Kind of like wearing mismatched socks on purpose and starting a fashion trend.)

Don’t Ignore the Fundamentals

Wedges don’t work in a vacuum. If the Fed drops a rate hike bomb or Japan intervenes verbally, your wedge might collapse like a flan in a cupboard.

Combine your technicals with fundamentals. Keep tabs on:

- Fed Rate Decisions

- US CPI & Jobs Reports

- BOJ Yield Curve Control (YCC) and Intervention Statements

Want real-time breakdowns without the noise? Hit up StarseedFX’s Forex News Today section.

Case Study: October 2023 Falling Wedge Breakout

In October 2023, USD/JPY dipped from 150.00 to 147.10, forming a tight falling wedge on the 4H chart. Traders were panicking, forums were doomsday prepping.

But…

- Falling wedge.

- Hidden bullish divergence.

- Bounce from a previous resistance-now-turned-support zone.

Boom. 350-pip move within 48 hours.

Lesson? Patterns are probabilities, not guarantees. But smart setups stack the odds.

Quickfire Checklist: Is Your USD/JPY Falling Wedge Legit?

Use this ninja-approved filter before pulling the trigger:

Nail at least 4 out of 5? That wedge is whispering money.

Want to Stack Even More Edge?

- Get a free trading plan designed for advanced setups like this: StarseedFX Trading Plan

- Keep a detailed record with our Free Trading Journal: Download Here

- Expand your arsenal with our Forex Education Portal: Free Courses

Wrap-Up: Trading Isn’t About Prediction—It’s About Preparation

The falling wedge on USD/JPY isn’t a magic trick. It’s a tactical tool. When paired with divergence, smart entry planning, and a dash of humor (so you don’t cry when it fakes out), it becomes part of a lethal edge.

So next time you spot a falling wedge on USD/JPY, don’t just see a pretty pattern. See a loaded spring—ready to launch.

And hey, if all else fails, at least you didn’t panic-buy at the top. That’s reserved for the guy who skipped this article.

Elite Takeaways:

- Falling wedge on USD/JPY is often bullish, not bearish.

- Hidden bullish divergence is the underground trigger most traders miss.

- Retest entries beat breakout chases 9 times out of 10.

- Fundamentals matter: watch for macro catalysts.

- Smart traders prepare, not predict.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The