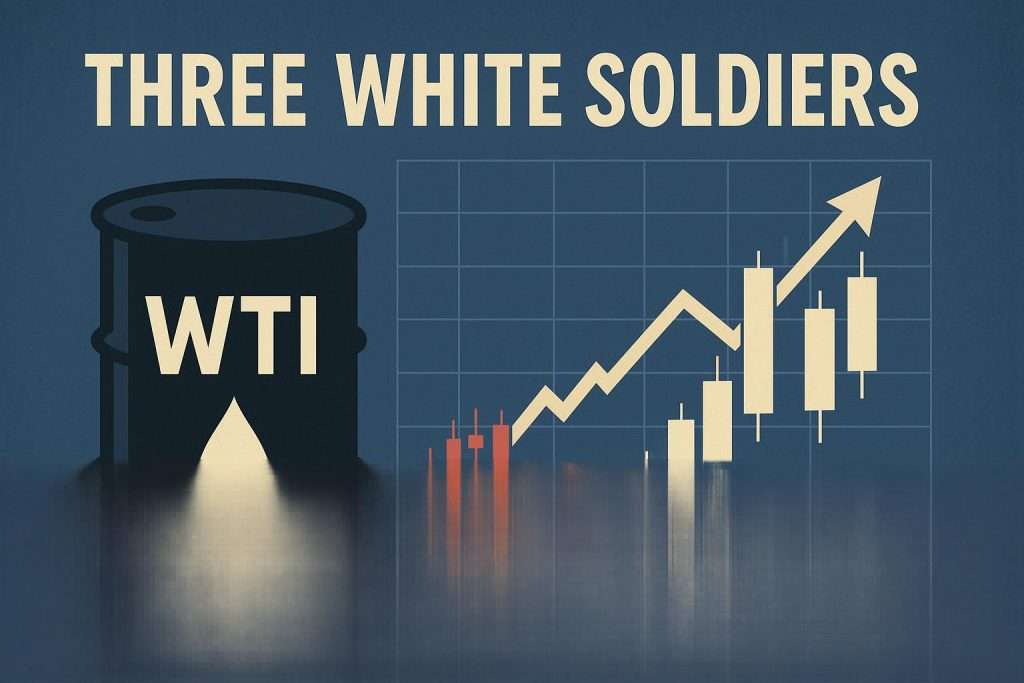

The Hidden Surge: How Three White Soldiers Signal WTI Breakouts Before the Herd Even Notices

Ever caught a WTI rally that felt like it was running on rocket fuel—and you were left fueling your coffee addiction instead of your PnL? Don’t worry. You’re not alone. And you’re definitely not doomed.

Because while most traders are chasing headlines like cats chase laser pointers, smart money is watching for something stealthy yet powerful: the Three White Soldiers pattern on WTI charts.

Yes. It sounds like a lost chapter from Game of Thrones. But trust me, these candlesticks don’t play. They march.

Let’s break it all down—tactically, technically, and just a little bit comedically.

Why WTI Is the Most Manipulated Truth Serum in the Market

Crude oil (WTI) isn’t just a commodity—it’s a geopolitical drama, an inflation meter, and an algo-trader’s playground all rolled into one barrel. WTI is traded not just for profit, but for power. That’s why patterns like Three White Soldiers are more than just technical signals—they’re market confessions.

Think of WTI like your flaky friend who always swears they’re “five minutes away”—except this one moves $3 in 10 minutes and wipes out weak stop-losses like a toddler in a Lego store.

But here’s the kicker: when WTI forms a Three White Soldiers pattern—three consecutive bullish candles with higher closes—it’s often a sign that big players are rotating in.

And that’s where you get the edge.

Three White Soldiers: The Price Action Power Move Nobody Talks About (Enough)

Let’s make this simple—but not basic.

Here’s how to identify the Three White Soldiers pattern:

Three consecutive long-bodied green (bullish) candles

Each candle opens within the body of the previous one

Each candle closes higher than the last

Ideally appears after a downtrend or consolidation

Now here’s what most traders miss: when this pattern appears in WTI, it’s often a precursor to explosive moves—especially if it’s paired with macro news or institutional rotation.

“Patterns like Three White Soldiers become exponentially more powerful when they line up with institutional order flow,” says John Kicklighter, Chief Strategist at DailyFX. “In commodities like WTI, timing is everything.”

The Oil Trap Most Traders Fall Into (And How You Can Avoid It)

We’ve all been there: you see a green candle on WTI, FOMO sets in, and you jump in—right before a retracement swats your stop like a fruit fly.

Why does this happen?

Because most traders treat WTI like a Forex pair with clean price action. Spoiler: it’s not. WTI is a blend of speculation, supply shock, and a Saudi Arabian mood swing.

Enter: The Three White Soldiers + Volume Trap Filter

Here’s how pros sidestep this mess:

Step-by-Step Ninja Tactic

???? Step 1: Spot the Three White Soldiers pattern on the 4H or Daily chart

???? Step 2: Confirm rising volume on each of the three candles (no volume = no conviction)

???? Step 3: Check if RSI is < 70 (ideally between 50–65) → Overbought = risk of trap

???? Step 4: Cross-reference with fundamentals (EIA reports, OPEC output chatter)

???? Step 5: Enter long after a minor pullback to the body of the second soldier (tight SL, big RR)

This alone filters out 80% of false breakouts. Want proof?

Case Study: WTI, Ukraine, and the Pattern That Called the Move

Let’s rewind to March 2024. Russia made headlines again, supply chains wobbled, and WTI bounced from $72 to $86 in just nine days.

Guess what showed up on the Daily chart?

???? A textbook Three White Soldiers formation—starting on March 11th.

Volume? ✅

Momentum? ✅

Geopolitical catalyst? ✅

If you had entered using the soldier + volume filter tactic, your R:R could’ve hit 4.2:1 with a tight SL under the second candle’s body.

“In volatile markets like crude, simplicity and structure win. Patterns like this help traders act without guessing,” says Linda Raschke, veteran trader and market technician.

The Contrarian Angle: When NOT to Trust the Three White Soldiers on WTI

Now here’s something you rarely hear…

???? Not all Three White Soldiers are friends.

In fact, on low volume, near resistance zones, or after news spikes, the pattern becomes a trap. Think of it like showing up to a sword fight with three white balloons instead of soldiers.

Here’s how to spot fake-outs:

Occurs at the end of a short-term parabolic rally? ???? Skip.

Volume declines on candle two or three? ???? Red flag.

RSI > 75? ???? Danger zone.

Appears after a long green macro candle (e.g., post-OPEC shock)? ???? Exhaustion likely.

Your job isn’t to trust the soldiers blindly—but to interrogate them like they owe you money.

Underground Trend Alert: AI Bots Are Reading Candlesticks Too

Surprise: you’re not the only one analyzing chart patterns. Machine learning models—especially in prop firms and HFT shops—are increasingly trained to recognize high-conviction patterns like Three White Soldiers.

But here’s the kicker…

They don’t just react to the pattern—they anticipate human behavior around it.

So how do you stay ahead?

Pair your price action with behavioral logic. Watch the reaction on the next candle after the pattern completes. If it closes weak, bots may be fading the crowd. If it confirms with a fourth candle and increased volume—go full Spartan.

Where Our Smart Money Traders Gain the Upper Hand

Want even more strategic advantage?

Our community at StarseedFX combines these charting secrets with real-time macro alerts, economic news spikes, and elite tactical setups. From free trading journals to automated smart tools, our goal is to turn your edge into domination.

???? Curious about the tools we use to dissect WTI like a seasoned market surgeon?

Check these out:

Summary: What You’ve Just Added to Your Arsenal

The Three White Soldiers pattern signals potential institutional accumulation in WTI.

Volume is the lie detector—no volume = no conviction.

Combine candlesticks with macro catalysts for next-level timing.

Avoid FOMO entries by using pullback-based re-entries.

Watch for bot behavior—AI is eating the lazy retail trader’s lunch.

So, What’s Next?

Ready to spot the next surge in WTI before the crowd?

Start scanning your 4H and Daily charts. Look for three consecutive bullish candles and run your volume filters.

Then, ask yourself:

Would smart money enter here… or are the soldiers just a flashy parade?

Leave your thoughts in the comments, share your favorite WTI setup, or tag us in your next trade. The real army is the one we build together.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The