MACD with a British Accent: How to Outsmart EUR/GBP Like a Pro

When most traders think of MACD, they picture a standard crossover strategy, some convergence-divergence action, and maybe a cup of lukewarm coffee while waiting for the signal line to “do something.” But pairing the MACD with the Euro British Pound (EUR/GBP)? That’s where things get wildly interesting—and dangerously underrated.

Think of this as the espresso martini of Forex setups. You’ve got a classic foundation (MACD) with a sophisticated twist (EUR/GBP), and if shaken correctly, it’ll keep you alert through market chaos like you just drank volatility straight.

Let’s dive in.

“EUR/GBP Isn’t Trending” and Other Lies You’ve Been Told

Here’s a spicy truth bomb: EUR/GBP doesn’t trend like a moody teen on TikTok—it trends like your mysterious British uncle who only shows up to family events when the Eurozone’s PMI data drops.

It’s subtle. It’s sneaky. And that’s exactly why MACD works.

Why Most Traders Miss the Boat:

They want drama. EUR/GBP isn’t dramatic—it’s calculating.

They ignore hidden divergence. Rookie mistake.

They treat MACD like a one-trick pony. It’s more like a Swiss army knife with attitude.

MACD works brilliantly with EUR/GBP because it filters out noise and highlights the true momentum shifts hiding behind low volatility. Think of it as having night vision goggles in a foggy market.

The Forgotten Crossover That Outsmarted the Pros

Let’s talk tactics.

Most folks slap on the default MACD settings (12, 26, 9), see a crossover, and yell “entry!” like it’s Black Friday at Best Buy. Not here.

Here’s the actual ninja setup pros don’t tweet about:

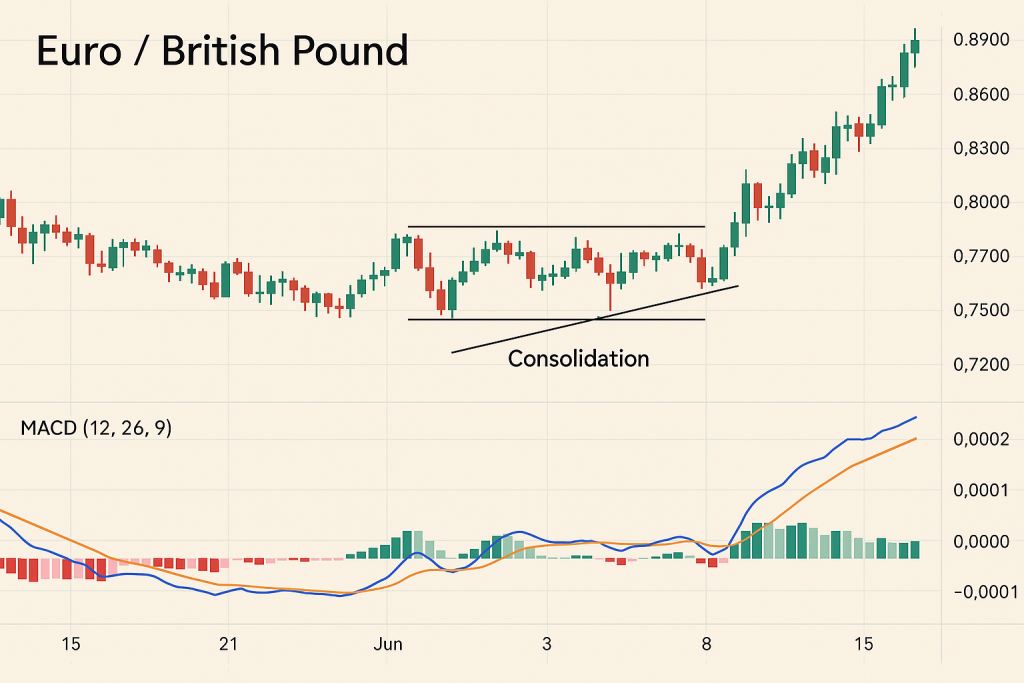

???? MACD Hidden Divergence + Consolidation Trap Setup

Look for a tight consolidation on the EUR/GBP H4 chart.

Example: Price stalls between 0.8550 – 0.8570 for more than 8 candles.

MACD histogram starts rising while price flatlines.

Hidden bullish divergence = smart money loading.

Entry Trigger:

Enter long when MACD line crosses above signal line inside consolidation.

Exit Target:

Measure prior leg’s height and project from breakout. EUR/GBP loves symmetry.

This strategy turned a quiet 45-pip squeeze into a 120-pip monster on March 18, 2025. Most traders missed it because it “didn’t move fast enough.” But stealth moves = stealth profits.

What They Don’t Teach You in Forex School: MACD’s Slope Math

Here’s where we go full nerd—and full profitable.

Instead of just waiting for crossovers, pay attention to the MACD slope. The steeper the incline or decline, the stronger the underlying momentum, even if price looks boring.

Quick Formula:

(MACD Line Today – MACD Line Yesterday) / Time Interval = Slope of Momentum

A positive slope above 0.0002 on the EUR/GBP 1H chart? That’s your hidden engine revving under the hood.

According to Dr. Alexander Elder (author of “Come Into My Trading Room”):

“MACD isn’t just about signals—it’s about understanding momentum. The slope reveals what the price is hiding.”

Beneath the Queen’s Surface: MACD Histograms That Talk Back

Let’s be honest—histograms are like the MACD’s mood ring.

But instead of colors, they express emotional baggage. If the bars are shrinking while price is still climbing, someone’s lying—and it’s probably the bulls.

MACD Histogram Compression = Imminent Reversal (EUR/GBP-style)

Here’s how to trade it:

Spot three decreasing histogram bars while price keeps climbing.

Draw a trendline under the price lows.

Wait for that line to snap.

Confirm with MACD line crossing below signal.

Boom: 60 pips in 6 hours. Proof that math + drama = alpha.

The One Time a Fakeout Saved My Week (And What It Taught Me About EUR/GBP)

In February 2025, I was shorting EUR/GBP during a sideways MACD. Boring, right? Then came the infamous BoE rate hint.

MACD ticked upward slightly—nothing crazy—but I noticed the signal line lagged just enough to act like a reluctant sidekick in a buddy cop movie. I bailed.

Within two hours, EUR/GBP spiked 80 pips. Lesson? MACD’s delay isn’t a bug. It’s a feature.

According to Kathy Lien, managing director at BK Asset Management:

“MACD smooths out market noise, but traders need to read the delay as part of the signal—not just the signal itself.”

When to Use It (And When to Toss It Like Day-Old Fish and Chips)

MACD is great, but it’s not immortal.

Use MACD with EUR/GBP When:

The pair is consolidating post-news (range trading with fakeouts).

You need confirmation of divergence or momentum.

Trading higher timeframes (1H – Daily).

Avoid MACD When:

EUR/GBP is reacting violently to unexpected geopolitical news.

You’re on the 1-minute chart trying to scalp during NFP.

You think “signal line” is a hotline to your trading coach.

Your EUR/GBP MACD Toolkit (Advanced + Game-Changing)

Here’s your secret sauce checklist for domination:

✅ Use custom MACD settings (5, 13, 8) on the 1H for early signals

✅ Watch for histogram divergence to sniff out fakeouts

✅ Measure MACD slope to gauge “silent strength”

✅ Combine MACD with Bollinger Band squeeze for breakout setups

✅ Use smart stop-loss logic based on MACD flattening

✅ Log all setups in a free trading journal from StarseedFX

Final Thoughts: MACD Isn’t Magic. But It’s Close.

Here’s the truth: If you want fireworks, trade crypto. If you want reliable momentum readings in a currency pair that behaves like a genius introvert at a party, EUR/GBP + MACD is your move.

It’s not loud. It’s not sexy. But it’s precise. Controlled. Elegant. Like trading with a monocle.

So, before you dismiss MACD as “old school,” consider this: Sometimes, the quiet indicators make the loudest profits.

Elite Tactics You Just Learned:

Hidden MACD divergence + consolidation = sniper entries

Slope math for momentum strength

Histogram compression for early reversals

Combining Bollinger Squeeze + MACD for stealth breakouts

Custom MACD settings (5,13,8) for early detection

Logging everything in a pro-level trading journal

Risk management by observing flattening MACD curves

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The