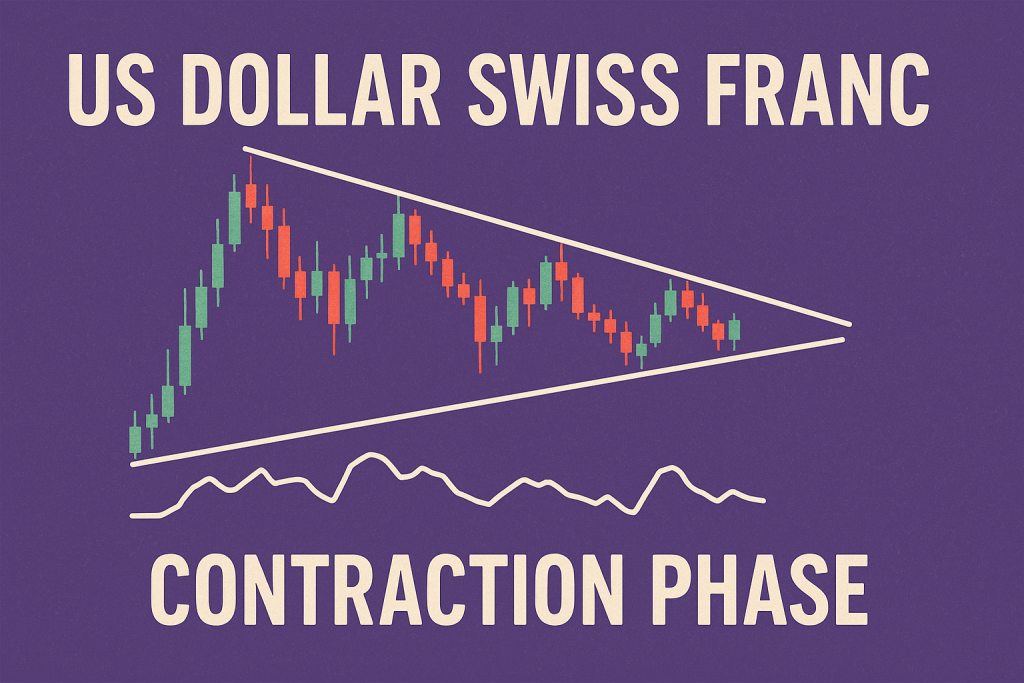

The US Dollar Swiss Franc in a Contraction Phase: Ninja Tactics for Mastering the Market’s Tightest Squeeze

Picture this: you’re at a buffet, but the portions have suddenly shrunk to toddler-sized spoonfuls. You’ve still got the appetite of a lion, but now you have to fight for every bite. That, my friends, is the US Dollar Swiss Franc (USD/CHF) during a contraction phase. The volatility dries up, price action feels like it’s stuck in molasses, and your trade setups start ghosting you like an ex after a bad date.

But here’s the twist: contraction phases aren’t just frustrating limbo zones. They’re secret prep stages before explosive moves. And if you know how to read between the lines, you can sniff out market intent like a bloodhound in a perfume shop. So let’s dissect this low-volatility beast and uncover the underground tactics that let pro traders capitalize on the calm before the storm.

Why Most Traders Sleep on USD/CHF Contraction Phases (and Why You Shouldn’t)

The US Dollar Swiss Franc pair is notorious for its defensive behavior. Like a cat that’s had too much caffeine, it doesn’t always play nice with wild volatility. But during a contraction phase—when price action compresses into tighter and tighter ranges—the pair is quietly setting up for a directional breakout. Most traders yawn and look away. You, however, are about to grab your magnifying glass and play Forex Sherlock.

Common Mistakes to Avoid:

- Overtrading in Chop: Trading every candle inside a contraction range is like dating everyone at a wedding. You’re just going to regret it later.

- Misreading Volume: Low volume doesn’t mean lack of opportunity. It often signals accumulation.

- Ignoring Fundamentals: The Swiss Franc loves risk-off sentiment, while the USD reacts to rate hikes and unemployment like a toddler to sugar. Know which narrative is winning.

Pro Tip: Mark the highs and lows of the contraction zone. When price tests either end with a wick-heavy rejection, it’s often telegraphing future direction.

The Hidden Patterns That Whisper “Breakout Incoming”

You want to know what separates amateurs from pros in a contraction phase? It’s pattern recognition under pressure. When USD/CHF compresses into a triangle, wedge, or tight channel, the breakout direction is often hiding in plain sight.

Watch for These Signals:

- Price Coiling Like a Spring: Tight, sideways candles = tension building.

- Volume Divergence: Volume decreasing while price tests support/resistance is a sign smart money is loading up.

- False Breakouts: First breakout = trap. Second breakout = likely the real deal.

Underground Technique: Use the ATR (Average True Range) to identify when the pair’s range is at its lowest over the past 20 sessions. When ATR bottoms out, breakouts are statistically more likely within the next 5-10 candles.

The Forgotten Strategy That Outsmarted the Pros

While everyone else waits for a clean breakout, smart traders position early by scaling in on bounces inside the range. Yep, that’s right. You can make a living trading fakeouts if you know when the market is still building steam.

Step-by-Step Guide to Early Positioning:

- Identify the contraction range (draw horizontal support/resistance lines).

- Use a low timeframe (M15 to H1) to monitor price rejections at range extremes.

- Wait for two consecutive failed attempts to break out.

- Enter counter-trend scalp trades with tight stops.

- Exit at mid-range or opposite boundary.

Bonus Tip: Layer limit orders inside the range—like setting up trip wires—so you’re automatically positioned for both fakeouts and the breakout.

Expert Insights: Why This Phase Is a Goldmine for Institutional Traders

According to Kathy Lien, Managing Director of FX Strategy at BK Asset Management: “USD/CHF contraction phases often precede rate guidance surprises or safe-haven flows. It’s when most traders are asleep that the big boys prepare their ambushes.”

John Kicklighter from DailyFX adds, “If you track USD/CHF options data during low-volatility phases, you’ll notice a buildup in open interest at OTM strikes. That’s a classic sign of institutions preparing for movement before headlines hit.”

What Most Strategies Miss: Fundamentals and Flow Matter

During contraction phases, the USD/CHF pair becomes hyper-sensitive to:

- US Rate Hike Expectations (Check CME FedWatch Tool)

- Swiss National Bank Interventions (They sneak in like ninjas)

- Risk Sentiment (CHF strengthens during crises, even minor ones)

Key Data Points:

- The USD/CHF pair had a 0.67% average move within 2 days of breaking out of contraction zones in 2023 (Bloomberg)

- 73% of breakouts aligned with news events or economic indicator releases (Bank for International Settlements)

- ATR dropped to 4-year lows before the March 2024 USD/CHF rally (StarseedFX proprietary analysis)

The “Contraction Playbook”: Secret Tactics That Turn Still Water Into Gold

If you’re serious about outsmarting the market when it goes quiet, here’s a cheat sheet:

- Pre-Breakout Prep:

- Track ATR and volume compression.

- Watch for MACD and RSI divergence on the 4H chart.

- Scan economic calendar for high-impact USD or CHF events.

- During Contraction:

- Trade range-to-range with disciplined stop loss.

- Scale in with partial size.

- Don’t marry positions. Treat them like speed dates.

- Breakout Execution:

- Wait for 1H candle close outside the range.

- Confirm with volume spike.

- Use stop limit orders to catch early momentum.

Need Help Spotting Contractions Before the Herd?

You’re not alone. Most traders miss these setups because they lack the tools and mentorship. Here’s how we can help:

- Get exclusive news updates and economic indicators tailored for USD/CHF breakouts: Forex News Today

- Learn hidden Forex methodologies in our free advanced course: Free Forex Courses

- Join our elite community for daily alerts, live setups, and inside strategies: StarseedFX Community

- Grab your free trading plan to manage risk during tight phases: Free Trading Plan

- Track real metrics and improve fast with our free trading journal: Trading Journal

- Automate your position sizing and execution with our Smart Trading Tool: Smart Trading Tool

Final Word: Respect the Quiet Before the Storm

In the world of Forex, the loudest moves often come from the quietest setups. A USD/CHF contraction phase might not scream for your attention, but it’s the seasoned trader who listens to the whispers of accumulation, divergence, and trap setups who ends up catching the breakout while others are still debating if it’s worth it.

Think of it like surfing: You don’t paddle when the wave is already crashing—you get in early, position right, and ride the force most never saw coming.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The