The Secret Weapon Traders Miss: Hedging with the Descending Broadening Wedge

Picture this: you’re juggling flaming swords (a.k.a. open trades), and the market suddenly decides it’s auditioning for a circus. Volatility spikes, your stops are sweating, and your equity curve starts doing the electric slide. Sound familiar?

Now imagine you had a chart pattern so sneaky, so beautifully chaotic, it could whisper the market’s next move—while doubling as a hedging playground. Enter the descending broadening wedge—the misfit genius of price action—and pair it with elite hedging strategies? You’ve just unlocked a secret dojo most traders don’t even know exists.

Let’s dive into the ninja-level synergy between this misunderstood pattern and professional-grade hedging tactics.

“The Market’s Panic Attack”: Why This Wedge Matters More Than You Think

Let’s not sugarcoat it—the descending broadening wedge looks like what happens when your trendlines hit espresso. It’s messy. It’s wide. It screams uncertainty.

But here’s the kicker: that chaos is exactly what makes it gold.

Shape: A descending broadening wedge is characterized by lower highs and even lower lows, expanding over time. Think of it as a market mid-tantrum.

Psychology: It reflects fear-driven selling spikes… followed by nervous short-covering.

Outcome: Despite its bearish look, this pattern often leads to explosive bullish breakouts.

???? According to Thomas Bulkowski’s Encyclopedia of Chart Patterns, descending broadening wedges result in upward breakouts 79% of the time when found in a downtrend. That’s not a pattern—that’s a probability-packed opportunity.

“It’s Not You, It’s Leverage”: Why Most Traders Blow It With Wedges

Let’s face it—many traders treat the descending broadening wedge like an ex they’d rather ghost. It’s hard to trade, unpredictable, and emotionally draining.

Here’s where they go wrong:

Overleverage – Entering early and going all in is like proposing marriage on the first date.

No Hedge Plan – Most traders don’t know that this pattern pairs beautifully with hedging, especially during the “expansion phase.”

Tunnel Vision – They zoom in on M15 charts, ignoring macro signals (like economic catalysts that triggered the panic in the first place).

Let’s fix that. Let’s get weird. Let’s hedge like a pro.

“Controlled Chaos”: How to Hedge Inside a Descending Broadening Wedge

Here’s the hidden gem: this wedge thrives in high volatility. So instead of avoiding it, use it to layer hedges like a chess-playing octopus.

The Strategy: Combine directional hedging with dynamic lot sizing inside the wedge.

Step-by-Step Ninja Hedge Execution:

Identify the Wedge

Use H1 or H4 charts for clarity.

Confirm with volume: expanding volume during lows often signals panic (ideal setup).

Add ATR (Average True Range) to gauge volatility spikes.

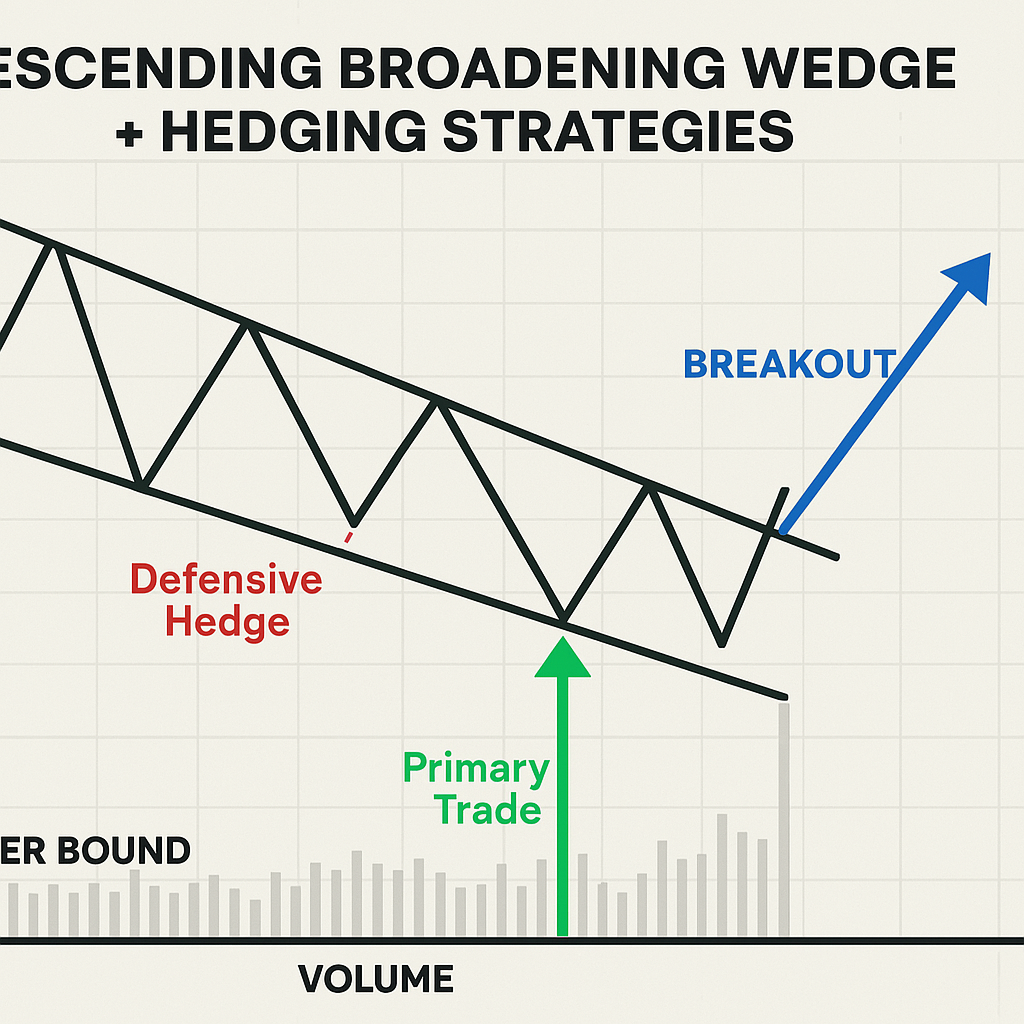

Anchor One Trade at the Lower Bound

Go long near the wedge’s bottom.

Use tight stop losses or trailing stops just under the recent swing low.

This is your primary trade—betting on a bullish breakout.

Place a Defensive Hedge Above

Open a short position above the midpoint of the wedge (between resistance and centerline).

If the price reverses mid-pattern, this hedge protects against false breakouts.

Use the Smart Trading Tool for precise lot sizing and balance between exposure: Try It Free

Add a Time-Based Filter

If price remains within the wedge for more than 3 sessions without breakout, close hedges and re-evaluate.

This avoids death-by-a-thousand-swaps.

Breakout Confirmation

Use RSI divergence + volume spike as breakout confirmation.

When breakout occurs, close the hedge, ride the breakout trade, and consider scaling in.

“The Quiet Genius”: Why Smart Traders Hedge Even When They’re Right

Here’s what separates the hedge-heroes from the headless chickens:

“In trading, defense is more important than offense. You don’t need to be right all the time—just prepared for when you’re not.”

— Mark Minervini, U.S. Investing Champion

Think about it. Professional traders don’t hedge because they’re unsure—they hedge because they’re strategic. They view volatility as a resource, not a risk.

This is especially relevant inside descending broadening wedges. When you hedge:

You preserve margin during drawdowns.

You avoid emotional exits.

You stay in the game longer.

It’s not about hedging your bets—it’s about hedging your edge.

“The Hidden Geometry of Emotion”: What This Pattern Really Reveals

Descending broadening wedges reflect emotional fractals: mass fear expanding in waves.

But here’s the psychological play:

Retail traders panic on new lows.

Smart money quietly accumulates on volume spikes.

Breakout traders chase the move late.

You, the hedge artist, get in before the breakout, protected on both sides.

It’s chess. Not checkers.

Case Study: GBP/AUD in the Wedge Zone (2024)

In late Q4 2024, GBP/AUD formed a textbook descending broadening wedge on the 4H chart. While retail forums screamed “stay out,” pros loaded long near 1.8650. Here’s what went down:

Primary Long entered at lower wedge support.

Protective Short Hedge was placed at 1.8800 with minimal lot size.

Breakout triggered at 1.8925 after positive UK labor data + RSI divergence.

Hedge closed. Longs scaled in. Trade closed at 1.9200 for a 275 pip gain.

Moral of the story? Patterns lie—but hedging speaks the truth.

“The Overlooked Combo That Beats 90% of Traders”

Here’s the underground alpha:

Pattern: Descending Broadening Wedge

Filter: Volume & RSI Divergence

Trigger: Breakout Confirmation

Defense: Strategic Hedging

Edge: Volatility Exploitation

This combo isn’t in your average YouTube tutorial because it works too well. Why share it when it gives you an edge?

Oh right—we do. Because we’re StarseedFX, and that’s our jam.

Little-Known Secrets To Maximize This Setup

✅ Overlay Fibonacci Extensions for breakout targets—aim for 1.618 as your stretch goal.

✅ Apply Hedging Only During the Expansion Phase—don’t over-hedge once price consolidates.

✅ Use Correlated Pairs for External Hedges—EUR/GBP often counterbalances GBP/USD, for example.

✅ Run Simulation Models to optimize hedge size and stop distance. Our Free Trading Journal helps track this over time → Get It Here

✅ Join a Pro-Level Trading Community that discusses wedge + hedge combos in real-time. Yours truly is waiting → StarseedFX Community

TL;DR: Wedge + Hedge = Strategic Advantage

Here’s what you now know (that most traders don’t):

Descending broadening wedges scream volatility and breakout potential.

You can hedge inside the wedge to defend capital and trade structure.

Real pros use these patterns for setup stacking—not single-shot bets.

The best trades are the ones with strategic flexibility, not just conviction.

✅ Elite Tactics Checklist

Spot the wedge early (H4 preferred)

Use RSI + volume for breakout confirmation

Anchor a directional trade at wedge low

Set a dynamic hedge above midpoint

Exit hedge on breakout confirmation

Log results in the free journal to optimize future setups

Ready to stop gambling and start compounding?

→ Explore our Free Forex Courses and get next-level strategies nobody else is teaching.

⚡ Final Word

Trading without a hedge is like cliff diving without depth-checking the water. Sure, it might be exciting—but one bad entry, and you’re out. If you want longevity, edge, and ninja-level coolness, you need structure inside chaos.

And nothing screams “structured chaos” like a descending broadening wedge.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The