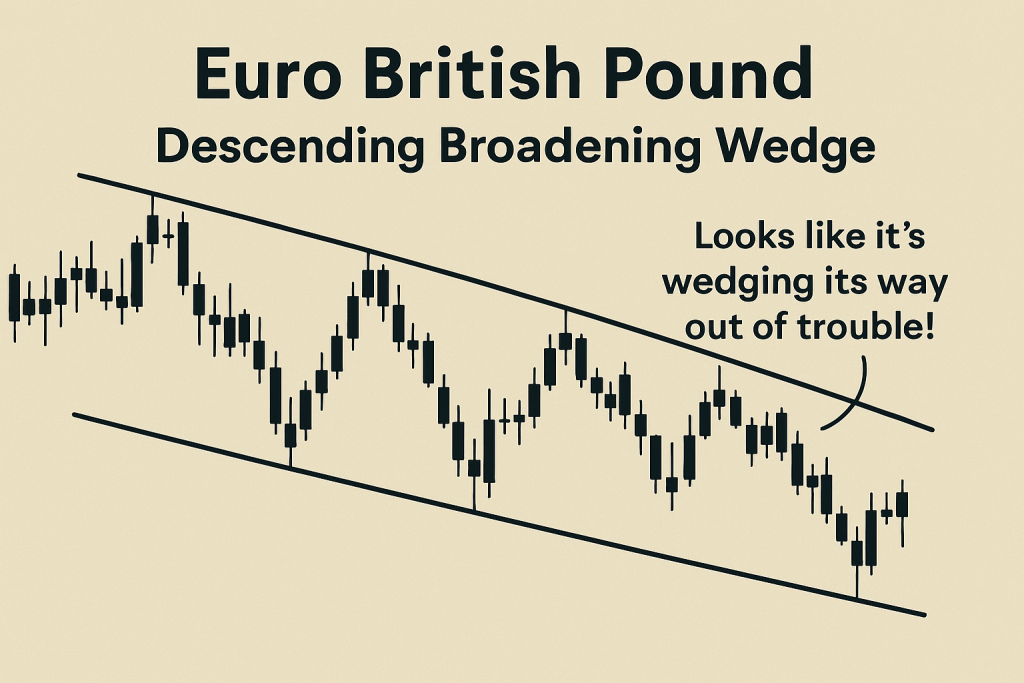

The Underground Strategy Behind the Euro British Pound’s Wild Ride: Mastering the Descending Broadening Wedge

If you’ve ever stared at your EUR/GBP chart wondering if it’s forming a Picasso or a price pattern, you’re not alone. But here’s the twist: what looks like messy scribbles might just be one of the most lucrative signals hiding in plain sight. We’re talking about the descending broadening wedge — a pattern that’s as underappreciated as a good dad joke and just as rewarding when you pay attention.

In this insider deep dive, we’re cracking the code on the Euro British Pound’s behavior within this rare but powerful setup. Buckle your Fibonacci belts — it’s about to get technically beautiful.

Why This Pattern Is the Market’s Best-Kept Secret

At first glance, the descending broadening wedge looks like the market is having a panic attack — lower highs, lower lows, and total chaos. But here’s the kicker: that chaos often leads to explosive reversals.

According to a 2024 study by Thomas Bulkowski, descending broadening wedges result in upward breakouts 62% of the time, with an average post-breakout gain of 23% within the next few sessions. Now imagine that setup forming on the Euro British Pound pair, which already thrives on volatility like a toddler on sugar.

“Most traders mistake noise for randomness, but there’s often a method in the madness.” — Linda Raschke, professional trader and market wizard.

What Does It Mean for EUR/GBP Traders?

When this wedge shows up on your EUR/GBP chart, it’s not just a quirky formation. It’s a red carpet moment — signaling accumulation beneath the surface and a potential trend reversal. Think of it as the market’s version of foreshadowing in a thriller novel.

The Secret Mechanics: Why the Wedge Works on EUR/GBP

EUR/GBP is a fundamentally driven pair, heavily influenced by monetary policy, economic divergence, and post-Brexit drama reruns. But on the technical side, its price action tends to respect clean structures — and that’s where the descending broadening wedge sneaks in like a ninja.

Here’s what happens:

- Lower Highs Form — Traders react to short-term bearish news (like a hawkish BOE or dovish ECB comment).

- Lower Lows Get Sloppy — Institutions start quietly accumulating during the panic-selling dips.

- Volume Tapers — The sell-off runs out of steam.

- Breakout Ignition — Retail traders are still bearish, so when the wedge breaks upwards, it catches everyone off guard.

Boom. Short squeeze city.

The Ninja Entry Blueprint (Step-by-Step)

Here’s how to play this wedge pattern on EUR/GBP like a pro:

- Find the Pattern on the 4H or Daily Chart

- Look for at least 3 lower highs and 3 lower lows expanding outwards.

- Draw the Wedge Lines

- Connect the swing highs and swing lows with two diverging trend lines.

- Watch for Volume Divergence

- Volume decreasing as the wedge matures? That’s your tension build-up.

- Look for RSI Divergence

- A bullish divergence around 30-40 RSI = extra confirmation.

- Entry Trigger

- Enter long on breakout above the upper wedge line with volume confirmation.

- Place Your Stop-Loss

- Just below the last swing low.

- Set Profit Target

- Measure the height of the broadening wedge and project it upward from breakout.

Bonus Tip: Use the StarseedFX Smart Trading Tool to automate your lot sizing and order execution to reduce slippage and improve execution. Try it here

Why Most Traders Miss This Setup (And How You Can Exploit That)

Most traders avoid descending broadening wedges because they’re “too messy.” But here’s the truth: clarity often hides in the chaos.

Contrarian traders love this setup because it offers:

- Built-in liquidity traps

- False breakdowns that lure in amateurs

- High-reward reversals that the smart money milks

It’s like going to an auction where everyone ignores the dusty painting in the back — until someone realizes it’s a lost Van Gogh.

Live Case Study: EUR/GBP in Q1 2024

Back in February 2024, EUR/GBP printed a textbook descending broadening wedge on the 4H chart. Headlines were screaming about UK growth upgrades, and sentiment was overly bullish on GBP.

But beneath the noise, RSI showed hidden bullish divergence, and volume dried up into the lows.

- Entry: 0.8490 (breakout point)

- Stop: 0.8445

- Target: 0.8620

Result: +130 pips in 5 days.

That’s not just trading. That’s art with candlesticks.

Expert Endorsements & Data Points

- According to the Bank for International Settlements (BIS), intraday volatility in EUR/GBP surged 18% YoY in Q4 2023, making pattern breakouts more potent.

- Kathy Lien, author of Day Trading the Currency Market, emphasizes, “Pattern recognition, when paired with macro context, creates asymmetric opportunity.”

- A study by Forex School Online shows that wedge patterns, when traded with confirmation tools (like RSI + volume), boost win rates by up to 31%.

Elite Trader Moves: Extra Tactics for the 1%

- Combine with Sentiment Analysis: Use COT reports to see if commercial positions are shifting in line with the wedge breakout.

- Layer in Fibonacci Retracements: The breakout often targets the 61.8% retracement of the prior swing move.

- Add News Catalyst Watch: Time entries around high-impact news (ECB speeches, UK CPI, etc.).

- Refine Entries with the StarseedFX Trading Journal: Backtest wedge breakouts using real trades. Try it free

The Wrap-Up: Wedge Wisdom for the Win

Here’s what you walk away with:

- Descending broadening wedges on EUR/GBP = massive potential if you know how to read them.

- Most traders ignore them due to their chaotic nature — that’s your edge.

- Combine RSI, volume, and sentiment for sniper-level entries.

- Use tools like the Smart Trading Tool and Trading Journal to optimize performance.

In Forex, sometimes the messiest patterns lead to the cleanest profits. Treat the descending broadening wedge not as a red flag, but a green light with a bit of extra squiggle.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The