The Medium-Term Trader’s Secret Weapon: Mastering the Rounding Bottom Pattern

Why Most Traders Miss the Rounding Bottom (And How You Can Profit Instead)

You know that feeling when you see an old stock chart, and it looks like a bowl of soup? Turns out, that “bowl” isn’t just market randomness—it’s a hidden money-making machine called the rounding bottom pattern. And if you’re trading in the medium-term, this little-known gem could be your secret weapon for catching some of the biggest market reversals before the herd catches on.

Let’s dive deep into this rare but powerful technical pattern, explore the psychology behind it, and, most importantly, uncover the ninja tactics to trade it profitably.

What is the Rounding Bottom Pattern? (And Why It’s a Big Deal for Medium-Term Traders)

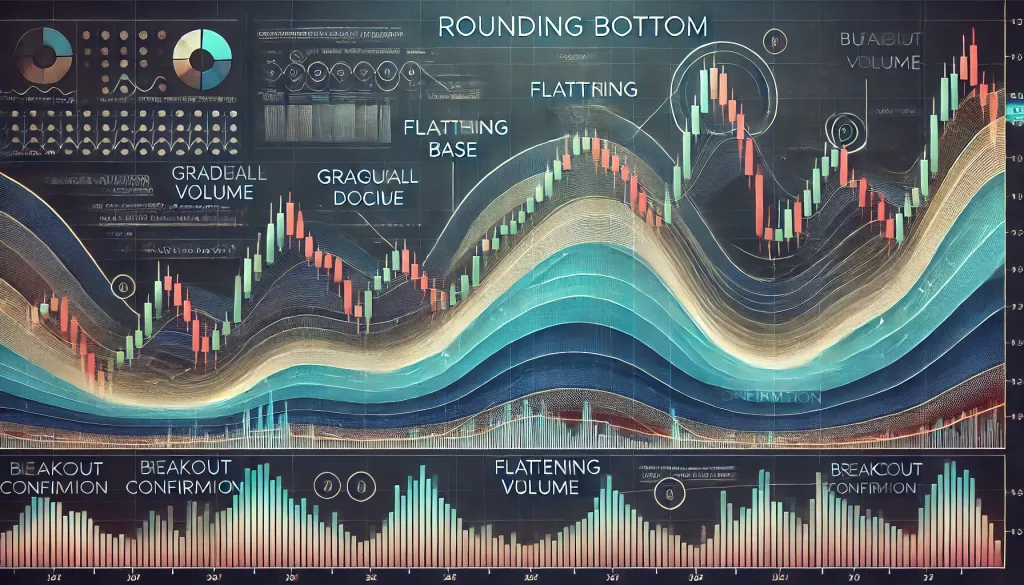

A rounding bottom is a technical formation that looks exactly like it sounds—a gradual, curved shift from a downtrend to an uptrend. It’s like the market taking a slow, deep breath before launching into a sprint.

Key Characteristics:

- It typically forms over weeks to months, making it a medium-term pattern.

- The price gradually declines, flattens out, and then starts to rise in a U-shape.

- Volume is highest at the beginning of the downtrend, lowest at the bottom, and increases as the uptrend starts.

- It signals a shift from bearish to bullish sentiment—a stealthy reversal most traders fail to spot early enough.

Why Most Traders Ignore It

Most traders focus on sharp breakouts, head-and-shoulders patterns, or cup-and-handle formations. The rounding bottom takes patience—it doesn’t scream “Buy now!” like a sudden breakout does. But here’s the kicker: when it completes, it’s one of the most reliable reversal patterns out there.

The Hidden Psychology Behind the Rounding Bottom

Imagine a stock that’s been beaten down over time. Retail traders panic and sell at every minor drop, thinking it’ll never recover. Meanwhile, smart money (institutions, hedge funds, and deep-pocketed pros) slowly accumulate positions at rock-bottom prices.

As the panic-selling dries up, the stock price stabilizes—the rounding bottom is forming. And once enough big players have loaded up, they let the price rise, triggering FOMO from retail traders who previously doubted the recovery. That’s when the rally truly begins.

How to Trade the Rounding Bottom Like a Pro

1. Spot the Setup Early

Checklist for identifying a rounding bottom:

✅ Gradual decline: No sharp drops, just a slow fade lower.

✅ Flatter base: The price levels off over time.

✅ Gradual increase in volume: Smart money starts accumulating.

✅ Breakout confirmation: The price breaks above resistance at the top of the pattern with strong volume.

Use higher time frames (daily or weekly charts) to confirm the pattern. The bigger the rounding bottom, the bigger the potential move.

2. Perfect Entry Timing

- Best entry: Wait for a breakout above resistance (the highest point before the rounding started). Confirmation happens when volume spikes.

- Aggressive entry: If you have conviction, you can enter near the bottom before the breakout, but you’ll need a tight stop-loss.

3. Set Your Targets Like a Sniper

- Conservative target: Measure the depth of the pattern and add it to the breakout level.

- Aggressive target: Use Fibonacci extensions for extended profit-taking levels.

- Stop-loss placement: Below the lowest point of the pattern or a recent swing low.

Real-World Case Study: Rounding Bottom in GBP/AUD

Back in 2022, GBP/AUD formed a beautiful rounding bottom on the daily chart. Traders who spotted it early had a massive 500+ pip rally once the breakout happened. The key? Volume analysis and patience.

???? Expert Quote: “The rounding bottom is one of the most overlooked reversal patterns, yet its reliability in medium-term trading is incredibly high.” — John Carter, Market Analyst at Simpler Trading

Avoid These Common Pitfalls

???? Entering Too Early: A rounding bottom can fake-out traders who enter before true confirmation.

???? Ignoring Volume: If the breakout happens on weak volume, it’s probably a false move.

???? Placing Tight Stops: Give the trade some room—this pattern isn’t for scalpers.

Final Thoughts: Why Medium-Term Traders Should Love the Rounding Bottom

Trading is like comedy—you don’t want to rush the punchline. The rounding bottom is proof that patience pays in Forex. If you can wait for the setup, confirm the breakout, and manage your risk, this pattern can give you some of the most predictable medium-term trades.

Want to refine your skills further? Check out these pro trader tools:

Happy trading, and may your trades round out to big profits! ????

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The