The Yearly Descending Broadening Wedge: The Hidden Pattern That’s Been Printing Money for Smart Traders

Why This One Chart Pattern Might Be The Closest Thing to a Crystal Ball

Imagine you’re hiking up a mountain, only to realize the path keeps widening, making it harder to see where you’re headed. That’s exactly how a Yearly Descending Broadening Wedge behaves in Forex—except, unlike your hiking trail, this pattern could lead you straight to serious profits if you know what to look for.

While most traders are busy chasing breakouts like kids after an ice cream truck, smart money is quietly watching this formation develop. If you’ve never heard of it, that’s because institutional traders love keeping it a secret. But today, we’re blowing the lid off.

What Exactly Is a Yearly Descending Broadening Wedge?

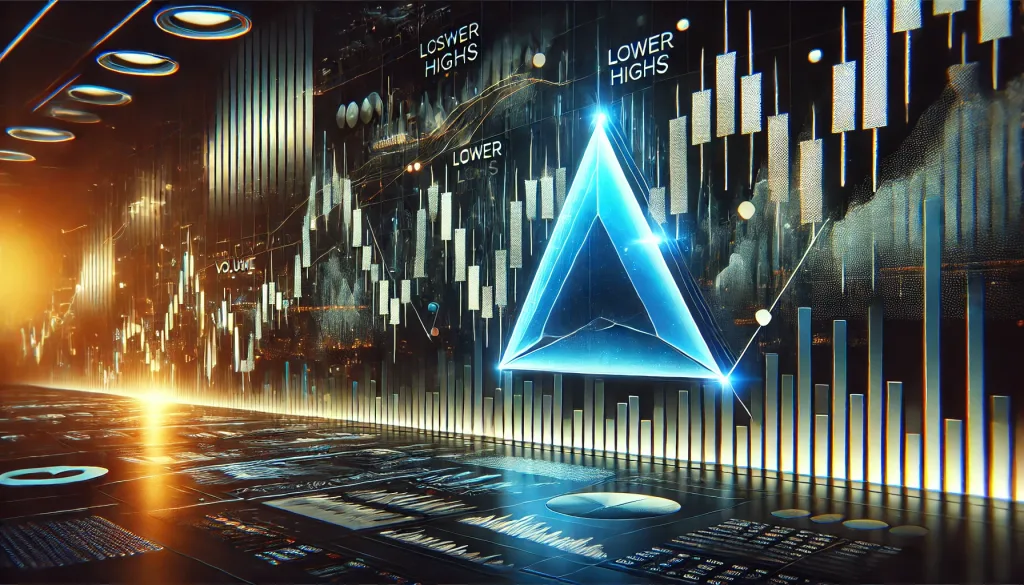

A descending broadening wedge is a chart pattern where price action makes lower highs and lower lows but does so with expanding volatility. Think of it like a slinky rolling down the stairs—unpredictable, but still following a structured movement.

When this happens on a yearly timeframe, it becomes a big deal because it signals long-term institutional accumulation. Here’s why:

- Higher Timeframes = Stronger Signals: The longer the timeframe, the harder it is for market makers to manipulate price action.

- Expanding Volatility = Market Frustration: This pattern shakes out impatient retail traders before making its move.

- Breakout = Major Trend Reversal: Once price escapes this formation, it often results in explosive moves.

Why Most Traders Get This Pattern Completely Wrong

A lot of traders assume that because price keeps making lower highs and lower lows, it will continue doing so forever. That’s like assuming your car will keep running on an empty tank just because it’s still moving.

But the truth is, institutions use this pattern to trap retail traders. Here’s how:

- The Fakeout: The market appears to break down further, convincing traders to go short.

- The Shakeout: A sudden surge wipes out weak hands, stopping out both long and short positions.

- The Takeoff: Once retail traders are out of the picture, institutions drive the price back up.

Let’s put some numbers behind this. According to a study by the Bank for International Settlements (BIS), nearly 80% of retail traders lose money because they enter trades too early. This wedge is a prime example of how the market lures them in before reversing against them.

How to Trade the Yearly Descending Broadening Wedge Like a Pro

1. Spotting the Setup

- Look for lower highs and lower lows on a yearly timeframe (Yes, zoom out!).

- Identify widening price action, meaning each leg down is more volatile than the last.

- Use a volume spike as confirmation—institutions leave footprints when they enter.

2. Waiting for the Right Entry

- Place a buy stop order above the last lower high to confirm breakout strength.

- Use a trailing stop to avoid getting shaken out.

- Add RSI divergence for extra confidence—when price makes new lows, but RSI doesn’t, that’s your cue.

3. Managing the Trade

- Set take profits near previous major resistance zones.

- Adjust stop losses once price confirms a breakout.

- Use Fibonacci extensions to identify long-term targets (1.618 and 2.618 are golden ratios for big moves).

A Real-World Example of a Yearly Descending Broadening Wedge in Action

Let’s rewind to 2019-2023 on the USD/JPY pair. After years of choppy price action, the pair formed a textbook descending broadening wedge on the yearly timeframe. Traders who recognized the pattern and waited for the breakout in late 2023 saw a 3,000-pip move in their favor—enough to turn a modest account into a serious bankroll.

Another example? Gold (XAU/USD) from 2012 to 2019. Everyone thought gold was dead, but smart money knew better. The wedge breakout sent prices soaring from $1,200 to nearly $2,000 in a single year.

Why This Pattern Works & How You Can Stay Ahead

Smart traders understand that history doesn’t repeat, but it rhymes. Markets move in cycles, and patterns like the yearly descending broadening wedge are simply roadmaps to future price action.

Here’s what separates winning traders from the herd:

✔ They zoom out. If you’re stuck on the 5-minute chart, you’re missing the big picture.

✔ They wait for confirmation. Patience is more profitable than guessing.

✔ They trade with institutions, not against them.

Final Thoughts: Will You Be the Trader Who Catches the Next Big Move?

While most traders are getting whiplash from short-term noise, those who understand the yearly descending broadening wedge are quietly stacking profits. The question is—will you be one of them?

If you want to get ahead of the curve, make sure you’re plugged into the StarseedFX community, where we provide:

- Real-time trading alerts so you never miss a move.

- Elite Forex courses covering strategies most traders never learn.

- Institutional-level analysis that gives you a major edge.

???? Get exclusive insights now: StarseedFX Trading Community

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The