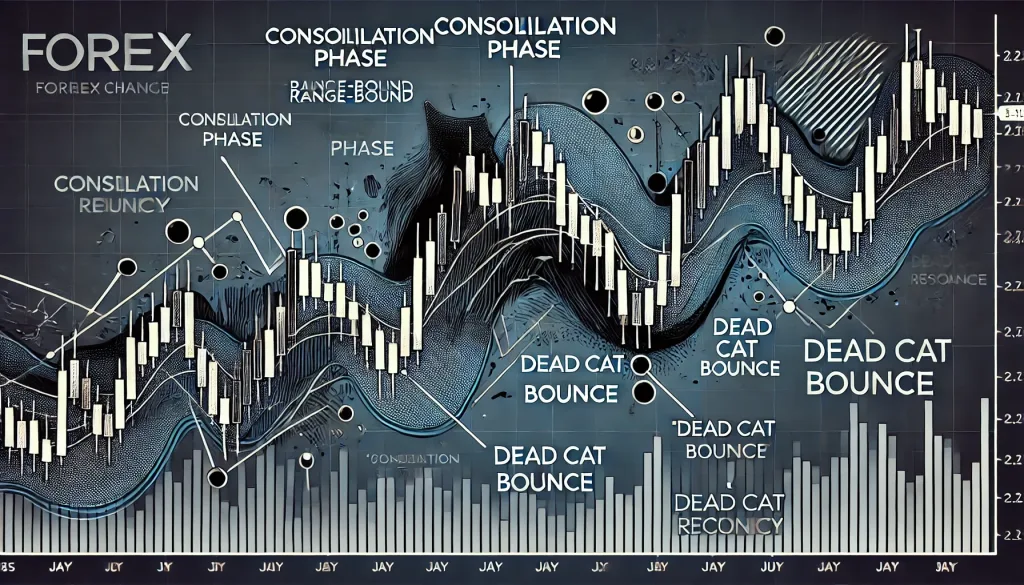

The Truth Behind the “Consolidation Phase” and the “Dead Cat Bounce” – Secrets Every Forex Trader Should Know

Introduction

Ah, the elusive “consolidation phase” and the infamous “dead cat bounce”—two concepts that often appear in Forex trading like that mysterious stranger at a party who never talks but always seems to be lurking in the background. Sure, you’ve heard of them, but do you really understand what they mean and how to turn them into profit-making machines? No? Well, that’s where I come in. Grab a blanket, make yourself a warm cup of tea (if you’re feeling cozy), and let’s break these down with humor, expert insights, and some ninja tactics that will have you seeing these phases in a whole new light. Ready to level up? Let’s go!

What is the Consolidation Phase?

If the market were a movie, the consolidation phase would be the awkward first act where everything is quiet, the tension builds, and you’re unsure if you should check your phone for a text from that one friend who always makes things more interesting. In Forex, consolidation is when the price of a currency pair trades within a specific range. It’s like the market is holding its breath, waiting for something to happen. But, spoiler alert: it’s not as boring as it sounds. If you know how to read it, you can make moves that leave most traders wondering how you got there.

Here’s why consolidation is a hidden gem:

- Range Bound: The market isn’t trending in any direction, so it creates a perfect opportunity for range trading. Buy at support, sell at resistance—simple, right? (But not easy! There’s a big difference.)

- The Calm Before the Storm: Often, consolidation happens before a big move. Understanding this can help you prepare and ride the wave when the storm hits.

Dead Cat Bounce – Don’t Be Fooled!

“Dead cat bounce” sounds like something you’d hear from a snarky financial analyst after a market crash. It refers to a brief, weak recovery in prices after a significant decline. Imagine you’re watching a falling cat (not something I endorse, please) and then—bam!—it momentarily bounces, but then falls again. That’s your dead cat bounce. It’s like the market’s way of trying to convince you that all is well, but don’t be fooled—this is a temporary reprieve, not a reversal.

So why does this happen?

- Emotionally Driven: After a big sell-off, traders who’ve been hit hard might jump back in, hoping that prices are bottoming out. This often leads to a brief price increase. But remember, this is usually short-lived.

- Stay Cautious: If you’ve ever heard someone say, “It’s a dead cat bounce!” in a tone that implies a massive market correction is coming, trust them. These bounces are often followed by a continuation of the downward trend.

Ninja Tactics for Handling Consolidation and Dead Cat Bounces

Now, let’s talk strategy—because at the end of the day, that’s what you really care about, right? If you want to actually profit from these tricky phases, you need more than just textbook knowledge. You need ninja-level insights. Here’s how you can start executing like a pro:

During Consolidation – Breakout Strategy

If you’re looking to capitalize on a breakout from a consolidation phase, patience is key. Don’t jump in prematurely—wait for the price to break out of the consolidation zone and confirm that the new trend is real. The breakout should be accompanied by volume, showing that there’s real market movement behind it.- Pro Tip: Watch for breakouts that occur after a longer consolidation. The longer the consolidation, the more powerful the breakout tends to be.

During a Dead Cat Bounce – Be Skeptical

When the market suddenly shoots up after a significant drop, don’t throw your strategy out the window. It’s easy to think that the market is reversing, but a dead cat bounce is usually a trap. Here’s what to do:- Short the Bounce: Once the price hits a key resistance level, it’s often a good time to enter a short trade, especially if the bounce isn’t backed by significant volume.

- Pro Tip: Use oscillators like RSI or Stochastic to check if the market is overbought. A dead cat bounce often coincides with overbought conditions.

Case Study – Real-World Example

Let’s look at a recent example that made headlines (but not in the good way): the GBP/USD after the UK’s Brexit referendum. The pair underwent a massive drop, followed by a consolidation phase. The market was in limbo for weeks, and then—bam!—a dead cat bounce. Traders who knew to wait for confirmation didn’t fall for the bounce and avoided getting caught in the trap.

Insider Secret: The Hidden Power of Price Action During These Phases

Now, here’s the juicy part that’ll make you feel like an insider—price action is your best friend when navigating consolidation and dead cat bounces. Here’s why:

- Consolidation Phase: Price action can help you determine the boundaries of support and resistance more accurately than any indicator. Watch the price’s reaction to these levels and look for candlestick patterns like pin bars or engulfing candles to spot potential breakouts.

- Dead Cat Bounce: Price action will often reveal exhaustion in the rally. Look for weak price action at resistance levels—small candles with little range suggest that the bounce is running out of steam.

The Big Secret No One Talks About

The most advanced traders know that consolidation phases and dead cat bounces aren’t just obstacles to overcome—they’re opportunities to make big profits. The market is constantly in flux, and knowing how to read these phases gives you a strategic edge. But here’s the kicker—many traders overlook the psychological aspect of these phases. The fear of missing out (FOMO) during a dead cat bounce can cloud judgment, and the anxiety of waiting for a breakout during consolidation can make you act impulsively. If you can stay calm, collected, and make moves based on logic rather than emotion, you’ll see a huge difference in your trading performance.

Conclusion – The Power Is in Your Hands

By understanding consolidation phases and dead cat bounces, you’ve unlocked a powerful tool in your trading arsenal. These concepts might seem like they’re just market noise, but with the right strategy, they can provide real opportunities to profit.

To wrap up:

- Consolidation phases are great for range trading or preparing for breakout opportunities.

- Dead cat bounces are typically traps, but if you know how to spot them, they can provide great shorting opportunities.

- Use price action to gain insights that most traders overlook, and remember: patience and discipline are key.

Keep honing your skills, and you’ll soon be the one who spots these opportunities before the herd does.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The