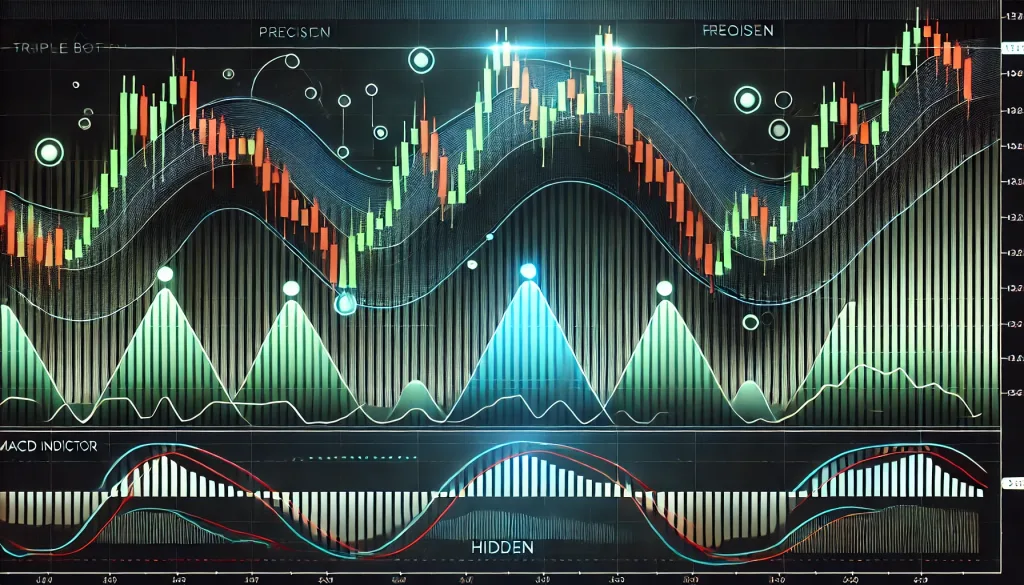

The MACD Triple Bottom Secret: The Hidden Power Move Pros Don’t Want You to Know

Picture this: You wake up, coffee in hand, ready to conquer the Forex market. You open your charts, spot a MACD crossover, and think, “This is it!” You place your trade—only to watch it nosedive like that one time you tried a new hairdresser and ended up with a bowl cut.

We’ve all been there. But what if I told you there’s a secret combo that elite traders quietly use to stack the odds in their favor? Enter the MACD + Triple Bottom strategy—an underground powerhouse that blends momentum precision with structural support to give you sniper-like trade entries.

But, spoiler alert: Most traders are doing it wrong. Today, we’re cracking open the vault to give you the exact blueprint for using this high-probability setup like a pro.

Why Most Traders Fumble the MACD (And How You Won’t)

Let’s get something straight. The MACD (Moving Average Convergence Divergence) indicator is not a crystal ball. It’s a lagging indicator, which means it often tells you what just happened—like that friend who only texts back after the party’s over.

Most traders make these MACD blunders:

- Mistaking every crossover as a signal: Not every crossover is a green light. Sometimes it’s just a head fake.

- Ignoring Market Structure: MACD without price structure is like trying to cook gourmet pasta with ketchup—it might work, but it won’t taste right.

- Dismissing Divergence: Hidden divergence is a ninja-level clue. Pros watch for it like hawks; amateurs swipe past it like it’s a terms-and-conditions popup.

Pro Move: Pair the MACD with a robust price pattern like the Triple Bottom, and you unlock a whole new level of precision.

Triple Bottom: The Market’s SOS for Reversal

A Triple Bottom is the chart pattern equivalent of the market saying, “I’ve had enough!” It forms after the price tests a support level three times and fails to break lower. Imagine trying to push open a door that just won’t budge—eventually, you give up and go the other way.

Key Triple Bottom Traits:

- Three Touches: Price tests the same support level three times, roughly equal lows.

- Volume Clue: Volume often increases on the third touch and breakout.

- Neckline Resistance: The high point between the lows forms a resistance. Break that, and it’s go-time.

Hidden Gem: The best Triple Bottoms often coincide with market manipulation or liquidity grabs—a shakeout before the real move. This is where you make your money.

The MACD + Triple Bottom Fusion: The Sniper Entry Blueprint

When you combine the MACD and Triple Bottom, you filter out noise and pinpoint high-probability reversals.

Step 1: Spot the Triple Bottom

- Look for the classic three-touch support pattern on your chart (preferably on H1 or H4 timeframes for stronger signals).

- Ensure the lows are near equal, but slight deviations are fine—smart money loves to fish for stop-losses.

Step 2: Watch the MACD

- Observe the MACD histogram and signal lines.

- Hidden Divergence Is King: If the price is making equal lows, but MACD shows higher lows, it’s a stealth signal the reversal is brewing.

Step 3: Timing the Trigger

- MACD Bullish Crossover: After the third bottom, wait for a MACD bullish crossover.

- Ideally, the crossover aligns with a neckline breakout.

Step 4: Entry & Risk Management

- Entry: Upon neckline breakout with MACD confirmation.

- Stop-Loss: Just below the third bottom (consider a buffer for wicks).

- Target: Measure the distance from the bottoms to the neckline and project it upward.

Pro Tip: When the MACD crossover happens slightly before the neckline break, it often signals smart money positioning. This is your golden ticket.

Real-World Example: EUR/USD Reversal (June 2024)

In June 2024, EUR/USD formed a textbook Triple Bottom on the H4 chart around the 1.0650 zone. Retail traders were shorting into support, but the MACD showed hidden bullish divergence.

When the neckline at 1.0720 broke with a MACD bullish crossover, price rocketed 120 pips in 24 hours. Traders who spotted the combo banked profits while the rest were left wondering what hit them.

Why This Strategy Works (And Will Continue to Work)

According to Linda Raschke, veteran trader and author of “Trading Sardines,” “Patterns like the Triple Bottom work because human behavior is consistent. Traders panic at support, institutions accumulate.”

Similarly, Paul Tudor Jones once said, “The market moves to inflict the maximum pain on the most traders.” The Triple Bottom + MACD alignment exploits this exact tendency.

Elite-Level Enhancements: Mastering the Setup

1. The Liquidity Sweep Twist

If the third low sweeps below the second low, trapping retail shorts, and the MACD shows bullish divergence—that’s your “back up the truck” signal.

2. Timeframe Synergy

Look for H4 or Daily Triple Bottoms, but time entries on M15 with MACD confirmation. Multi-timeframe confluence is an elite hack.

3. Volume Confirmation

Volume surge on the breakout is the final stamp of smart money approval.

Final Takeaways: Trade Like an Insider

- The MACD + Triple Bottom fusion filters fakeouts and enhances reversal precision.

- Hidden divergence on MACD is the unsung hero.

- Liquidity grabs often precede explosive breakouts.

- Multi-timeframe alignment magnifies success rates.

Turbocharge Your Trading Arsenal

Elevate your game with cutting-edge resources from StarseedFX:

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The