The Williams Alligator & Maximum Drawdown: The Hidden Risks & Untapped Profits

Why Your Trading Account Feels Like a Netflix Drama (and How to Fix It)

Imagine this: You spot what looks like a perfect trade setup, place your order, and within minutes, your account balance nosedives faster than a reality show contestant’s credibility. Ever wonder why this happens? If you’re using the Williams Alligator indicator without fully grasping its nuances—or worse, ignoring Maximum Drawdown—you’re setting yourself up for a wild ride (minus the fun part).

Let’s uncover the secret world of these two powerful concepts, and more importantly, how you can leverage them like a pro while dodging the pitfalls that keep most traders stuck in a loop of frustration.

The Williams Alligator: A Sleepy Reptile That Can Bite

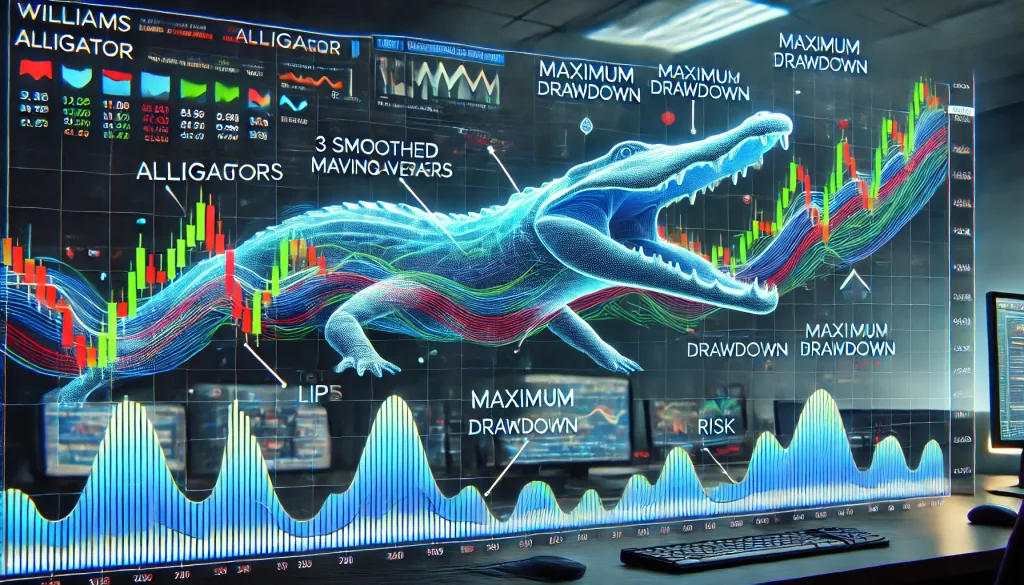

Bill Williams, the mastermind behind this indicator, designed it to spot trends early—kind of like a jungle predator waiting for its prey. It consists of three smoothed moving averages, nicknamed the “jaws,” “teeth,” and “lips.” Here’s what they do:

- Jaws (Blue Line, 13-period SMMA): The longest and slowest of the three, representing long-term trends.

- Teeth (Red Line, 8-period SMMA): The medium-term trend, slightly more responsive.

- Lips (Green Line, 5-period SMMA): The fastest-moving line, detecting early momentum shifts.

When the Alligator is “sleeping” (lines tangled together), the market is ranging. When it “wakes up” (lines separate and align), a trend is forming.

The Hidden Trap: Many traders see the Alligator’s mouth opening and rush to jump in, only to watch their position reverse against them. Why? Because they fail to pair it with risk management principles like Maximum Drawdown.

Maximum Drawdown: The Silent Killer of Trading Accounts

If Williams’ Alligator represents a trader’s hunger for trends, Maximum Drawdown (MDD) is what keeps their bankroll from getting eaten alive.

What Is Maximum Drawdown?

Maximum Drawdown is the biggest peak-to-trough decline in your trading account before it recovers. If your balance started at $10,000, hit $15,000, then fell to $8,000 before rebounding, your MDD is $7,000 (46.6%).

- A high MDD means you’re risking too much per trade.

- A low MDD means you’re managing risk well, but maybe not maximizing profits.

The Big Mistake: Traders using the Williams Alligator often go all-in when the jaws open, not realizing that false breakouts and market noise can trigger massive drawdowns.

Elite Strategies: Combining the Williams Alligator & Maximum Drawdown Like a Pro

1. The “Alligator Filter” Technique

Instead of jumping into every “jaws open” signal, filter out low-quality trades by applying the following rules:

✅ Only trade when the Alligator is fully awake—the three lines should be clearly separated.

✅ Check MDD stats before entering a trade—if your strategy historically suffers a 20% drawdown in similar setups, reduce position size or skip the trade.

✅ Confirm with volume indicators—a rising volume alongside the “jaws” opening confirms strong momentum.

2. The “Max Drawdown Stop-Loss Formula”

Most traders set random stop-losses. Professionals, however, use historical MDD data to calculate smarter stops:

- Identify the worst drawdown scenarios in your trading history.

- Set a stop-loss that keeps your losses below 50% of that MDD.

- Example: If similar trades led to an average 10% drawdown, your stop should be set at 5% risk per trade.

3. The “Alligator Trend Catcher” with ATR

The Average True Range (ATR) is your secret weapon to catching real trends while avoiding false signals:

???? Step 1: Wait for the Alligator’s jaws to open AND ATR to be above its 20-period average.

???? Step 2: Enter a position in the direction of the trend.

???? Step 3: Use ATR x 1.5 as a stop-loss distance.

???? Step 4: Ride the trend, trailing stops based on new ATR values.

Avoiding the Pitfalls: What Most Traders Get Wrong

???? Mistake #1: Ignoring Maximum Drawdown Most traders only think about winning trades, but pros obsess over their biggest losing streaks. If you don’t control MDD, you’ll eventually blow up your account.

???? Mistake #2: Blindly Following the Alligator Just because the Alligator’s mouth is open doesn’t mean the price will keep running. Check higher timeframes and economic news events before entering a trade.

???? Mistake #3: Trading Without a Safety Net If you don’t have a risk management plan, you’re gambling, not trading. Use proper position sizing, stop-losses, and drawdown protection to stay in the game.

Final Takeaways: How to Trade Smarter, Not Harder

???? Williams Alligator is a powerful trend-following tool—but only if combined with proper drawdown management.

???? Never risk more than half of your historical Max Drawdown per trade.

???? Use ATR as an additional filter to confirm trend strength.

???? Always backtest strategies before trading live.

Want daily expert insights and premium Forex strategies? Check out StarseedFX Community for elite tactics, live trading setups, and exclusive Forex education.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The