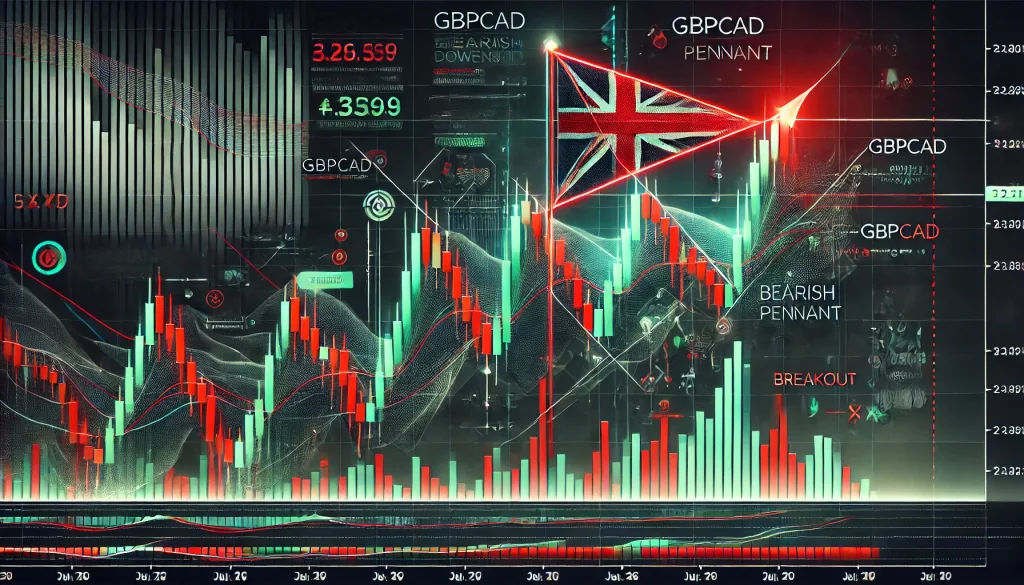

Why the GBPCAD Bearish Pennant is a Hidden Goldmine (If You Know How to Play It)

The Trap Most Traders Fall Into

Let’s be real—technical patterns are like magic tricks. Some traders believe in them religiously, while others think they’re just smoke and mirrors. But if you’ve been around the Forex block, you know that the bearish pennant on GBPCAD isn’t just a random squiggle on your chart—it’s a powerhouse of a setup when handled correctly.

And yet, most traders mess it up worse than someone trying to microwave a fork.

The reason? They either:

- Enter too early and get faked out.

- Fail to spot the confirmation signal.

- Ignore macroeconomic factors that could shift momentum.

But that’s where the underground tactics come in. Let’s dive into what the pros do differently—and how you can ride this setup for maximum gains.

What Exactly is a Bearish Pennant, and Why Should You Care?

For those new to this pattern, let’s break it down:

- A bearish pennant forms after a strong downward move (the flagpole), followed by a period of consolidation in a tight range (the pennant).

- It signals that selling pressure is temporarily taking a breather before the next big drop.

- The breakout happens when price breaks below the pennant’s support level, leading to another sharp decline.

Now, here’s where things get interesting—not all bearish pennants are created equal. The ones on exotic or minor pairs, like GBPCAD, tend to have higher volatility, offering traders some serious potential for big moves.

But how do you separate a winning pennant from a dud? Here’s where advanced analysis kicks in.

The Hidden Formula Pros Use to Trade GBPCAD Bearish Pennants

Traders who consistently win with this setup don’t just rely on luck—they follow a specific formula:

- Identify the Perfect Setup

- The flagpole should be steep and aggressive—weak moves won’t cut it.

- The pennant should have lower highs and higher lows, forming a tight triangle.

- Volume should decrease during consolidation—this shows that buyers are getting exhausted.

- Avoid the Fakeout Trap

- Most rookies enter as soon as the price touches support. Bad move.

- Pros wait for a strong breakout with high volume, often using the ATR (Average True Range) indicator to confirm volatility.

- Look for a retest of the broken support level—this is where institutions stack their orders.

- Factor in Fundamentals

- BoC (Bank of Canada) Rate Decisions: If the BoC is hawkish, GBPCAD is more likely to continue downward.

- UK Economic Data: Weak UK GDP or employment data strengthens the bearish case.

- Oil Prices: Since Canada is a major oil exporter, rising oil prices can push CAD higher, fueling the bearish move.

- Stack the Odds with Smart Risk Management

- Stop Loss: Above the pennant’s resistance (tight stops get hunted).

- Take Profit: Measured move = flagpole length projected downward.

- Risk-Reward Ratio: Aim for at least 2:1 to make the trade worthwhile.

Why Most Traders Fail (And How to Avoid It)

Even when the stars align, traders often sabotage their success. Here’s why:

- They trade in isolation. Not checking economic calendars, central bank sentiment, or institutional positioning is like trying to drive blindfolded.

- They enter too aggressively. Patience is key—wait for clear confirmation.

- They move stop losses too soon. Let the trade breathe! False breakouts are common before the real move happens.

- They risk too much. Just because a setup looks great doesn’t mean you go all-in. Position sizing is what separates the gamblers from the pros.

Final Thoughts: Why GBPCAD’s Bearish Pennant Deserves Your Attention

If you’ve ignored this pattern before, it’s time to take a second look. The GBPCAD bearish pennant, when traded with precision, can be a low-risk, high-reward setup—but only if you follow the rules above.

So, next time you see this formation, remember:

✅ Wait for a strong breakout with volume confirmation.

✅ Use fundamentals as a filter for better accuracy.

✅ Manage risk like a pro—because no setup is 100% guaranteed.

Want to stay ahead of the game? Get exclusive market insights, smart trading tools, and real-time analysis at StarseedFX—because smart traders don’t go in blind.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The