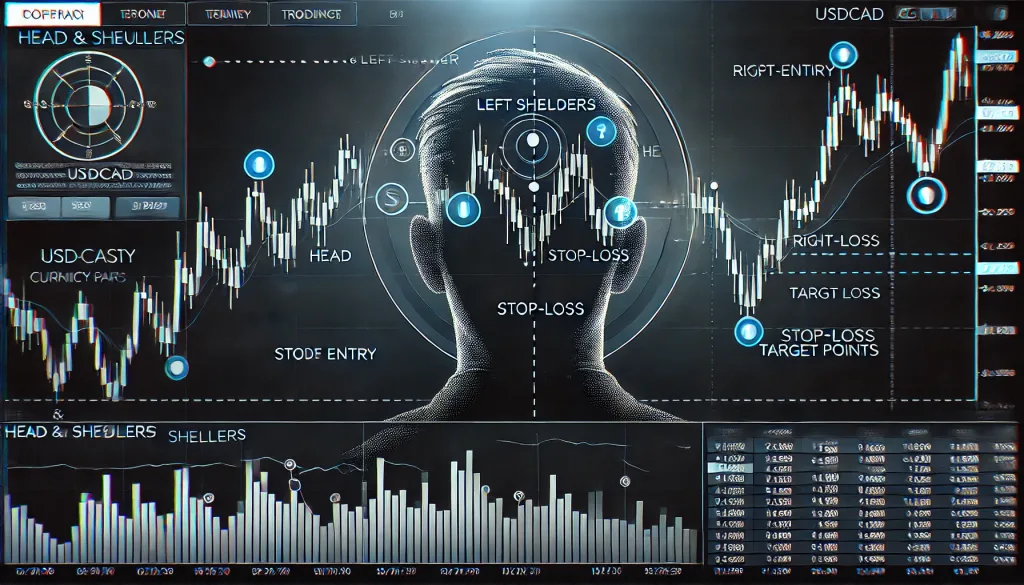

USDCAD Head and Shoulders Pattern: The Hidden Playbook for Smart Traders

Why Most Traders Get It Wrong (And How You Can Avoid It)

Picture this: You spot a textbook-perfect Head and Shoulders pattern on the USDCAD chart, your palms get sweaty (knees weak, arms heavy), and you rush to place a trade. Then—bam!—the market fakes you out, and your account takes a hit. Sound familiar?

That’s because most traders blindly follow conventional wisdom without understanding the insider nuances that separate pros from the rookies. The truth? The Head and Shoulders pattern isn’t just about spotting a fancy formation—it’s about reading market psychology, detecting hidden signals, and knowing exactly when to pull the trigger.

Let’s dive into the next-level strategies that smart money uses to trade the USDCAD Head and Shoulders like a seasoned pro.

The Hidden Psychology Behind the Head and Shoulders Pattern

Before you start shorting the market every time you see three peaks, understand this: the Head and Shoulders pattern isn’t magic—it’s a visual representation of shifting market sentiment.

Here’s what it really means:

- Left Shoulder: Buyers push the price up, but they start running out of steam.

- Head: A final desperate push higher (often fueled by retail FOMO), but sellers are lurking.

- Right Shoulder: Buyers try one last time, fail, and the market finally caves in.

- Neckline Break: The confirmation of true selling pressure, leading to a sharp drop.

???? Pro Tip: The best trades happen when you can confirm real distribution at the head, rather than blindly entering at the neckline break. More on this later.

Why Most Traders Lose Money on the USDCAD Head and Shoulders

1. Entering Too Early (Or Too Late)

The biggest mistake traders make? Jumping in the moment the neckline breaks. While this is a classic entry point, it often leads to fake breakouts (cue the dramatic sigh of frustration).

Instead, do this:

- Wait for a retest of the neckline before entering.

- Look for volume confirmation—a real breakout has a surge in volume.

- If the right shoulder forms too quickly after the head, the pattern is weaker.

2. Ignoring the Bigger Picture

The USDCAD doesn’t move in isolation. The best Head and Shoulders setups occur when fundamental and technical forces align:

- Oil Prices – USDCAD has a strong inverse correlation with oil. If crude oil is surging while a Head and Shoulders is forming, the probability of a breakdown skyrockets.

- Interest Rate Differentials – Pay attention to Fed vs. BoC rate decisions. A dovish Fed and a hawkish BoC? That’s your golden signal.

- DXY (US Dollar Index) – If the USD is weakening across the board, it gives extra confluence to short USDCAD.

???? Pro Tip: Always check the higher time frames (daily, weekly) for trend confirmation before acting on a Head and Shoulders setup on the lower time frames.

How to Trade the USDCAD Head and Shoulders Like a Pro

Step 1: Spot the Ideal Setup

- Head must be significantly higher than both shoulders

- Shoulders should be symmetrical (roughly equal heights and widths)

- Volume should decrease from the left shoulder to the right shoulder

- Neckline should be clear and well-defined

If these conditions aren’t met, you’re probably looking at a false pattern.

Step 2: Look for Insider Confirmation Signals

- Divergence on RSI or MACD – If the Head is higher, but RSI is lower, that’s a red flag for buyers.

- Institutional Order Blocks – Check for liquidity zones where smart money is likely to step in.

- COT Reports – If big players are reducing long positions on the CAD, it’s an extra confirmation.

Step 3: Execute with Precision

- Entry: Either at the neckline retest or early on the right shoulder if volume confirms.

- Stop Loss: Just above the right shoulder (tight SL keeps risk controlled).

- Target: Measure the distance from the head to the neckline and project it downward.

- Bonus Move: Trail your stop loss once price hits 50% of the target.

Case Study: A 200-Pip Move on USDCAD

Let’s rewind to a real-world setup.

???? Date: August 2023 ???? USDCAD Price: 1.3640

- A perfect Head and Shoulders formed on the 4H chart.

- Oil prices surged +5% in two days (a strong CAD booster!).

- The right shoulder formed weakly with declining volume.

- Neckline broke at 1.3570, retested, and USDCAD collapsed to 1.3370.

- Total move: 200 pips (traded risk-free with a trailing stop).

This is the power of combining technicals with fundamentals.

The Secret Weapon: Trade Smarter, Not Harder

Mastering the USDCAD Head and Shoulders isn’t about blindly following a chart pattern. It’s about reading the hidden story behind it, confirming with data, and executing with surgical precision.

Want insider access to real-time alerts, in-depth trade setups, and expert analysis? Join the StarseedFX Community and unlock game-changing Forex strategies today.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The