The Bearish Pennant Conundrum: Why the Contraction Phase Holds the Key to Mastering Forex Breakouts

Trapped in a Bearish Pennant? Here’s How to Flip the Script

Imagine walking into a high-stakes poker game, thinking you’ve got a winning hand, only to realize you were the bluff all along. That’s exactly what happens to traders who misunderstand the bearish pennant and its sneaky little friend—the contraction phase. If you’ve ever been on the wrong side of a breakout, this article will show you how to avoid falling for the market’s biggest bait-and-switch.

Let’s dive into the hidden patterns, expert-level tactics, and under-the-radar insights that give elite traders an edge over the unsuspecting herd.

The Hidden Language of the Bearish Pennant

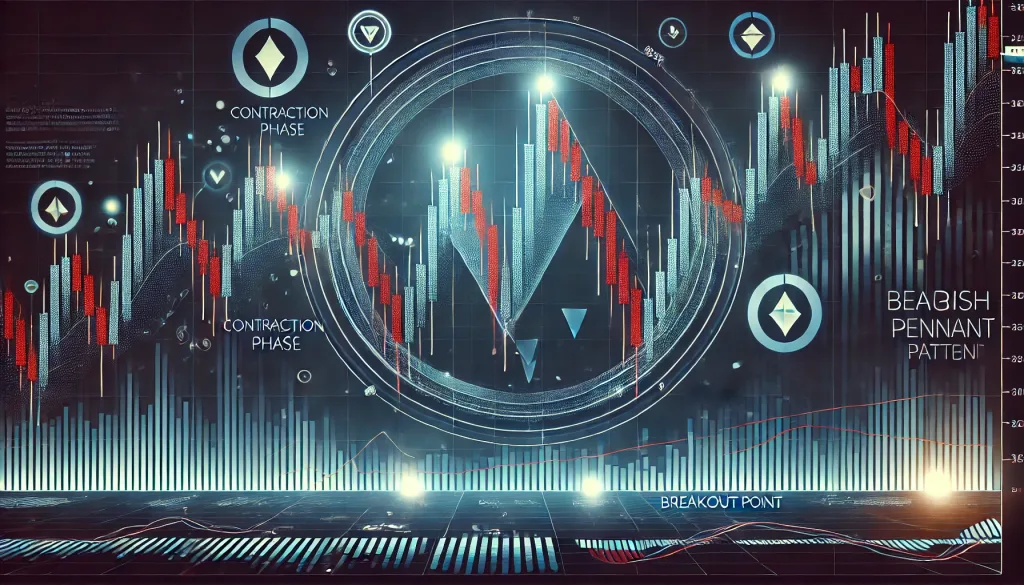

A bearish pennant is a continuation pattern that appears after a strong downward move, where price consolidates in a small, narrowing range before breaking out lower. Sounds simple, right? Well, here’s the catch: most traders treat the breakout as the only thing that matters, while professionals know the real story unfolds in the contraction phase.

“Smart traders don’t chase breakouts—they anticipate them by mastering contraction phases.” – Anton Kreil, professional trader & managing partner at ITPM

Key Characteristics of a Bearish Pennant:

- Sharp Downward Move: The initial leg before the pennant forms (known as the flagpole) sets the stage.

- Consolidation (Contraction Phase): A tightening price range with lower highs and higher lows—this is where the magic happens.

- Breakout Confirmation: A breakdown below the lower support level with increased volume.

But if you only focus on the breakout, you’re missing at least 50% of the equation. Let’s fix that.

The Contraction Phase: Where Smart Money Takes Position

Most traders see the contraction phase as a waiting room before the real action. In reality, it’s a high-stakes chess match between institutions and retail traders.

What Really Happens During Contraction:

- Institutional Loading: Big players accumulate short positions while the market looks “stable.”

- Retail Confusion: Retail traders misinterpret the range as support and start buying the dips.

- Volume Trap: A deceptive decline in volume convinces traders that volatility is dying down.

- False Breakouts: Market makers push price slightly above resistance to trigger stop-losses before the real move.

If you’re still treating contraction phases like a waiting period, you’re playing checkers while institutions are playing 4D chess.

Ninja Tactics to Master Bearish Pennants

Now that we know the contraction phase is where the real battle is fought, let’s go over how to exploit it.

1. Volume as Your Lie Detector

- If volume declines during the contraction phase, it signals institutional positioning.

- If volume suddenly spikes without a breakout, it’s likely a fake move to bait traders.

- The real breakdown often happens on a volume surge after contraction.

2. The 50% Rule for Contraction Phases

- Measure the flagpole and note the 50% retracement level.

- If the pennant forms above this level, it’s a weak bearish signal.

- If the pennant forms below this level, the breakdown is high-probability.

3. Liquidity Hunting: How Market Makers Set Traps

- Fake breakouts above resistance are designed to wipe out early short sellers.

- True breakdowns happen after this liquidity grab—wait for the trap to spring before entering.

4. Using ATR to Confirm the Real Move

- The Average True Range (ATR) should expand right before or immediately after the breakout.

- A shrinking ATR suggests the market isn’t ready for a real move yet.

5. Insider Move: Watch the Smart Money Index (SMI)

- The SMI helps track institutional vs. retail behavior.

- If institutions are selling while retail traders are still holding, the breakdown is imminent.

Case Study: The 2022 EUR/USD Bearish Pennant Breakdown

In mid-2022, EUR/USD formed a textbook bearish pennant after a 300-pip drop. Retail traders were lured into false hope, buying every dip inside the contraction phase. But institutions had a different plan.

How Smart Money Played It:

- The contraction phase lasted 12 trading days, luring in longs.

- Volume dropped by 34%—a classic sign of institutional positioning.

- A fake breakout above resistance triggered stop-losses before price crashed.

- When the breakdown came, volume spiked 60% above the 10-day average.

- Result: EUR/USD plummeted another 500 pips while retail traders held their losing positions.

Final Takeaways: How to Use This in Your Own Trading

✅ Don’t Chase Breakouts: Watch the contraction phase and anticipate the real move.

✅ Volume Tells the Truth: Decreasing volume = institutional positioning; sudden spike = potential trap.

✅ Wait for the Fake-Out: The best breakouts happen after a liquidity grab.

✅ Use ATR & SMI: If ATR and SMI confirm, the move is high-probability.

✅ Trade with Smart Money: Understand where institutions are accumulating and follow their lead.

Want to get real-time insights on Forex patterns before the crowd catches on?

???? Get the latest Forex news here

???? Upgrade your trading game with our free Forex courses

???? Join our elite community for expert analysis & trade alerts

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The